Instructure acquired by Thoma Bravo for ~$2 billion.

These days I feel more and more like Thornton Melon from Back to School. Corporate learning and compliance training is one thing, I see you Bridge, but due to the pandemic, I think a lot of us are really drinking from the firehose, when it comes to online learning and figuring out various Learning Management Systems (LMS) like Canvas for our children. Some of us may be handling it better than others.

Instructure / Thoma Bravo Deal overview

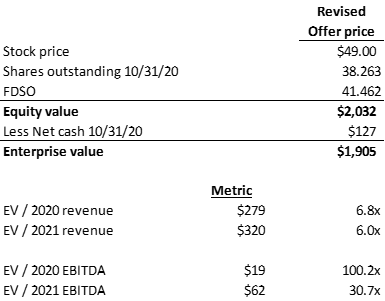

On December 4, 2019, Instructure announced that it has entered into a definitive agreement to be acquired by Thoma Bravo, in an all-cash transaction that values Instructure at a value of ~$2 billion.

The original $47.60 price per share represented an 18% premium to the company’s 3-month volume-weighted average price as of October 27, 2019, the day prior to the Company’s third quarter earnings call. The price was ultimately raised to $49.00 (~3%) after investor pushback.

Thoma Bravo committed to invest cash consideration of ~$2 billion to purchase the equity securities of Instructure.

Golub was the lead arranger for the $775 million Term Loan and $50 million revolver, the rest of the syndicate included Owl Rock, Goldman, Monroe, New Mountain and Thoma Bravo’s credit funds also signed up for a $130M ticket. The commitment letter guided L + 4.5-7.0% depending on leverage and loan type.

Key points in the Background on the offer

TL;DR: This was a deal that had some hair on it. There definitely were some issues surrounding the CEO, that played out during the strategic process. That said, Instructure contacted 40 potential parties, entered into CAs with and engaged in due diligence or provided management presentations or other information to 19 potential bidders, ultimately receiving indications of interest from 5 bidder groups, and negotiating with Thoma Bravo as well as 3 other bidding groups, none of which was willing to make a definitive offer at a price above $47.60. No party made an alternative acquisition proposal before the go-shop period expired. ISS and Glass Lewis both recommended that the Instructure stockholders vote against the initial proposal. Thoma Bravo increased its final offer to $49.00 per share after the pushback and conducted a tender offer.

The strategic process really started when Sponsor A expressed an interest in acquiring Instructure for $53.00 to $55.00 per share on January 8, 2019

Ultimately deemed not a sufficiently compelling offer to depart from its strategic plan

Sponsor A had reduced its bid to $49.00-$51.00 and requested a 25 day exclusivity without confirming the exact price and its ability to complete due diligence

Two weeks after the nonbinding offer, the BoD enacted a new policy for turning Management cash bonuses for 2018 into a package of RSUs that was 25% larger. The BoD also discontinued cash bonuses through 2022 in favor of new, long-term stock grants for executive officers and gave all staff the option of receiving 20% of their base salary in equity

Between January 16, 2019 and January 19, 2019, Instructure conducted a bake-off with five potential financial advisors

January 20, 2019, approved the engagement of J.P. Morgan as financial advisor

Late June to October, conducted preliminary discussions with financial sponsors, with preference to remain public, absent a compelling proposal

October 3, 2019, BoD determined to conduct a limited market check with interested parties

October 23, 2019, Board and JPM, segmented parties into tiers based on, (i) strategic rationale for a transaction, (ii) historical interest in Instructure, (iii) ability and track record of financing similarly sized transactions and (iv) track record of acquiring SaaS or EdTech companies

Engaged with “tier 1” parties which included the seven financial sponsors that had expressed interest in a strategic transaction and an additional four strategic parties

JPM requested that the seven financial sponsors that had been involved in the process to date provide IoIs prior to November 1, 2019

October 28, 2019, announcement on the earnings call that the CFO would retire in 2020 after nearly eight years of service

October 31, 2019, Reuters published an article that stated that activist investor Sachem Head Capital Management had accumulated a position and wanted Instructure to pursue a full sale process.

First week of November 2019, each of Sponsor A, Sponsor F and Industry Participant G declined to further pursue a strategic transaction

Sponsor A had concerns about bookings growth, profit margin expansion and how strategic changes and cost reductions could be implemented

November 5, 2019, determined to contact eight additional “tier 2” strategic parties including a strategic party and its related financial sponsors and seven other strategic parties

Each of these strategic parties subsequently declined to further pursue a strategic transaction.

November 13, 2019, Bloomberg published additional reporting that Instructure was exploring strategic options including a sale following pressure from activist investors, and that a number of private equity firms were weighing bids

November 14, 2019, Instructure publicly announced that in response to interest received from multiple third parties

November 18, 2019, further extend the But reach to ten additional “tier 3” parties including three new strategic parties and, if applicable, their respective financial sponsors and seven new financial sponsors

November 25, 2019 Sponsor E declined to further pursue a strategic transaction and indicated concerns about new bookings, the ability to increase prices and the consequences of implementing cost reductions

November 29, 2019, Thoma Bravo and Sponsor C requested that Mr. Goldsmith and Mr. Kaminer enter into letter agreements to limit the acceleration of outstanding equity awards upon the consummation of a strategic transaction

On December 2, 2019 pursuant to JPM’s instructions to provide a revised proposal, Sponsor C submitted a bid of $47.00 and Thoma Bravo submitted a bid of $47.50

Sponsor C Proposal depended upon debt financing whereas Thoma Bravo proposed a fully equity financed transaction

During the “go-shop” period, twenty-four potential buyers were approached, including nine parties with whom Instructure had already discussed a potential strategic transaction

Contacted fifteen additional parties and executed a CAs with two parties, and one of those parties subsequently declined to continue discussions

No party made an alternative acquisition proposal before the go-shop period expired on January 8, 2020

January 27, 2020 and January 29, 2020, ISS and Glass Lewis both recommended that the Instructure stockholders vote against the proposal

February 13, 2020, Asked Thoma Bravo to increase the consideration payable from $47.60 per share in cash to $49.00 per share in cash

Thoma Bravo further clarified that this was it’s “best and final” offer

Thoma Bravo would conduct a tender offer instead of the originally proposed shareholder vote

Mr. Goldsmith agreed to forfeit 48% of his outstanding equity awards that vest after March 1, 2020

Reverse termination fee of $136,857,000 (~7% of Equity Value)

Termination fee of $63,540,750 (~3% of Equity Value)

February 18, 2020 before market open, Instructure announced Mr. Goldsmith’s intent to step down as CEO and a member of the Instructure Board, and the execution of the Merger Agreement

Bidders

When you look at the tier criteria, you really are left with big financial sponsors like Vista (Powerschool / EAB / Pluralsight), Francisco Partners (Renaissance), Silver Lake (Weld North), Onex (Powerschool), TPG (Ellucian), Leonard Green (Ellucian), Providence (Blackboard), Blackstone (Ascend Learning), H&F (former Renaissance / Ellucian), Advance Publications (Turnitin) and Veritas (Anthology / Rosetta Stone).

Offer timeline

The wringer

Instructure filed 14D9 on February 24, 2020 that contained JPM’s fairness opinion. JPM delivered an oral and written opinion to the BoD on December 3, 2019. The initial submission is missing some key financial data, Investors picked up on this omission and a lawsuit was filed January 17, 2020. An amended DEFA14A and 14D9/As were filed on 2/05/19 and 3/13/20, respectively, that filled in some but not most of the holes we would need to tie everything out.

It is fair to JPM, as Instructure agreed to pay a transaction fee of ~$24 million, of which $3 million became payable upon delivery of the Opinion and the remainder payable upon the completion of the Merger. That works out to ~1.26% of the ~$1.9 billion Enterprise Value, which would probably be at the upper end of the sell-side M&A fee schedules for deals that size.

For its fee, JPM goes with the standard valuation methods and then throws in a couple extra for reference only, for good measure.

Trading comparables

Transaction comparables

DCF

52-Week Historical Trading Range

Equity Research Analyst Price Targets

Management Project Financials

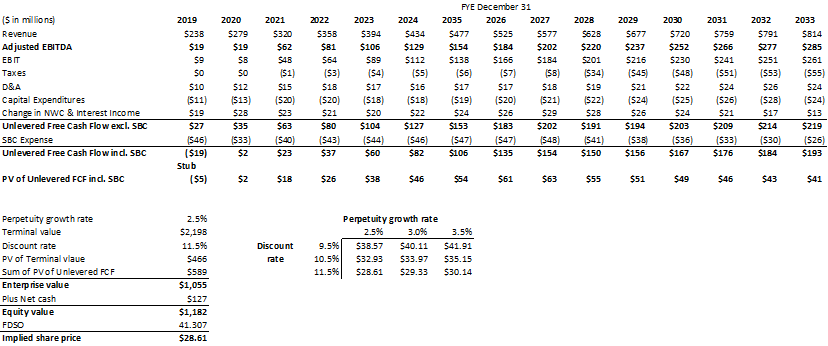

Management provided 2 cases, 35% long-term EBITDA margin case and an updated 40% long-term EBITDA margin case. The changes in the model start in 2023.

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Quarterly projections not provided

A full option schedule was not provided in any filings

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

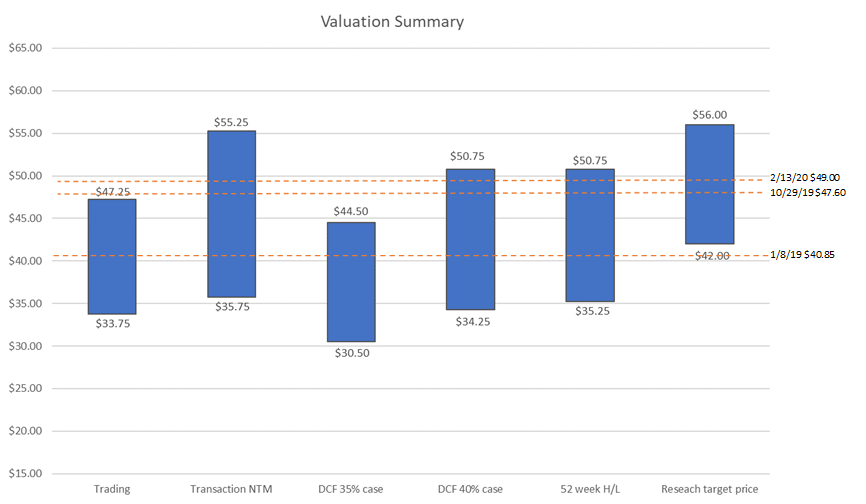

Summary Valuation

Selected Publicly Traded Companies Analysis

Rosetta Stone lists the companies below in its 10-K as competitors, most are private with the exception of Cornerstone OnDemand, which is a comp of the smaller of Instructure’s 2 segments.

JPM selected publicly traded software companies engaged in businesses judged to be analogous to Instructure. 2U is EdTech, but more Online Program Management (OPM) than LMS. JPM than calculated a multiple of firm value as of December 3, 2019 to published equity research consensus estimates obtained from FactSet for revenue for the calendar year 2020 (“CY 2020E FV/Revenue”).

JPM selected multiple reference ranges for CY 2020E FV/Revenue of 4.5x-6.5x. This multiple range was then applied to Instructure’s estimated revenue for calendar year 2020 as provided by Management.

Indicated implied equity value per share ranges, rounded to the nearest $0.25, of $33.75 to $47.25.

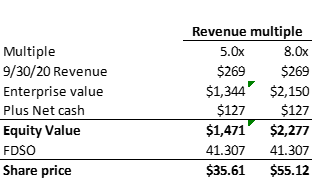

Selected Transactions Analysis

JPM examined selected transactions involving software companies engaged in businesses judged to be sufficiently analogous to the business of Instructure. JPM is sticking to Software and not using any EdTech comps. The most relevant comp might be Blackboard / Providence, but that was back in 2011.

For each of the selected transactions, JPM calculated the firm value to be paid for the target company as a multiple of published equity research estimates for revenue for the 12-month period following the announcement of the applicable transaction (“FV/NTM Revenue”).

JPM selected a multiple range for FV/NTM Revenue of 5.0x – 8.0x, The FV/NTM Revenue multiples were then applied to Instructure’s estimated revenue for the 12-month period following September 30, 2019.

Indicated an implied equity value per share range, rounded to the nearest $0.25, of $35.75 to $55.25.

Illustrative Discounted Cash Flow Analysis

JPM calculated the unlevered free cash flows that Instructure is expected to generate during fiscal years 2020 through 2033 and fourth quarter 2019 based upon financial projections prepared by the management of Instructure.

Management provided two separate cases to extrapolate EBITDA margin after fiscal year 2023

EBITDA margin increase from 2023 to 2026 up to 35% and steady thereafter

EBITDA margin increase from 2023 to 2026 up to 40% and steady thereafter

JPM treated stock-based compensation as a cash expense in the unlevered free cash flow calculation, as stock-based compensation is viewed as a true economic expense of the business

JPM also calculated a range of terminal values at the end of fiscal year 2033 by applying a perpetual growth rate ranging from 2.5% to 3.5% to the revenue estimated by Instructure for calendar year 2033 to determine of the unlevered free cash flow of Instructure during the final year of the 14.25-year period

Discounted using a range of discount rates from 9.50% to 11.50%

Adding net cash balance of $127 million as of September 30, 2019

The problem for me in recreating the DCF is the Terminal Value. The verbiage in the filing is a little unclear. If we try a normalized terminal year, we are missing the most assumptions. If I were to use the unlevered FCF excluding SBC instead of including SBC, we would be pretty close to JPM’s range. I have shown the 35% EBITDA case below.

Resulted in an indicated a range of equity values, rounded to the nearest $0.25, of:

• $30.50 to $44.50 per share for the 35% long-term EBITDA margin case

• $34.25 to $50.75 per share for the 40% long-term EBITDA margin case

Equity Research Analyst Price Targets

JPM reviewed certain equity research analyst price targets for Instructure obtained from Wall Street Research, and available as of December 3, 2019. JPM noted that the range of such price targets, was $42.00, $45.00, $46.00, $47.00, $50.00, $52.00, $55.00 and $56.00 per share

Valuation Summary

Is it Fair?

As my barber used to say, only God and the Delaware Courts can decide that.

Well, ISS and Glass Lewis recommended shareholders vote against the original offer because “the conduct of the process, a seemingly uncompelling valuation, and a strong standalone case”. Thoma Bravo ultimately increased its offer ~3% and also assessed that a large portion of shareholders had turned over and they could use a tender offer to complete the deal. On March 20, 2020, 24,828,913 Shares were tendered representing ~64.4% of the aggregate voting power of the Shares outstanding. Notices of Guaranteed Delivery had been delivered for 7,802,215 Shares, which represent ~20.2% of the aggregate voting power of the Shares then outstanding.

Let me know what you think in the comments below.