⚖️ For Fairness Sake ⚖️ Collectors of the Universe

A quick look at Collectors Universe fairness opinion.

Collectors Universe acquired by Investor group led by entrepreneur and sports card collector Nat Turner, D1 Capital Partners, and Cohen Private Ventures, for a revised offer from ~$700 million to ~$850 million.

So, some of the drama associated with CLCT has just played out at the expiration of the first tender offer the other day. That said, lets dive into the fairness opinion and see what all of the fuss was about.

Collectors Universe / Investor group deal overview

November 30, 2020 Collectors Universe (CLCT) announced that it entered into a definitive agreement under which an investor group led by entrepreneur and sports card collector Nat Turner, D1 Capital Partners L.P., and Cohen Private Ventures will acquire all of the Company’s outstanding shares of common stock for $75.25 per share in cash, representing a fully diluted equity value of ~$700 million, and is not subject to any financing contingency. The transaction represents a premium of ~30% over the Company’s 60-day volume-weighted average price ended on November 25, 2020, the last full trading day before today’s announcement.

Jan. 20, 2021 the Investor Group, has increased its offer to acquire all outstanding shares of Collectors Universe to a “best and final” offer of $92.00 per share in cash. The “best and final” offer represents an approximately 32% premium to Collectors Universe’s unaffected share price on November 25, 2020, the last full trading day before the transaction was announced, and a premium of 18% to the Company’s closing share price on January 19, 2021. The offer, which is not subject to any financing contingency, values Collectors Universe at ~$853 million.

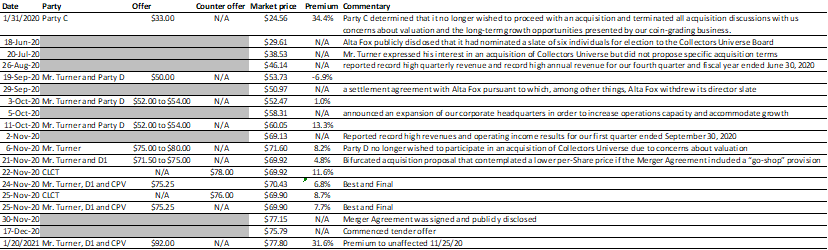

Background of the merger

TL;DR: CLCT ran a sale process in 2016, contacting 100 parties, none of which made an offer. July 2019, a financial acquirer (Party C) exploring a possible acquisition of CLCT, culminated in a all-cash proposal of $33. In January 2020, Party C determined that it no longer wished to proceed with an acquisition. June 18, 2020, Alta Fox publicly disclosed it had acquired ~5.4% of the outstanding Shares and is commencing an activist campaign, including a slate of Directors nominating Nat Turner. July 7, 2020, Nat Turner withdraws as a candidate for the Board. Thirteen days later, Mr. Turner expressed his interest in an acquisition of CLCT. CLCT and HL never run a full blow strategic process. The offers from the Nat Turner Investor Group are relatively low from a premium perspective. CLCT reports stellar earnings and the stock price increases over the course of negotiations. BoD accepts an offer of $75.25, with a no-shop agreement, when the stock was trading at $69.90, for a premium of ~8%.

Offer timeline

The wringer

CLCT filed 14D9 on December 17, 2020 that contained Houlihan Lokey’s fairness opinion. HL delivered an oral and written opinion to the BoD on November 30, 2020. The initial submission is missing a good amount of key financial data need to recreate the analysis and a 14D9A was filed on January 11, 2021 that filled in most of the holes.

CLCT agreed to pay HL a transaction fee of ~$9.1 million for its services, a portion of which became payable upon the delivery of Houlihan Lokey’s opinion, and a substantial portion of which will become payable contingent upon the consummation of the Offer and the Merger.

It is fair to HL. This works out to ~1.4% of the ~$660 million enterprise value, which would probably be at the middle of M&A sell-side fee tables.

For its fee, HL goes with the standard valuation methods.

Trading comparables

Transaction comparables

DCF

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Quarterly projections not provided

A full option schedule was not provided in any filings

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

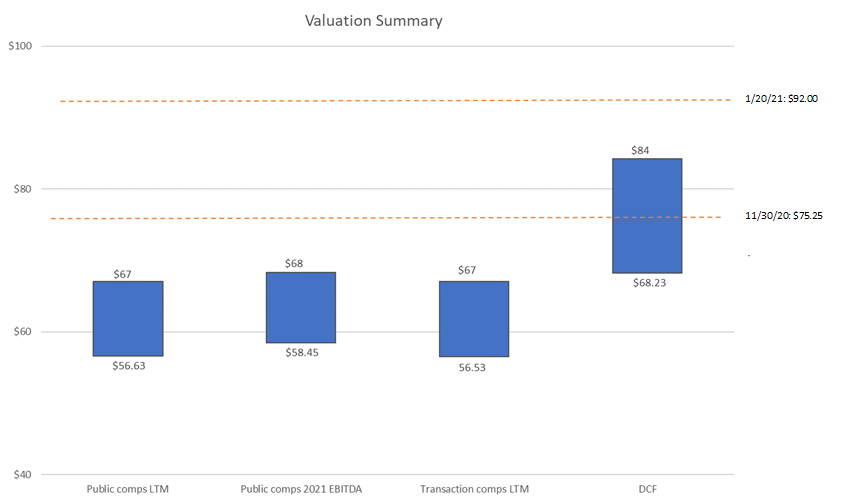

Valuation Summary

Is it Fair?

As my seamstress used to say, only God and the Delaware Courts can decide that.

The process described in the background for the merger, does lead to some questions. The ranges selected for the comps, may not account for the revenue growth of the company as accurately as they could. As a result of these types of questions, several institutional holders came out against tendering at the initial offer price.

On January 6, 2021 Alta Fox filed a 13D that stated it believed that the tender offer is neither fair nor in the best interests of stockholders.

On January 12, 2021 Adirondack Retirement Specialists recommended its clients not tender shares as the offer significantly undervalues the company.

As of January 19, 2021 only ~393,018 Shares (including the Turner Rollover Shares had been validly tendered, representing ~4.34% of the outstanding Shares. In connection with execution of the A&R Merger Agreement and increase in the Offer Price, the Expiration Date of the Offer was extended until 12:00 midnight, New York time on February 3, 2021.

The tender offer was amended again until February 5, 2021, because as of February 3, 2021, ~5,063,280 Shares (including the Turner Rollover Shares) have been validly tendered and not properly withdrawn pursuant to the Offer (or, in the case of the Turner Rollover Shares, are counted as if they were tendered for purposes of determining whether the Minimum Condition was satisfied in accordance with Section 251(h) of the DGCL), representing ~56% of the outstanding Shares.

On February 5, 2021, the tender offer was completed after an aggregate of 5,179,075 Shares (including the Turner Rollover shares, had been validly tendered, representing ~57 percent of the shares outstanding.

Let me know what you think about the quick read version in the comments below.

Management projected financials

In fiscal year 2020, CLCT started to experienced a rapid increase in demand for our card-grading and authentication services. Much of this increased demand was driven by an increased interest in collectibles. The question is how sustainable is the change in consumer behavior, particularly post-pandemic.

Summary valuation

Discounted Cash Flow Analysis

Calculated the NPV of the projected unlevered, after-tax free cash flows and the estimated net present value of the terminal value, based on the CLCT Forecasts. HL calculated terminal values by applying a range of terminal value Adjusted EBITDA multiples of 10.0x to 12.0x to estimated fiscal year 2025 Adjusted EBITDA. The NPVs were then calculated using discount rates ranging from 9.0% to 11.0%, which were based on an estimate of CLCT’s WACC. Subtracted total debt and added cash and cash equivalents, each as of October 30, 2020. The figures in the implied equity value reference range were then divided by the number of FDSO.

Selected Companies Analysis

CLCT lists the following companies in it s10K as competitors, but all are private.

There aren’t any really good comps to look at, but when I think about experts validating things, I think Services and Consulting. The one issue to contend with is CLCT’s revenue growth of ~70% in 2021E,~30% in 2022E, and 13% thereafter, those growth rates will push you to the the high end.

HL applied the selected multiple ranges 20.0x - 24.0x LTM Adjusted EBITDA and 11.0x - 13.0x FY 2021E Adjusted EBITDA to corresponding financial data, based on the CLCT Forecasts, to calculate an implied enterprise value reference range. Houlihan Lokey then subtracted total debt and added cash and cash equivalents (pro forma for disbursements related to previously incurred advisory and professional fees), each as of October 30, 2020, to derive an implied equity value reference range. The figures in the implied equity value reference range were then divided by the number of FDSO.

Selected Transactions Analysis

Again, it is a tough company to comp, but I think you probably need to look at the NTM multiples as well, due to the high growth rate of ~ 70%. LTM multiples, might not not capture all of the value.

Taking into account the results of the selected transactions analysis, HL applied a selected multiple range of 20.0x to 24.0x to LTM Adjusted EBITDA as of October 30, 2020, to calculate an implied enterprise value reference range. Houlihan Lokey then subtracted total debt and added cash and cash equivalents (pro forma for disbursements related to previously incurred advisory and professional fees), each as of October 30, 2020, to derive an implied equity value reference range. The figures in the implied equity value reference range were then divided by the number of FDSO

Background of the Mergers

In 2016, CLCT engaged a nationally recognized investment banking firm to evaluate then-current trading prices against potential long-term realizable stockholder value and to assess various strategic alternatives for Collectors Universe.

During this process, contacted over 100 potential acquirers; these potential acquirers did not include Messrs. Turner, Sundheim or Cohen or any of their affiliated entities

All of the potential acquirers that we contacted declined to pursue discussions regarding a possible acquisition of our company

During the first half of 2019, two different financial acquirers (which we refer to as “Party A” and “Party B”) separately contacted CLCT regarding their interest in exploring a possible acquisition of our company

After preliminary discussions, both Party A and Party B terminated their interest in an acquisition due to concerns about the long-term growth prospects of our business.

In July 2019, a financial acquirer (which we refer to as “Party C”) contacted CLCT regarding its interest in exploring a possible acquisition of our company.

The negotiations culminated in a proposal by Party C for a per-Share all-cash price of $33

In January 2020, negotiating with Party C on an exclusive basis, Party C determined that it no longer wished to proceed with an acquisition and terminated all acquisition discussions with us

Cited its evolving concerns about valuation and the long-term growth opportunities presented by our coin-grading business

June 18, 2020, Alta Fox publicly disclosed on a Schedule 13D filed with the SEC that it had acquired ~5.4 percent of the outstanding Shares

Publicly disclosed that it had nominated a slate of six individuals for election to the Board. Mr. Turner was one of the individuals nominated

July 1, 2020, retained Houlihan Lokey to serve as our financial adviser in connection with a possible proxy contest with Alta Fox

July 7, 2020, Alta Fox amended its Schedule 13D to disclose that Mr. Turner had withdrawn as a candidate for election to the Collectors Universe Board

July 20, 2020, Mr. Turner expressed his interest in an acquisition of Collectors Universe but did not propose specific acquisition terms

July 22, 2020, The family office of a high-net-worth individual (“Party D”) initiated a conversation, introductory in nature and focused on allowing Party D to better understand the company

July 23, 2020, It was the consensus of the members of the Collectors Universe Board that they were unlikely to consider an acquisition proposal that did not reflect a premium to the trading level of the Shares

July 24, 2020, Party D expressed an interest to Mr. Orlando in exploring a potential transaction

August 7, 2020, Mr. Turner and Party D would like to work cooperatively toward an acquisition of Collectors Universe.

Later on August 10, 2020, Party D was unlikely to pursue an acquisition of Collectors Universe other than in partnership with Mr. Turner

August 13, 2020, we entered into a confidentiality agreement with Mr. Turner, which included a one-year “standstill”

September 19, 2020, Mr. Turner and Party D submitted a preliminary non-binding all-cash offer of $50.00 per Share. Included a draft exclusivity agreement to negotiate exclusively for a period of 30 days

September 23, 2020, Based on its view of the September 19 Proposal relative to our prospects, the BoD determined to decline to enter into any exclusivity agreement with Mr. Turner and Party D

The September 19 Proposal did not form a basis on which we would proceed with additional discussions regarding a potential transaction and unlikely to consider an acquisition proposal that did not reflect a premium to the trading level of the Shares

September 29, 2020, entered into a settlement agreement with Alta Fox pursuant to which, among other things, Alta Fox withdrew its director slate

October 3, 2020, Mr. Turner and Party D submitting a preliminary non-binding all-cash offer of $52.00 to $54.00

October 2, 2020 BoD would be unlikely to consider an acquisition proposal that did not reflect a premium to the trading level of the Shares.

October 5, 2020, Mr. Moyer expressed his view that the acquisition proposal that did not reflect a premium to the trading level of the Shares was not actionable based on the BoD’s views of acceptable valuations

Continued discussions with Mr. Turner and Party D represented a significant distraction to management and appeared unlikely to result in a transaction that would be acceptable and should be suspended

October 11, 2020, Mr. Turner and Party D submitted a preliminary non-binding all-cash offer of $52.00 to $54.00

October 20, 2020, an individual involved in the collecting and alternative asset space, whom we refer to as “Party E,” understood that CLCT were involved in discussions to sell our company

Reviewed publicly available information concerning Party E, including Party E’s financial resources and determined that Party E, acting independently, would be unlikely to be able to make a viable acquisition proposal at valuations that the Collectors Universe Board would find acceptable without substantial financing requirements

On October 23, 2020, Requested and received approval for Mr. Turner to speak with D1 as a prospective source of equity financing

On October 26, 2020, Informed Party E that we were focused on pursuing our plan as a standalone public company

November 4, 2020, following requests from Party E, HL noted that the market cap exceeded $600 million and would require substantial amounts of capital

HL did not receive further communication from Party E

November 6, 2020, Mr. Turner submitted a preliminary non-binding all-cash proposal of $75.00 to $80.00

Party D no longer wished to participate in an acquisition of Collectors Universe due to concerns about valuation

November 10, 2020, November 6 Proposal represented a potentially attractive valuation for Collectors Universe relative to long-term prospects reflected in the Forecasts and the risks associated with realizing those prospects

November 15, 2020, The discussion focused on provisions of the draft Merger Agreement relating to (1) ability to solicit alternative transactions and (2) no single investor bearing responsibility for the entire purchase price or “reverse” termination fee

Discussed our prior strategic review process in 2019 and the relative likelihood of potential alternative bidders, particularly in light of Party C and Party D having declined to continue discussions over valuation

Request a “go-shop” provision that would permit us, for a specified period following execution of the Merger Agreement, affirmatively to solicit alternative transaction proposals from third parties

Require D1, as the largest and most creditworthy of the investors that had been identified thus far to Collectors Universe, to commit to provide all of the necessary equity capital and guarantee the payment of the “reverse” termination fee

November 16, 2020, HL left a message for a representative of Party E and requested a return call. Neither Party E nor its representatives returned the message

November 21, 2020, in response to the request that the definitive Merger Agreement contain a “go-shop” provision, Mr. Turner and D1, made a revised, bifurcated acquisition proposal that contemplated a lower per-Share price if the Merger Agreement included a “go-shop” provision and respect to the size of any termination fee payable

An all-cash per-Share price of $71.50 if permitted affirmatively to solicit alternative transactions

The termination fee payable by CLCT in connection with accepting an alternative, superior transaction with a third party of 1.75% of the transaction value in connection with a transaction arising during the “go-shop” period and 3.75% in all other instances

A “reverse” termination fee of 5.0% of the transaction value.

An all-cash per-Share price of $75.00 if the Merger Agreement precluded our ability to solicit alternative offers

A termination fee payable by CLCT in connection with our entry into an alternative transaction with a third party of 3.25% of the transaction value

A “reverse” termination fee equal to 5.5% of the transaction value

November 22, 2020, CPV entered into a joinder to our confidentiality agreement with Mr. Turner, which included the “standstill” restrictions

November 22, 2020, Deborah A. Farrington, one of our independent directors, disclosed to the other members of the Collectors Universe Board a business relationship between her affiliated venture capital fund and one of the sources of equity capital to the Investor Group, which source had been identified for the first time in materials provided by the Investor Group.

The Collectors Universe Board noted that the higher alternative offer price of the November 21 Proposal was at the bottom of the range specified in the November 6 Proposal and that the lower alternative was below that range

Noted in particular its views that the range of valuations being discussed was reasonable and favorable to stockholders

Expressed its willingness to proceed with a transaction with the Investor Group that included a “window-shop” provision in lieu of a “go-shop” provision due to, among other factors, (1) the lack of a substantial response from potential acquirers following our review of strategic alternatives in 2016; (2) the lack of interest in an acquisition exhibited by Party A and Party B; (3) Party C’s decision to withdraw its acquisition proposal of $33.00 per Share due to business and valuation concerns; (4) Party D’s decision to terminate its involvement with Mr. Turner due to concerns about the valuation of Collectors Universe; and (5) the view of the Collectors Universe Board that the higher of the two alternatives, although at the low end of the range specified in the November 6 Proposal, nevertheless represented a reasonable and favorable valuation

BoD would likely support a transaction with the following terms: (1) a per-Share price of $78.00 in cash; (2) a termination fee payable by Collectors Universe in connection with our entry into an alternative transaction with a third party of equal to 2.75 percent of the transaction value; (3) a “reverse” termination fee equal to 7.0 percent of the transaction value; and (4) a “window-shop” provision in lieu of a “go-shop” provision.

Determine if Party C had any interest in reengaging in any type of discussions

November 24, 2020, the latest proposal was “best and final.” This proposal contemplated an acquisition of Collectors Universe for an all-cash per-Share price of $75.25. In addition, the proposal provided that (1) the termination fee payable by Collectors Universe in connection with our entry into an alternative transaction with a third party would be equal to 3.25 percent of the transaction value and (2) the “reverse” termination fee would be equal to 6.25 percent of the transaction value. The proposal further provided that D1 and CPV would provide equity commitments for the full amount of the purchase price, and that they would proportionally guarantee payment of any “reverse” termination fee.

November 25, 2020, Counterproposal to the Investor Group that sought to further improve the terms of the transaction in favor of our stockholders, CLCT would likely support a transaction with the following terms: (1) a per-Share price of $76.00 in cash; (2) a termination fee payable by Collectors Universe in connection with our entry into an alternative transaction with a third party equal to 3.0 percent of the transaction value; and (3) a “reverse” termination fee equal to 6.25 percent of the transaction value.

Investor Group reiterated that the November 24 Proposal was “best and final” and that the Investor Group was unwilling to modify the terms of the November 24 Proposal.

Still later on November 25, 2020, Agreed that the Investor Group was unlikely to improve the economic terms of their offer at this point in the negotiations

Also on November 29, 2020, Ms. Farrington disclosed to the other members of the Collectors Universe Board her business relationships with two of the sources of equity capital to the Investor Group, the second of which had been identified to the Collectors Universe Board as a source of equity capital to the Investor Group prior to the meeting.

Ms. Farrington then left the meeting to permit the remaining directors to consider whether these relationships presented an actual or apparent conflict of interest that would impair her ability to evaluate and potentially approve the proposed transaction with the Investor Group

Ms. Farrington should not participate in further deliberations concerning the proposed transaction with the Investor Group