Care.com acquired by IAC for ~$500 million.

If nothing else, the Update Nanny and movies like Adventures in Babysitting, Don’t Tell Mom the Babysitter is Dead, Uncle Buck and The Sitter have told us that it is very important to find the right caregiver for your kids.

Care.com / IAC deal overview

On December 20, 2019, IAC and Care.com, announced IAC will acquire Care.com for $15.00 per share in an all-cash transaction representing ~$500 million of enterprise value. This valuation represents a 34% premium to Care.com’s unaffected closing stock price on October 25, 2019, the last trading day before a media report was published speculating about a potential sale process.

Key points in Background on the offer

TL;DR: It appears Care.com has been evaluating strategic alternatives since 2017, even having discussed a sale to IAC, but no one made any proposals to buy the company in 2017. Care.com tried again in 2018, talking to various Financial Sponsors, again no one made a formal proposal. It wasn’t until the bad press associated with the platform’s safety in early 2019, Care.com lost nearly 70% of its market value in just five months, that the process really seemed to gain momentum for a sale. Process included outreach to 4 potential strategic bidders and 17 potential private equity bidders, which resulted in IAC's submission of its final offer of $15. Only IAC and Sponsor G submitted final round bids. IAC’s $15 offer represented a 61% premium to the closing price on August 14, 2019, (the day before Engine Capital L.P. issued a letter to the Care.com Board urging it to explore a sale) and 13% premium to the closing price on December 19, 2019 (the last trading day prior to the meeting of the Care.com Board to approve the Merger Agreement).

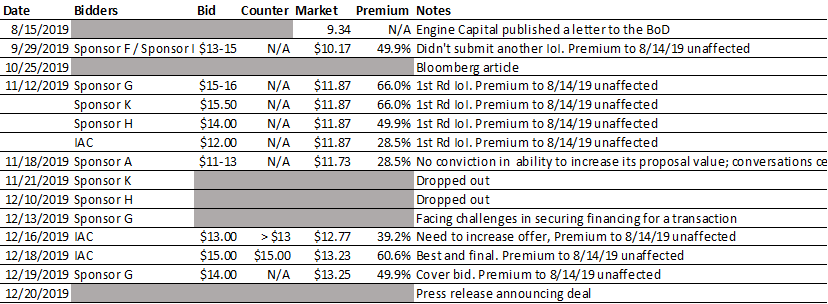

Offer timeline

The wringer

Care.com filed a 14D9 on January 13, 2020 that contained MS’s fairness opinion.

It is fair to MS as Care.com has agreed to pay MS a fee of ~$13 million for its services, approximately $1 million of which was payable in connection with the delivery of the fairness opinion and approximately $12 million of which is contingent upon consummation of the Offer. That works out to ~2.6% of the $500 million Enterprise Value, which would probably be at the upper end of the sell side M&A fee tables. I assume MS has been working on this deal for quiet a while.

For its fee, MS goes with the standard valuation methods and then throws in a couple extra for reference only, for good measure.

Trading comparables

Discounted Equity Value Analysis

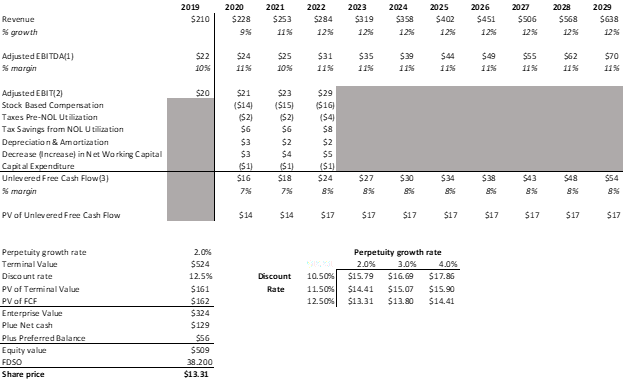

DCF

Transaction comparables

Illustrative Leveraged Buyout Analysis

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Only 3 years of projections are provided, MS extrapolations not provided

Quarterly projections are not provided

A full option schedule was not provided in any filings

There is just too missing data in the filings to recreate the LBO properly. You know what they say garbage in, garbage out. We don’t have any of the financial projections used and it is unclear how much cash from the balance sheet was assumed used to fund the transaction. I used similar assumptions to the DCF, but it is obvious I am missing some key pieces of information, that it make sit not worth showing.

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

Valuation Summary

Is it Fair?

As my plumber used to say, only God and the Delaware Courts can decide that.

As we can see above, the $15 offer is above the majority of the valuation ranges MS chose for the analysis.

That said, the offer is in the bottom half of the DCF range, but it is a relatively wide range.

Overall MS’s valuation range was 52% - 122% of the implied share prices as compared to the offer price, which is a slightly larger range than average.

The stock price had declined from $25.21 in March due to the bad press, so the offer isn’t close to the 52 week high, but the premium to the 3 month high prior to the media reports is healthy.

An implied ~23x LTM EBITDA acquisition multiple is slightly above average for the sector

That said, on February 10, 2020, a total of approximately 26,256,871 Common Shares and 46,350 Preferred Shares, collectively representing ~81.3% of the voting power represented by the outstanding Common Shares and Preferred Shares, were validly tendered.

The details of the Valuation Analysis are below, as well as the Key points in the background of the merger.

Let me know what you think about the new format in the comments below.

Management projected financials

Summary valuation

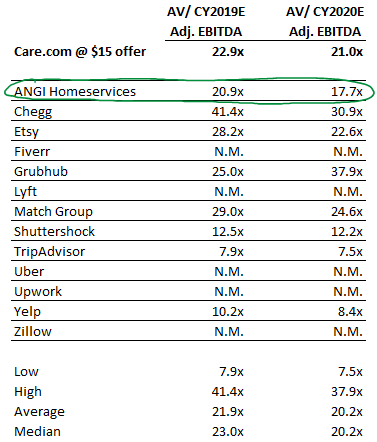

Selected Publicly Traded Companies Analysis

Care.com lists the following companies as competitors in its 10K.

That said, Care.com is considered an Internet company, so no real surprises with comps that MS went with.

MS selected companies, similar business characteristics and/or other similar operating characteristics and utilized publicly available estimates of Adjusted EBITDA compiled by Thomson Reuters, prepared by equity research analysts, available as of December 18, 2019.

Multiples greater than 60.0x (or negative multiples) deemed not meaningful for Morgan Stanley's analysis and labeled as "N.M."

It is probably interesting to note that the range MS chose was closer to the low end of the comps and that Yelp is the closet comp to the trading range MS chose. Angie’s List seems like another decent comp, and is trading at multiple similar to Care.com at the offer price.

The analysis resulted in a range of estimated implied values for the Common Shares, rounded to the nearest $0.25, as follows:

Discounted Equity Value Analysis

MS calculated the future equity value per Common Share at the end of calendar years 2020 and 2021 by:

Applying an Adjusted EBITDA multiple range of 11.0x to 13.0x to Care.com's NTM Adj. EBITDA as of December 31, 2020 and December 31, 2021

Added projected cash and cash equivalents

Subtracted contingent acquisition consideration and the face value, including accrued payment-in-kind interest, of the Preferred Shares to the extent such Preferred Shares were not in-the-money as of December 31, 2020 and December 31, 2021, as well as the cumulative impact of stock based compensation from November 30, 2019 to December 31, 2020 and December 31, 2021, respectively, to reach a future implied equity value

Then divided by FDSO as of December 31, 2020 and December 31, 2021

Including Common Shares issuable upon the conversion of Preferred Shares, including accrued interest to December 31, 2020 and December 31, 2021, assuming such Preferred Shares were in-the-money as of December 31, 2020 and December 31, 2021, as determined under the treasury stock method, which was based on the outstanding basic shares and dilutive securities schedule provided by Care.com as of November 30, 2019 (the latest basic share count and dilutive securities schedule provided to IAC prior to submission of its final proposal).

Then discounted the resulting implied future equity value per share at a discount rate equal to Care.com's assumed mid-point cost of equity of 11.5%

This analysis indicated a range of implied equity values, rounded to the nearest $0.25, of $8.75 to $10.50 per share.

Illustrative Discounted Cash Flow Analysis

MS calculated the unlevered free cash flows that Care.com was forecasted to generate as contained in the Management Baseline Projections for2020 through 2024, as well as top-line extrapolations of such financial forecasts for 2025 through 2029, including the cash flow impact from Care.com's utilization of net operating losses for such periods.

For purposes of the DCF analysis, estimated cash and cash equivalents and contingent acquisition consideration (on a net basis) as provided by Care.com as of December 31, 2019 of approximately $129 million was utilized and the face value, including accrued payment-in-kind interest, of the Preferred Shares as of December 31, 2019 was treated as a debt-like item to the extent such Preferred Shares were not in-the-money

The equity value is then divided by the fully diluted share count as determined under the treasury stock method, including Common Shares issuable upon the conversion of Preferred Shares as of December 31, 2019, assuming such Preferred Shares were in-the-money, which was based on the outstanding basic shares and dilutive securities schedule provided by Care.com as of November 30, 2019 in order to arrive at an implied value per Common Share

Calculated a range of terminal values for Care.com at December 31, 2029 by applying a perpetual growth rate ranging from 2.0% to 4.0% to the normalized unlevered free cash flows for calendar year 2029.

Discounted to present values at December 31, 2019 using a range of discount rates from 10.5% to 12.5%, which reflect Care.com's estimated weighted average cost of capital

The tax savings from net operating loss utilization were discounted to present values at December 31, 2019 using a range of discount rates from 10.5% to 12.5%, which range of discount rates was selected, upon the application of Morgan Stanley's professional judgment and experience, to reflect Care.com's estimated cost of equity

The market data used to calculate the estimated weighted average cost of capital and the estimated cost of equity was as of December 18, 2019

This analysis indicated a range of implied equity values for the Common Shares, rounded to the nearest $0.25, of $13.25 to $18.25 per share.

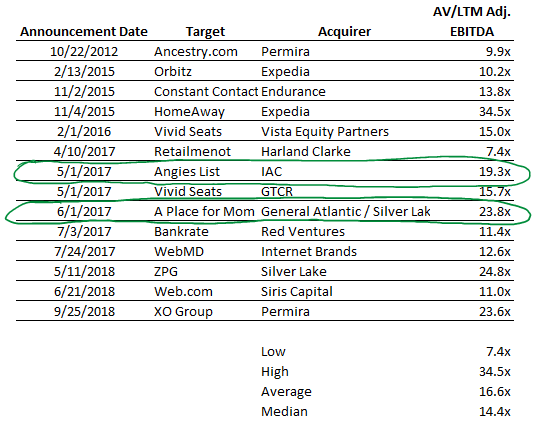

Selected Transactions Analysis

MS selected such comparable transactions, businesses judged to be similar in certain respects to Care.com’s business and because they shared certain characteristics with the Offer and the Merger, most notably because they were in the internet sector.

Ratio of the AV of each transaction to each target company's Adjusted EBITDA for the prior 12-month period as of the transaction announcement date based on publicly available estimates as of the date of such announcement ("LTM Adj. EBITDA")

Applied an AV/LTM Adj. EBITDA range of 12.0x to 18.0x to Care.com's projected LTM Adj. EBITDA as of December 31, 2019 of $22 million from the Management Baseline Projections.

Based on the issued and outstanding Common Shares on a fully-diluted basis as of December 31, 2019 as determined under the treasury stock method, including Common Shares issuable upon the conversion of Preferred Shares, assuming such Preferred Shares were in-the-money, as provided by Care.com as of November 30,2019 (the latest basic share count and dilutive securities schedule provided to IAC prior to submission of its final proposal)

Estimated net cash and cash equivalents and contingent acquisition consideration as provided by Care.com as of December 31, 2019 of approximately $129 million

As well as the face value, including accrued payment-in-kind interest, of the Preferred Shares as of December 31, 2019 to the extent such Preferred Shares were not in-the-money

This analysis resulted in a range of estimated implied values, rounded to the nearest $0.25, of $9.50 to $12.75 per share.

Illustrative Leveraged Buyout Analysis

For reference only, and not as a component of its fairness analysis, MS performed a hypothetical leveraged buyout analysis to determine the prices at which a financial sponsor might affect a leveraged buyout under current market conditions.

Transaction date of December 31, 2019

Five-year investment period ending December 31, 2024

5.0x of total debt to LTM Adj. EBITDA of $22 million

Debt financing and transaction expenses based on prevailing market terms (including an interest rate of 12.5%)

Range from 12.0x to 18.0x of AV/LTM Adj. EBITDA exit multiples

Target internal rates of return for the financial sponsor of 15% to 25%

This analysis indicated a range of implied equity values, rounded to the nearest $0.25, of $8.25 to $14.50 per share.

Equity Research Analysts' Price Target Analysis

For reference only, and not as a component of its fairness analysis, MS reviewed and analyzed future public market trading price targets for the Common Shares prepared and published by equity research analysts prior to December 18, 2019. These targets reflected each analyst's estimate of the future public market trading price of the Common Shares. The range of undiscounted analyst price targets for the Common Shares was $12.00 to $14.00 per Common Share as of December 18, 2019 as reported by Capital IQ.

MS discounted the range of analyst price targets by one year at a rate of 11.5%, was selected to reflect Care.com's mid-point cost of equity, based on market data as of December 18, 2019.

This analysis indicated a range of implied equity values, rounded to the nearest $0.25, of $10.75 to $12.50 per share.

Historical Trading Range Analysis

For reference only, and not as a component of its fairness analysis, MS reviewed the historical trading range for the three-month period based on calendar days ending on October 25, 2019 (the last trading day prior to the publication of a report disclosing Care.com's exploration of a potential sale). During this period, the high and low closing prices were $7.73 and $11.53 per share, respectively.

Key points in the Background of the Merger

June 2019, Care.com received a number of unsolicited in-bound inquiries regarding whether the Company was reviewing strategic alternatives, but these inquiries did not indicate a proposed price per share

August 6, 2019, announced that Ms. Marcelo would resign as President and Chief Executive Officer of Care.com

August 15, 2019, Engine Capital published a letter to the Care.com Board, which called on the Care.com Board to explore strategic options

August 15, 2019, Engaged Morgan Stanley as a financial advisor

October 1, 2019, Morgan Stanley contacted 21 potentially interested parties, including four strategic parties (including IAC), and 17 financial sponsors

13 parties expressed interest and entered into CAs with all 13 of these potentially interested parties, including two strategic parties and 11 financial sponsors

Held management presentations with 12 of 13 parties who executed CAs

Perceived competitive concerns related to Strategic Party A and its lack of expressed interest in the Company as a whole, determined that Strategic Party A would not be invited to participate in the process for the whole Company

Sponsor B (and its affiliated strategic party), Sponsor C and Sponsor D had previously participated in the 2018 process and were not viewed as likely bidders for the whole Company in this context and, accordingly, were not invited to participate

October 25, 2019, MS sent bid letters to the 12 potential bidders who had participated in in-person management presentations with the Company, requesting that each bidder provide a non-binding indication of interest by November 11, 2019

October 25, 2019, Bloomberg published an article speculating that Care.com was working with financial advisors to explore a potential sale transaction

December 4, 2019, MS sent revised bid letters to each of IAC, Sponsor G and Sponsor H, asking each potential bidder to submit final binding proposals by no later than December 16, 2019

December 13, 2019, Sponsor G noted it was facing challenges in securing financing for a transaction and requested that certain stockholders rollover their equity interests, including CapitalG, as part of a proposed transaction

December 15, 2019, IAC confirmed there was no financing condition to its proposal, and IAC would be in a position to sign a definitive agreement in a short period of time if the parties could come to agreeable terms.

MS reiterated that IAC would need to provide an updated bid with a per share purchase price that reflected a control premium in order for to move forward in the final phase of bidding

December 16, 2019, IAC submitted a revised proposal of $13.00 per share in cash, which IAC noted was a 39% premium on Care.com's share price on August 14, 2019 (the day prior to the release of Engine Capital's letter urging Care.com to explore a sale of the Company)

December 17, 2019, Sponsor G, which indicated it was going to submit a revised offer on December 19, 2019 and was still working to be in the target range of $15.00 to $16.00 in cash

Sponsor G would not be in a position to execute a transaction until the first week of January 2020 because it was continuing to work to secure debt financing and would need to negotiate equity rollover terms with CapitalG

December 17, 2019, Morgan Stanley contacted IAC to discuss its proposal, indicating that IAC's proposal was inadequate and would not provide a basis for the Company to move forward.

December 18, 2019, IAC submitted its best and final offer of a price of $15.00 in cash per share of common stock of Care.com

Provided that the parties execute definitive transaction documentation no later than December 20, 2019

Offer was not subject to any financing condition and did not require the rollover of any equity, Did require stockholder support agreements from each Supporting Stockholder

A "two-step" tender offer structure for the proposed transaction

December 19, 2019, Sponsor G submitted a revised proposal for $14.00 per share in cash, subject to completion of definitive documentation, receipt of third party debt financing commitments and equity rollover by CapitalG

December 20, 2019, IAC and Care.com issued a joint press release announcing the transaction

On January 13, 2020, IAC commenced the Tender Offer