RealPage acquired by Thoma Bravo for ~$10.2 billion

If you are a landlord like Pearl, you might be able to use RealPage to improve your operating performance and increase capital returns. RealPage provides services like applicant screening and online billing so you don’t have to go hunt down the monthly rent from tenants like Will.

RealPage / Thoma Bravo deal overview

On December 21, 2020, RealPage, a leading global provider of software and data analytics to the real estate industry, announced it has entered into a definitive agreement to be acquired by Thoma Bravo, in an all-cash transaction that values RealPage at ~$10.2 billion, including net debt.

Under the terms of the agreement, RealPage stockholders will receive $88.75 in cash per share. The purchase price represents a premium of 30.8% over RealPage’s closing stock price of $67.83 on December 18, 2020, a premium of 36.5% over RealPage’s 30-day volume-weighted average share price through that date, and a premium of 27.8% over RealPage’s all-time high closing stock price of $69.47 on December 7, 2020.

45 day Go Shop; No Solicitation expires on February 3, 2021.

TB has obtained equity financing and debt financing commitments of:

Funds advised by Thoma Bravo have committed to provide an aggregate equity contribution of $7,360 million

Goldman Sachs has agreed to provide TB with debt financing in an aggregate principal amount of up to $4 billion

Eying a $2.75 billion first-lien term loan, a $1 billion second-lien term loan, and a $250 million revolver

Update:

Goldman Sachs-led arranger group has set price talk on the $2.75 billion first-lien term

Price talk on the seven-year term loan has been set at L+350-375, with a 0.75% Libor floor and an original issue discount of 99.5. Lenders will be offered six months of 101 soft call protection. At talk, yield to maturity is approximately 4.41%-4.67%.

Additionally, there is a ticking fee for the term loan, with no fee from days 0-60, a fee of 50% of margin from days 61-90 and stepping to 100% of the margin after 90 days.

Financing will also include a $1 billion second-lien term loan that is being privately placed.

First-lien facility ratings are B/B2/B+, with recovery ratings of 2 and 3 from S&P Global Ratings and Fitch. Corporate ratings are B-/B3/B, with stable outlooks.

Credit Suisse, UBS, Apollo, Barclays, BMO Capital Markets, Deutsche Bank, KKR Capital Markets, Nomura, RBC Capital Markets, TB Credit, Truist Securities, Wells Fargo and Stone Point Capital Markets are bookrunners on the transaction.

Background of the merger

TL;DR: This was a pretty quick deal from start to finish. On November 3, 2020, Thoma Bravo, sent an email to RealPage CEO Steve Winn requesting a videoconference call. On November 12, 2020, Thoma Bravo stated that it was interested in acquiring RealPage and that it could be aggressive on price and timing. Shortly after TB follows up with a IoI of $80 and expected to be able to complete its due diligence within three weeks. RealPage does not run a full strategic process, but wants a robust go-shop period after announcement. Some back-and-forth negotiation on price and the merger agreement terms and they ultimately agree on $88.75 (30.8% premium) and ~11% increase from the original offer.

Offer timeline

The wringer

RealPage filed PREM14A on January 19, 2021 that contained BofA’s fairness opinion. BofA delivered an oral and written opinion to the BoD on December 20, 2020. The initial submission is has most of the data need to recreate the analysis, we will see if there is additional disclosure after the go-shop period ends.

It is fair to BofA. RealPage has agreed to pay BofA Securities an aggregate fee of $42.75 million, of which $3.0 million was payable upon delivery of its opinion and the remainder of which is contingent upon consummation of the Merger.

This works out to ~0.4% of the $10.2 billion enterprise value, which would probably be at middle of M&A sell-side fee tables for deals that size.

For its fee, BofA goes with the standard valuation methods.

Trading comparables

Transaction comparables

DCF

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Quarterly projections not provided

A full option schedule was not provided in any filings

Not enough info for the PV of Tax Savings in the DCF analysis

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

Valuation Summary

Is it Fair?

As my mailman used to say, only God and the Delaware Courts can decide that.

RealPage had lackluster stock performance and was trading a discount to most of the software comps prior to the offer, primarily due to organic growth decelerating on a combination of implementation timing headwinds and macro factors.

The takeout multiple is below the software industry average. It looks like BofA generally chose multiple ranges from RealPage’s unaffected share price trading multiple to the median of the software comp set. The discount is more pronounced when you look at the revenue multiples.

The DCF range is extremely wide primarily based off of a “normalized” Terminal Value that makes up ~90% of the Enterprise Value.

Since the execution of the merger agreement, in connection with the go-shop period which expires on February 3, 2021, communicated with 49 additional parties to gauge such parties’ interest in making an alternative Acquisition Proposal. Of those 49 parties, RealPage executed CAs with two parties. To date, no party has made an alternative Acquisition Proposal.

Update:

March 8, 2021, RealPage held a special meeting of stockholders to consider certain proposals related to the Agreement and Plan of Merger, dated as of December 20, 2020 and approved the the proposal to adopt the Merger Agreement.

At the Special Meeting, a total of 74,862,649 shares of Common Stock, representing ~73.35% of the outstanding shares issued and outstanding and entitled to vote, were present virtually or by proxy, constituting a quorum to conduct business.

Let me know what you think about the quick read version in the comments below.

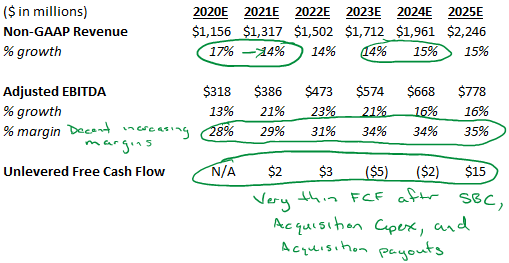

Management projected financials

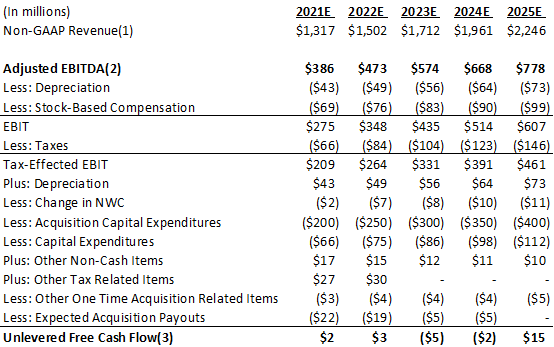

“Unlevered Free Cash Flow” calculated as Adjusted EBITDA less (i) estimated tax expense (assuming a 24% effective tax rate), less (ii) the after tax impact of stock-based compensation expense, less (iii) change in net working capital, less (iv) acquisition capital expenditures, less (v) capital expenditures (other than acquisition capital expenditures), plus (vi) other non-cash items, plus (vii) other tax related items, less (viii) other one time acquisition related items, less (ix) expected acquisition payouts

Updated (2/26/21)

Summary valuation

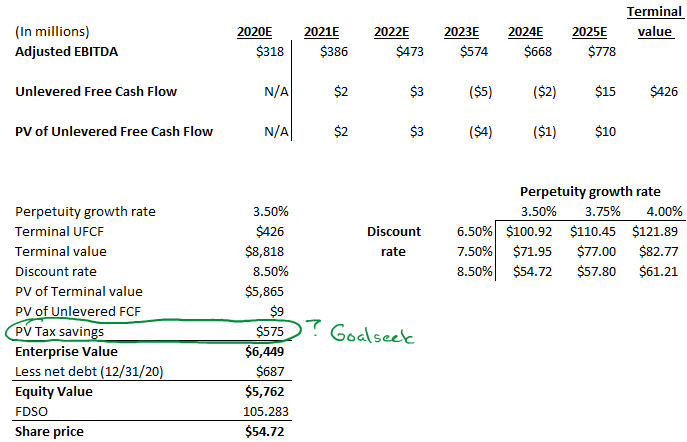

Discounted Cash Flow Analysis

Calculate the PV of the standalone unlevered, after-tax free cash flows during RealPage’s calendar years 2021 through 2025.

Calculated the PV of tax savings from the tax deductible goodwill and intangibles as reflected in the Management Forecasts (calculated at a tax rate of 24% per management)

Calculated terminal values by applying perpetuity growth rates of 3.50% to 4.00%, to terminal year Unlevered Free Cash Flow of $426 million, derived by adjusting CY2025 Unlevered Free Cash Flow, principally to eliminate acquisition capital expenditures, based on management guidance

The cash flows, the tax savings from the tax deductible goodwill and intangibles, and terminal values were then discounted to PV as of December 31, 2020 using discount rates from 6.50% to 8.50% (estimate of RealPage’s WACC)

Deducted net debt as of December 31, 2020 to derive equity values and dividing the result by the number of FDSO, calculated using the treasury stock method, based on information provided by management

This analysis indicated the following approximate implied per share, rounded to the nearest $0.25, of $55.00 - $120.50

Selected Companies Analysis

RealPage lists the following companies in its 10K as competitors. AppFolio (property management software) and CoStar (commercial real estate data and analytics) are public companies, so interesting to see at least AppFolio not included in the software comp set BofA chose.

BofA Securities reviewed publicly available financial and stock market information for RealPage and ten publicly traded companies in the software industry.

Based on the financial characteristics of the selected publicly traded companies and RealPage and based on its professional judgment and experience, BofA applied

CY2021 and 2022 revenue multiples of 5.75x to 9.75x and 5.0x to 9.0x, respectively

RealPage had a NTM revenue multiple that was 4.6x lower than the multiple for the selected publicly traded companies

To CY2021 revenue of $1,317 million and CY2022 revenue of $1,502 million

BofA then applied

CY2021 and 2022 EBITDA multiples of 17.0x to 25.0x and 15.0x to 21.0x, respectively

RealPage had a NTM Adj. EBITDA multiple that was 3.5x lower than the multiple for the selected publicly traded companies

To CY2021 and 2022 Adj. EBITDA of $386 million and $473 million

BofA then applied

CY2021 and 2022 FCF multiples of 20.0x to 30.0x and 18.0x to 27.0x, respectively

To CY2021 and 2022 FCF, calculated as Adj. EBITDA minus capital expenditures (excluding acquisition capital expenditures) on an unlevered basis, of $320 million and $398 million

BofA then

Calculated implied equity value reference ranges per share by deducting estimated net debt of RealPage of $687 million

Dividing the result by the number of FDSO (treasury stock method)

This analysis indicated the following approximate implied per share, rounded to the nearest $0.25, of:

Selected Transactions Analysis

BofA reviewed, to the extent publicly available, financial information relating to twenty-one selected transactions involving companies in the software industry.

BofA then applied

Enterprise value to LTM Revenue and NTM Revenue multiples of 6.0x to 9.0x and 5.5x to 8.0x, respectively

To CY2020 revenue of $1,156 million, and CY2021 revenue of $1,317 million

BofA then applied

Enterprise value to LTM EBITDA and NTM EBITDA multiples of 19.5x to 28.0x and 17.5x and 24.0x, respectively

To LTM Adj. EBITDA as of December 31, 2020 of $318 million and NTM Adj. EBITDA as of December 31, 2020 of $386 million

BofA then

Calculated implied per share of RealPage common stock equity value reference ranges by deducting estimated net debt of RealPage of $687 million, as provided by RealPage’s management, as of December 31, 2020

Dividing the result by the number of FDSO (treasury stock method)

This analysis indicated the following approximate implied per share, rounded to the nearest $0.25, of:

Background of the Mergers

November 3, 2020, Scott Crabill, Managing Partner of Thoma Bravo, sent an email to CEO Steve Winn, stating TB’s belief that the current environment may afford an opportunity to work together, and requesting whether Winn may be available for a videoconference call to discuss the matter

November 12, 2020, Winn and Crabill and Orlando Bravo, Managing Partner of TB, joined a videoconference call. Bravo and Crabill stated that TB was interested in acquiring RealPage, that it could be aggressive on price and timing, and that it had the capacity to accomplish a transaction without involving any other equity participant. They further stated that they understood that any transaction would have to be at a significant premium to the current trading price of RealPage common stock

November 18, 2020, Winn, Bravo and Crabill joined a videoconference call. Bravo and Crabill stated that TB was interested in acquiring RealPage for $80 per share in cash, which would be financed by approximately $3 billion in debt and $7 billion in equity, and that, subject to due diligence, they expected to be able to sign a transaction in three weeks

Following the telephone call, Crabill emailed a letter to Winn containing a non-binding letter of intent for TB to acquire 100% of the outstanding common stock of RealPage for $80 per share. The Initial LOI noted that the full consideration would be financed with equity from TB funds and debt from one or more of TB’s lending partners, and the transaction would not be subject to a financing condition. The Initial LOI also indicated that TB expected to be able to complete its due diligence with respect to RealPage within three weeks

November 19, 2020, The TB initial proposal did not fairly value RealPage and that TBshould increase its proposed purchase price. It was also agreed that Winn would inform TB that RealPage would consider providing to TB certain high priority due diligence information that would facilitate such an increase, subject to the parties entering into an appropriate confidentiality agreement.

November 24, 2020, Contact BofA to inquire about a possible engagement and, subject to confirming BofA was not conflicted, engaging BofA , due to, among other things, its extensive experience in RealPage’s industry

November 27, 2020, RealPage and TB executed the agreement, which included a customary standstill provision

December 4, 2020, TB emailed a non-binding letter of intent for to acquire 100% of the outstanding common stock of RealPage for $87 per share. The Revised LOI noted that the full consideration would be financed with $7.268 billion of equity from TB equity funds and $3 billion of new debt from only one of TB’s lending partners, and the transaction would not be subject to a financing condition. The Revised LOI also indicated that TB expected to be able to complete its remaining due diligence with respect to RealPage within 10 days.

December 7, 2020, Discussed standalone prospects, as well as whether other potential bidders would be capable of and willing to offer a more attractive value than TB’s $87 per share all-cash proposal. After discussion regarding the likelihood of potential interest from other bidders, the risk of leaks from a broader process, and the potential impact on discussions with TB, as well as other factors, the BoD preliminarily determined not to solicit alternative third-party interest at this time, but to negotiate for a robust go-shop process

December 16, 2020, Discussed the money transmitter license approvals required in connection with the proposed transaction with the BoD, including that various state governments would be required to consent to the proposed transaction because one of RealPage’s subsidiaries was licensed as a money transmitter in such states

December 17, 2020, TB had recently indicated it was close to completing its due diligence review. The BoD also revisited its earlier discussion, with input from BofA Securities, regarding whether other potential bidders would be capable of and willing to offer a more attractive value than TB’s $87 per share all-cash proposal or TB’s deal certainty, especially in a timely manner. Following discussion with its advisors, the BoD determined that a go-shop structure, especially if favorable go-shop terms could be secured, was an advisable path to achieve a value-maximizing transaction based on the prevailing facts and circumstances.

BoD determined that RealPage should continue the current course of negotiations with TB, seeking the highest price and most favorable terms available, and specifically that BofA Securities should present a counteroffer of $90 per share.

December 18, 2020, TB indicated it would be willing to increase its proposed purchase price to $88.50 per share

December 18, 2020, Propose $88.75 per share, with an indication that the BoD would be preliminarily prepared to recommend a transaction at that price

After the meeting, representatives of BofA Securities held a videoconference call with Bravo and Crabill and proposed a purchase price of $88.75 per share, which the representatives of TB agreed to in a subsequent videoconference call later that day

December 20, 2020, the parties executed and delivered the merger agreement

45-day “go-shop” period

Termination fee of either (i) $91,000,000 (~1% equity value) if terminated before the No Shop Period Start Date with respect to an Excluded Party or (ii) $288,000,000 (~3% equity value), for any other termination

Reverse Termination fee of $528,000,000 (~5.75% equity value)

December 21, 2020, issued a press release announcing the transaction

Since the execution of the merger agreement, in connection with the go-shop period provided for in the merger agreement, which expires on February 3, 2021, at the direction of the BoD, representatives of BofA Securities have communicated with 49 additional parties to gauge such parties’ interest in making an alternative Acquisition Proposal. Of those 49 parties, RealPage executed a confidentiality agreement with two parties. To date, no party has made an alternative Acquisition Proposal.