⚖️ For Fairness Sake ⚖️ Proofpoint acquired by Thoma Bravo

A quick look at Proofpoint's fairness opinion

Proofpoint acquired by Thoma Bravo for ~$12.3 billion.

This is a little more preliminary look since the PREM14A with the fairness was just filed and we are missing some data that may get filled in. I will likely update this post as we get more data.

Proofpoint / Thoma Bravo deal overview

April 26, 2021 — Proofpoint, (NASDAQ: PFPT), a leading cybersecurity and compliance company, announced that it entered into a definitive agreement to be acquired by Thoma Bravo, in an all-cash transaction that values Proofpoint at ~$12.3 billion.

Under the terms of the agreement, Proofpoint shareholders will receive $176.00 per share in cash, representing a premium of ~34 percent over Proofpoint’s closing share price on April 23, 2021, the last full trading day prior to the transaction announcement, and a premium of ~36 percent over Proofpoint’s three-month volume-weighted average closing share price through April 23, 2021.

Transaction Details

The agreement includes a 45-day “go-shop” period expiring on June 9, 2021, which allows the Board and its advisors to actively initiate, solicit and consider alternative acquisition proposals from third parties. The Board will have the right to terminate the merger agreement to enter into a superior proposal subject to the terms and conditions of the merger agreement.

The Company is also entitled to terminate the Merger Agreement, and receive a termination fee of $676,400,000 from Parent, including if (1) Parent fails to consummate the Merger following the completion of a marketing period for Parent’s debt financing and satisfaction or waiver of certain closing conditions or (2) if Parent otherwise breaches its obligations under the Merger Agreement such that the conditions to the consummation of the Merger cannot be satisfied.

If the Merger Agreement is terminated in certain other circumstances, including by the Company in order to enter into a superior proposal or by Parent because the Board withdraws its recommendation in favor of the Merger, the Company would be required to pay Parent a termination fee of $368,946,000; provided that a lower fee of $122,982,000 will apply with respect to a termination to enter into a superior proposal during the Go Shop Period.

Advisors

Morgan Stanley & Co. LLC is acting as exclusive financial advisor to Proofpoint, and Skadden, Arps, Slate, Meagher & Flom LLP is acting as its legal counsel.

Financing for the transaction is being provided by Goldman Sachs & Co. LLC. Goldman Sachs & Co. LLC is also serving as financial advisor to Thoma Bravo, and Kirkland & Ellis LLP is serving as its legal counsel.

Update:

Proofpoint acquisition financed by $250 million secured revolving credit facility (RCF) and $2.6 billion first-lien secured term loan and a $800 million second-lien secured term loan.

Background of the merger

TL;DR: TB reached out and expressed interest in acquiring Proofpoint in August 2020. TB made its first offer of $125 in November 2020, which Proofpoint deemed not in the best interest of its shareholders at the time. TB came back in February 2021 with a revised offer of 165.00 per share in cash, implying a premium of 25%. Proofpoint countered that it would engage with TB if TB increased its proposed offer price to at least $175.00. At that point Proofpoint and MS ran a very limited market check to a handful of potential Strategics, which did not result in any other offers. TB agreed to offer $175 and started Due Diligence with the company. Proofpoint final counter in April was at $180 and resulted in TB’s best and final of $176 , which was accepted.

Offer timeline

The wringer

Proofpoint filed PREM14A on June 2, 2021 that contained MS’s fairness opinion. MS delivered an oral and written opinion to the BoD on April 25, 2021. The initial submission is missing a large amount of key financial data need to recreate the analysis, we will see if Investors sue to get more disclosure.

Proofpoint has agreed to pay Morgan Stanley a fee of ~$78 million for its services, $16 million of which has been paid following delivery of the opinion and the remainder of which is contingent upon the consummation of the Merger.

It is fair to MS. This works out to ~0.63% of the $12.3 billion enterprise value, which would probably be at the higher end of M&A sell-side fee tables.

For its fee, MS goes with the standard valuation methods and some for observation only.

Trading comparables

Transaction comparables

DCF

Discounted Equity

Premia paid

Historical Trading Ranges

Equity Research price targets

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Quarterly projections not provided

A full option schedule was not provided in any filings

No detail on the terminal multiple for the DCF provided

Levered Free Cash Flow (LFCF) projections not provided (Can Goal Seek numbers and they are close to some Equity Research)

Street financial projections not provided

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

Valuation Summary

Is it Fair?

As my electrician used to say, only God and the Delaware Courts can decide that.

Ran a limited market check to a handful of Strategics that did not result in any offers

Go-shop period expires June 9, 2021 and has yet to result in a superior offer

$176 offer is near the top of the majority of the valuation ranges MS chose, but significantly lower than the DCF and Discounted Equity highs

Relatively healthy 34% premium

Stock performance has been slightly volatile, trading within a band of $100 to $140 over the last 2 years

Let me know what you think about the quick read version in the comments below.

Management projected financials

(1) “EBIT” is non-GAAP operating income, which is defined as operating loss, adjusted to exclude stock-based compensation expense, the amortization of intangibles, costs associated with acquisitions, litigations and facility exit costs related to the relocation of our corporate headquarters. Costs associated with acquisitions include legal, accounting, and other professional fees, as well as changes in the fair value of contingent consideration obligations.

(2) “Unlevered Free Cash Flow” is non-GAAP operating income plus depreciation and amortization expense, less (1) stock-based compensation expense, (2) cash taxes, (3) capital expenditures, and (4) capitalized software expense and plus or minus changes in net working capital and other adjustments.

Updated 7/13/21

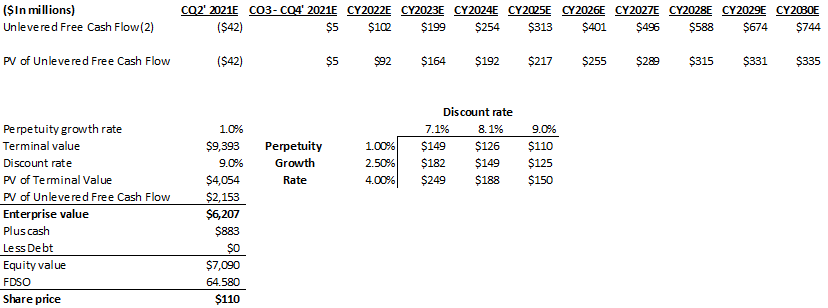

Discounted Cash Flow Analysis

Morgan Stanley performed a discounted cash flow analysis, which is designed to provide an implied value of a company by calculating the present value of the estimated future cash flows and terminal value of such company. Morgan Stanley calculated a range of fully diluted equity values per share for the Proofpoint common stock based on a discounted cash flow analysis to value Proofpoint as a standalone entity. Morgan Stanley utilized estimates from the Street Consensus and Management Plan for purposes of its discounted cash flow analysis, as more fully described below.

Morgan Stanley first calculated the estimated unlevered free cash flow, which is defined as non-GAAP operating income, plus depreciation and amortization expense, less (1) stock-based compensation expense, (2) cash taxes, (3) capital expenditures, and (4) capitalized software expense and plus or minus changes in net working capital and other adjustments. Each of the Street Consensus and Management Plan included estimates prepared by Proofpoint’s management through 2030. The free cash flows and terminal values were discounted, using a mid-year convention, to present values as of April 23, 2021, at a discount rate ranging from 7.1% to 9.0%, which discount rates were selected, upon the application of Morgan Stanley’s professional judgment and experience, to reflect an estimate of Proofpoint’s weighted average cost of capital determined by the application of the capital asset pricing model.

Based on the outstanding shares of Proofpoint common stock on a fully diluted basis as provided by Proofpoint’s management, Morgan Stanley calculated the estimated implied value per share of Proofpoint common stock as follows:

Assuming Convertible Debt is converted to equity, gets closer to the MS range, assuming a perpetuity growth rate range of 1% - 4%.

Discounted Equity Analysis

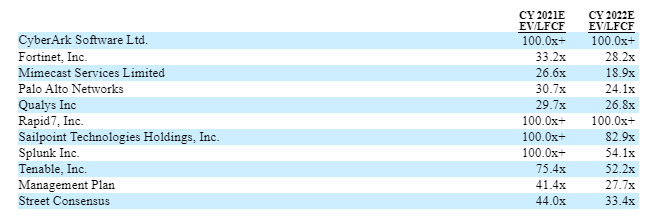

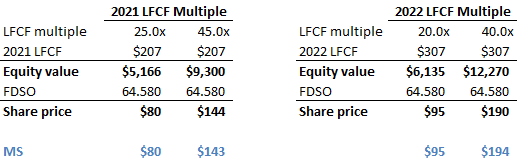

Morgan Stanley performed a discounted equity value analysis, which is designed to provide insight into the potential future equity value of a company as a function of such company’s estimated future LFCF. The resulting equity value is subsequently discounted to arrive at an estimate of the implied present value. In connection with this analysis, Morgan Stanley calculated a range of implied present equity values per share of the Proofpoint common stock on a standalone basis for each of the Street Consensus and Management Plan.

To calculate these discounted fully diluted equity values, Morgan Stanley utilized calendar year 2023 LFCF estimates under each of the Street Consensus and Management Plan. Based upon the application of its professional judgment and experience, Morgan Stanley applied a forward range of fully diluted equity value to LFCF multiples (based on the range of fully diluted equity value to LFCF multiples for the comparable companies) to these LFCF estimates in order to reach a future implied fully diluted equity value.

In each case, Morgan Stanley then discounted the resulting implied future fully diluted equity value to April 23, 2021, at a discount rate of 8.1%, which rate was selected based on Proofpoint’s estimated cost of equity, which was arrived at by applying the capital asset pricing model, to calculate the discounted fully diluted equity value. The resulting discounted fully diluted equity value was then divided by Proofpoint’s fully diluted share count as provided by Proofpoint’s management to derive the implied discounted fully diluted equity value per share as follows:

Proofpoint does not provide the Levered FCF projections or the projected 2023 FDSO, but using Goal Seek and assuming a static share count, we are directionally close to Equity Research LFCF projections.

Selected Companies Analysis

Proofpoint lists the following companies in it s10K as competitors.

Morgan Stanley performed a public trading comparables analysis, which attempts to provide an implied value of a company by comparing it to similar companies that are publicly traded. Morgan Stanley reviewed and compared certain financial estimates for Proofpoint with comparable publicly available consensus equity analyst research estimates for companies, selected based on Morgan Stanley’s professional judgment and experience, that share similar business characteristics and have certain comparable operating characteristics including, among other things, similarly sized revenue and/or revenue growth rates, market capitalizations, profitability, scale and/or other similar operating characteristics (these companies are referred to as the “comparable companies”). These companies were the following:

For purposes of this analysis, Morgan Stanley analyzed the ratio of fully diluted equity value to estimated levered free cash flow (“LFCF”), which, for purposes of this analysis, (i) for Proofpoint, (x) was provided to Morgan Stanley, and approved for Morgan Stanley’s use, by Proofpoint’s management for calendar years 2021 and 2022 for the Management Plan, and (y) was based on publicly available consensus equity analyst research estimates for calendar years 2021 and 2022 for the Street Consensus; and (ii) for each of the comparable companies, was based on publicly available consensus equity analyst research estimates for comparison purposes. Based on its analysis of the relevant metrics for each of the comparable companies and upon the application of its professional judgment and experience, Morgan Stanley selected representative ranges of fully diluted equity value to LFCF multiples and applied these ranges of multiples to the estimated relevant metric for Proofpoint. For purposes of this analysis, Morgan Stanley utilized publicly available financial information, available as of April 23, 2021 (the last full trading day prior to the meeting of the Board of Directors to approve and adopt the Merger Agreement, declare the advisability of the Merger Agreement and approve the transactions contemplated thereby, including the Merger).

Based on the outstanding shares of Proofpoint common stock on a fully diluted basis as provided by Proofpoint’s management and the selected ranges of fully diluted equity value to LFCF, Morgan Stanley calculated the estimated implied value per share of Proofpoint common stock as follows:

Proofpoint does not provide the Levered FCF projections, but using Goal Seek and assuming a static share count, we are directionally close to Equity Research LFCF projections.

Selected Transactions Analysis

Morgan Stanley performed a precedent transactions multiples analysis, which is designed to imply a value of a company based on publicly available financial terms. Morgan Stanley compared publicly available statistics for selected software transactions. Morgan Stanley selected such comparable transactions because they shared certain characteristics with the Merger, most notably because they were similar software transactions. For such transactions, Morgan Stanley noted the estimated fully diluted equity value of the transaction to the next 12 months’ (which we refer to as “NTM”) LFCF based on publicly available information at the time of announcement of each such transaction.

The following is a list of the selected software transactions reviewed, together with the applicable multiples:

Based on its analysis of the relevant metrics and time frame for each of the transactions listed above and upon the application of its professional judgment and experience, Morgan Stanley selected representative ranges of the fully diluted equity value to the estimated NTM LFCF multiples of the transactions, and applied these ranges of multiples to the estimated calendar year 2021 LFCF for Proofpoint based on the Management Plan and the Street Consensus. The following table summarizes Morgan Stanley’s analysis:

Proofpoint does not provide the Levered FCF projections, but using Goal Seek and assuming a static share count, we are directionally close to Equity Research LFCF projections.

Illustrative Precedent Premiums

Morgan Stanley performed an illustrative precedent premiums analysis by reviewing the same sets of comparable transactions as under the Precedent Transactions Multiples Analysis. For these transactions, Morgan Stanley noted the distributions of the implied premium to the acquired company’s closing share price on the last trading day prior to announcement (or the last trading day prior to the share price being affected by acquisition rumors or similar news). The following table summarizes Morgan Stanley’s analysis:

Based on its analysis of the premia for such transactions and based upon the application of its professional judgment and experience, Morgan Stanley selected a representative range of premia and applied such range to Proofpoint’s closing share price on April 23, 2021 (the last full trading day prior to the meeting of the Board of Directors to approve and adopt the Merger Agreement, declare the advisability of the Merger Agreement and approve the transactions contemplated thereby, including the Merger).

The following table summarizes such calculation:

Historical Trading Ranges

Morgan Stanley noted certain trading ranges with respect to the historical share prices of Proofpoint common stock. Morgan Stanley reviewed a range of closing prices of the Proofpoint common stock for various periods ending on April 23, 2021 (the last full trading day prior to the meeting of the Board of Directors to approve and adopt the Merger Agreement, declare the advisability of the Merger Agreement and approve the transactions contemplated thereby, including the Merger). Morgan Stanley observed the following:

Equity Research Analysts’ Future Price Targets

Morgan Stanley noted certain future public market trading price targets for Proofpoint common stock prepared and published by equity research analysts prior to April 23, 2021 (the last full trading day prior to the meeting of the Board of Directors to approve and adopt the Merger Agreement, declare the advisability of the Merger Agreement and approve the transactions contemplated thereby, including the Merger). These targets reflected each analyst’s estimate of the future public market trading price of Proofpoint common stock. The range of undiscounted analyst price targets for the Proofpoint common stock was $100 to $166 per share as of various dates ranging from November 1, 2020 to April 18, 2021. Morgan Stanley discounted the range of analyst price targets per share for the Proofpoint common stock by one year at a rate of 8.1%, which discount rate was selected by Morgan Stanley, upon the application of its professional judgment and experience, to reflect Proofpoint’s cost of equity. This analysis indicated an implied range of fully diluted equity values for Proofpoint common stock of $92 to $154 per share, as discounted by one year based on undiscounted analyst price targets, as of April 23, 2021 (the last full trading day prior to the meeting of the Board of Directors to approve and adopt the Merger Agreement, declare the advisability of the Merger Agreement and approve the transactions contemplated thereby, including the Merger).

Background of the Mergers

On August 11, 2020, Mr. Andrew Almeida of Thoma Bravo contacted Mr. Gary Steele, CEO of Proofpoint to request a meeting.

On August 27, 2020, Seth Boro and Chip Virnig of Thoma Bravo met with Mr. Steele and Mr. Jason Hurst, SVP of Corporate Development of Proofpoint, by videoconference and discussed Thoma Bravo’s investment strategy as a general matter and the firm’s investments in software security businesses in particular. After some discussion, Mr. Boro stated that Thoma Bravo would be interested in exploring an acquisition of Proofpoint if Proofpoint was receptive to a potential transaction.

On October 27, 2020, the Proofpoint Board of Directors held its annual strategic planning meeting. The agenda included a comprehensive review of Proofpoint’s near term and long term business plans and strategies and the development of near term and long term financial projections. Mr. Steele informed the Board of Directors of his recent conversation with Messrs. Boro and Virnig and agreed to keep the Board of Directors apprised of any further discussions with Thoma Bravo.

On November 4, 2020, Messrs. Boro, Virnig and Almeida had another videoconference with Messrs. Steele and Hurst, during which Messrs. Boro, Virnig and Almeida previewed that they would be sending a written indication of interest to acquire Proofpoint. Later that day, Proofpoint received a non-binding letter of intent from Thoma Bravo (the “Initial Letter of Intent”) to acquire Proofpoint for $125.00 per share in cash. The Initial Letter of Intent noted that the full consideration would be financed with a combination of equity from Thoma Bravo Funds and debt from one or more of Thoma Bravo’s lending partners, and the transaction would not be subject to a financing condition. The Initial Letter of Intent was promptly shared with the Board of Directors, with a note recommending that Proofpoint work with Morgan Stanley to evaluate the proposal and prepare an analysis for the Board of Directors. Proofpoint then contacted representatives of Morgan Stanley on November 4, 2020 to enlist their assistance with a review of Thoma Bravo’s proposal. Proofpoint requested Morgan Stanley’s assistance based on Proofpoint’s long standing relationship with Morgan Stanley, including Morgan Stanley’s work with Proofpoint in connection with its ongoing strategic review, as well as Morgan Stanley’s extensive expertise and experience advising software companies in connection with potential strategic transactions (including numerous transactions with Thoma Bravo). Proofpoint signed a formal engagement letter with Morgan Stanley on February 8, 2021.

On November 23, 2020, The Board of Directors discussed the preliminary financial analysis of the proposal contained in the Initial Letter of Intent and determined that Proofpoint’s management team should continue its strategic review process and that a potential sale of Proofpoint for $125.00 per share in cash was not in the best interests of Proofpoint Stockholders and did not warrant further discussion or engagement with Thoma Bravo.

Later that day, Messrs. Steele and Hurst met with Messrs. Boro and Virnig by videoconference to provide feedback on the Initial Letter of Intent. Messrs. Steele and Hurst informed Messrs. Boro and Virnig that the Board of Directors and Proofpoint’s senior management were in the process of conducting a strategic review of Proofpoint’s business and the Board of Directors did not believe that the proposal contained in the Initial Letter of Intent was sufficient to interrupt Proofpoint’s strategic review. Mr. Steele emphasized that the Board of Directors and management were confident in Proofpoint’s business outlook and Proofpoint was not looking for a sale transaction. Despite this feedback, Messrs. Boro and Virnig suggested that representatives of Thoma Bravo and representatives of Proofpoint get together in January 2021 to discuss Thoma Bravo’s thoughts on Proofpoint and Thoma Bravo’s investment thesis underlying its interest in Proofpoint. Messrs. Boro and Virnig also suggested that Thoma Bravo might be able to improve its proposal with access to certain confidential information from Proofpoint, and, accordingly, they requested that the parties enter into a non-disclosure agreement to enable Proofpoint to provide this information to Thoma Bravo. Messrs. Steele and Hurst informed them, however, that Proofpoint was not interested in providing any confidential information to Thoma Bravo because Proofpoint was not looking for a sale transaction.

On November 24, 2020, a representative of Morgan Stanley received a call from Mr. Boro. On the call, Mr. Boro stated that Thoma Bravo was very interested in acquiring Proofpoint and believed that Thoma Bravo could make a compelling proposal with access to certain confidential information from Proofpoint. Mr. Boro emphasized that Thoma Bravo wanted to find a path forward with Proofpoint prior to the conclusion of Proofpoint’s strategic review so as not to lose time.

On November 25, 2020, Mr. Virnig contacted Mr. Steele to inform him that Thoma Bravo remained interested in a potential transaction with Proofpoint despite the Board of Directors' response and wanted to spend more time with Proofpoint’s management before the forthcoming holidays. Mr. Virnig also told Mr. Steele that he wanted to introduce him to Orlando Bravo, the founder of Thoma Bravo, so that Mr. Bravo could also explain Thoma Bravo’s interest in Proofpoint. On November 27, 2020, Mr. Steele informed Mr. Virnig that he was willing to meet with Mr. Bravo and would confirm his availability for a videoconference. Mr. Steele informed a member of the Board of Directors of this development in order to keep the Board of Directors generally advised of his engagement with Thoma Bravo.

On December 11, 2020, Messrs. Steele and Hurst met with a financial sponsor (“Financial Sponsor A”) to discuss a potential transaction with Proofpoint, following an introduction from a third party financial advisor.

On December 22, 2020, Messrs. Steele and Hurst met with Messrs. Virnig, Bravo and Boro by videoconference during which Messrs. Virnig, Bravo and Boro emphasized their continuing interest in acquiring Proofpoint and provided background on Thoma Bravo and some of its investments to date.

On January 22, 2021, Proofpoint’s management team provided Morgan Stanley with their forecasts of Proofpoint’s financial results based on their ongoing strategic review of Proofpoint’s business and their revised long range strategic plans for Proofpoint (the “Management Plan”).

On January 27, 2021, Morgan Stanley reviewed updated preliminary financial analysis of the proposal contained in the Initial Letter of Intent based on publicly available information and the Management Plan. Morgan Stanley’s analysis included, among other things, the financial analysis of Proofpoint on a standalone basis, the premium and multiples implied by the proposal contained in the Initial Letter of Intent and Proofpoint’s potential vulnerability to activist shareholder attacks. After discussion, the Board of Directors maintained its previously reached determination that the proposal contained in Thoma Bravo’s Initial Letter of Intent was not in the best interests of Proofpoint Stockholders.

On February 5, 2021, Mr. Boro contacted a representative of Morgan Stanley to schedule a call. During the call, Mr. Boro reiterated Thoma Bravo’s interest in acquiring Proofpoint and expressed Thoma Bravo’s desire to find a path forward with Proofpoint. Mr. Boro requested guidance on a sale price that Proofpoint might find sufficiently attractive to warrant engagement. The representative of Morgan Stanley reiterated that, based on feedback and directions from Proofpoint, Proofpoint was not looking for a sale transaction so Thoma Bravo would likely need to propose a transaction reflecting a traditional market premium to Proofpoint’s then-current stock price to entice Proofpoint to engage in further discussions with Thoma Bravo.

On February 10, 2021, Mr. Boro also called Mr. Steele and a representative of Morgan Stanley to inform them that Thoma Bravo would be sending a revised written indication of interest to acquire Proofpoint. Following these telephone calls, Mr. Boro sent a revised non-binding letter of intent (the “First Revised Letter of Intent”) to Mr. Steele and representatives of Morgan Stanley. The First Revised Letter of Intent contained a proposal to acquire Proofpoint at $165.00 per share in cash, implying a premium of 25% to Proofpoint’s then-current stock price of $132.04.

On February 16, 2021, The Board of Directors discussed potential responses to Thoma Bravo. Following such discussions, the Board of Directors directed representatives of Morgan Stanley to propose that Proofpoint would engage with Thoma Bravo if Thoma Bravo increased its proposed offer price to at least $175.00 per share in cash, but also directed Morgan Stanley to inform Thoma Bravo that Thoma Bravo would ultimately need to increase its offer price above $175.00 per share after completing its due diligence on Proofpoint in order to obtain the Board of Directors’ support for a transaction.

The Board of Directors then discussed whether to commence a market check to determine whether any third parties might have interest in exploring an acquisition of Proofpoint. As part of this discussion, representatives of Morgan Stanley described various structures and forms of market checks (including the use of a so-called “go-shop” arrangement) and the advantages and disadvantages of the various market check approaches, including the leak risks created by making outbound calls to a broad set of potential acquirors and the business risks created by contacting Proofpoint’s competitors to gauge their interest in acquiring Proofpoint. Morgan Stanley noted that Thoma Bravo’s proposal letters had expressed a willingness to incorporate a “go-shop” provision in any definitive agreement to acquire Proofpoint. Representatives of Morgan Stanley then reviewed an analysis of third parties who might have interest in exploring a potential acquisition of Proofpoint based on their financial resources and strategic fit with Proofpoint and suggested that Proofpoint contact three of these parties in a pre-signing market check. These strategic buyers are referred to herein as “Strategic Party A,” “Strategic Party B” and “Strategic Party C,” respectively. The Board of Directors determined not to contact other financial sponsors at that time based on the view that Thoma Bravo had unique expertise and interest in the security software business sector, coupled with its current willingness and financial capability to acquire a company of Proofpoint’s size and scale. The Board of Directors further noted that, if Proofpoint ultimately signed a definitive agreement with Thoma Bravo, it would be able to contact other financial sponsors during the “go-shop” process.

On February 17, 2021, Morgan Stanley asked that Thoma Bravo submit a further revised proposal in writing. Later that night, Mr. Boro contacted a representative of Morgan Stanley and requested a copy of the Management Plan before determining whether it would be willing to increase its proposed offer price.

On February 18, 2021, representatives of Morgan Stanley called Paul Auvil, CFO of Proofpoint, by telephone, and after such discussion, it was agreed that Morgan Stanley would provide Thoma Bravo with the Morgan Stanley Equity Research report on Proofpoint and not the Management Plan on the basis that Thoma Bravo had not yet signed a non-disclosure agreement with Proofpoint.

On February 21, 2021, Thoma Bravo sent Proofpoint a revised written non-binding letter of intent (the “Second Revised Letter of Intent”), which contained a revised proposal to acquire Proofpoint for $175.00 per share in cash, implying a premium of 26% to Proofpoint’s then-current stock price of $139.13. Later that day, a representative of Morgan Stanley requested that Thoma Bravo provide a summary work plan, and Thoma Bravo sent representatives of Morgan Stanley an outline of a work plan together with an initial ‘high priority’ due diligence request list.

On February 22, 2021, Thoma Bravo noted that the full consideration would be financed with a combination of equity from Thoma Bravo Funds and debt from one of Thoma Bravo’s lending partners. The attendees agreed that a potential transaction could be executed in three weeks and that to meet this timeline, Thoma Bravo would send an agenda for management presentations and further due diligence request lists from its advisors over the next couple of days.

On March 3, 2021, Proofpoint and Thoma Bravo signed a non-disclosure agreement that included a “standstill” provision (but did not include a so-called “don’t ask, don’t waive” provision).

On March 4, 2021, Messrs. Steele and Auvil hosted a management presentation by videoconference with Messrs. Boro, Virnig, Almeida and other representatives from Thoma Bravo and representatives of Morgan Stanley in attendance. At that meeting, Messrs. Steele and Auvil presented the Management Plan to Thoma Bravo and answered questions regarding the same.

On March 11, 2021, Morgan Stanley contacted Strategic Party A to inquire if it was interested in a potential acquisition of Proofpoint. Strategic Party A indicated that it was not interested in exploring a potential transaction with Proofpoint.

On March 15, 2021, Morgan Stanley contacted Strategic Party B to inquire if it was interested in a potential acquisition of Proofpoint. Strategic Party B indicated that it was not interested in exploring a potential transaction with Proofpoint. Later that day, Mr. Steele contacted Strategic Party C to inquire if it was interested in a meeting in connection with a potential strategic transaction involving Proofpoint. Later that day, a representative of Strategic Party C introduced Mr. Steele to another member of Strategic Party C’s senior management team.

On March 17, 2021, Mr. Steele and other representatives of Proofpoint hosted a technology due diligence kick-off meeting by videoconference with representatives of Thoma Bravo, West Monroe Partners (“WMP”), Thoma Bravo’s technology advisor, and Morgan Stanley.

On March 19, 2021, Mr. Steele spoke by telephone with a representative of Strategic Party C to schedule a management presentation for Strategic Party C the following week.

On March 21, 2021, Strategic Party C sent a draft non-disclosure agreement to a representative of Skadden. A representative of Skadden sent comments to a representative of Strategic Party C later that day.

On March 23, 2021, The Board of Directors discussed potential outreach to two additional strategic buyers (referred to herein as “Strategic Party D” and “Strategic Party E”). The Board of Directors directed representatives of Morgan Stanley to contact Strategic Party D, but declined to authorize calls to Strategic Party E at the time given competitive sensitivities with this party. The Board of Directors determined not to contact Strategic Party E unless and until there was already a strategic bidder for Proofpoint because Strategic Party E is a direct competitor and the Board of Directors believed that Strategic Party E was unlikely to engage unless there was other strategic interest in Proofpoint. The Board of Directors also considered the fact that any definitive agreement with Thoma Bravo was likely to include a “go-shop” provision that would allow Strategic Party E to pursue an acquisition of Proofpoint with a reduced termination fee if it was interested in acquiring Proofpoint.

On March 25, 2021, Proofpoint and Strategic Party C signed a non-disclosure agreement that included a “standstill” provision

On March 29, 2021, Morgan Stanley contacted Strategic Party D to inquire if such party was interested in a potential acquisition of Proofpoint. Strategic Party D indicated that it was not interested in exploring a potential transaction with Proofpoint.

On April 4, 2021, Mr. Steele emailed Messrs. Boro and Virnig summarizing Proofpoint’s anticipated first quarter results and noting that the results were expected to beat equity research analyst expectations across a range of metrics including revenue, billings, bookings and free cash flow.

On April 5, 2021,Proofpoint hosted a follow-up management presentation with Strategic Party C by videoconference. Later that day, provided access to the virtual data room to the financial advisor to Strategic Party C.

On April 16, 2021, Messrs. Steele and Auvil spoke with representatives of Thoma Bravo by telephone regarding Proofpoint’s outlook for the second quarter and remainder of 2021.

On April 19, 2021, Thoma Bravo sent Proofpoint a letter (the “Third Revised Letter of Intent”) confirming the proposal contained in the Second Revised Letter of Intent to acquire Proofpoint at $175.00 per share in cash, implying a premium of 29% to Proofpoint’s then-current stock price of $135.62.

On April 20, 2021, Morgan Stanley reminded the Board of Directors of Proofpoint’s recent outreach to other potential buyers, noting that none of them had expressed interest in exploring an acquisition of Proofpoint, other than Strategic Party C. Mr. Steele described his most recent conversations with representatives of Strategic Party C, noting that Strategic Party C had not sent an acquisition proposal nor shown the level of engagement that would suggest it was prepared to proactively pursue an acquisition of Proofpoint at such time. Following discussion, the Board of Directors instructed the representatives of Morgan Stanley to inform Thoma Bravo that the Board of Directors would support a transaction at a price of $180.00 per share in cash. Later that day, representatives of Morgan Stanley presented the counterproposal to representatives of Thoma Bravo.

On April 21, 2021, a representative of Thoma Bravo called a representative of Morgan Stanley by telephone and verbally presented Thoma Bravo’s “best and final offer” to acquire Proofpoint for $176.00 per share in cash (“Final Proposal”), implying a premium of 35% to Proofpoint’s then-current stock price of $130.75.

On April 23, 2021, a representative of Strategic Party C sent a note to Mr. Steele asking for a meeting, and Mr. Steele replied that he was available at Strategic Party C’s convenience.

On April 24, 2021, Morgan Stanley reminded the Board of Directors that, at its last meeting, the Board of Directors had instructed Morgan Stanley to present a counteroffer of $180.00 per share in cash to Thoma Bravo and that Thoma Bravo had responded with its “best and final” offer of $176.00 per share in cash (implying a premium of 34% to Proofpoint’s then-current stock price of $131.78). Representatives of Morgan Stanley proceeded to outline the key terms of the proposal including: (1) a go-shop period of 45 days, (2) a termination fee equal to 1% of Proofpoint’s equity value based on the Per Share Merger Consideration payable by Proofpoint if Proofpoint terminated the Merger Agreement to enter into a definitive agreement in respect of a superior proposal with a party prior to the end of the go-shop period, (3) a termination fee equal to 3% of Proofpoint’s equity value based on the Per Share Merger Consideration payable by Proofpoint if Proofpoint terminated the Merger Agreement in certain circumstances, (4) a termination fee equal to 5.5% of Proofpoint’s equity value based on the Per Share Merger Consideration payable by Thoma Bravo if Thoma Bravo terminated the Merger Agreement under certain circumstances, including if Thoma Bravo fails to secure financing for the transaction, and (5) key protections for employees. The Board of Directors discussed various aspects of Thoma Bravo’s Final Proposal, including agreeing that employee retention should be a key area of focus in order to allow Proofpoint to stabilize its employees during the pendency of the transaction given the likely uncertainties that the transaction would create. Mr. Steele provided an update on his conversations with Strategic Party C. At the meeting, the Board of Directors determined that Strategic Party C had been given sufficient time to indicate whether it was interested in tabling a proposal and that, in light of the lack of engagement to that date, it was unlikely that Strategic Party C would proceed. If Strategic Party C did decide to proceed, it would have the opportunity to do so during the “go-shop” period contemplated by the transaction with Thoma Bravo. After discussion, the Board of Directors concluded that, in light of all the factors and risks associated with Proofpoint’s standalone strategic plans and the pre-signing market check process, Thoma Bravo’s Final Proposal was in the best interests of Proofpoint Stockholders because, among a number of reasons, it enabled them to realize a significant premium for their stock without the execution and other risks associated with Proofpoint’s standalone strategic plans. The Board of Directors authorized and instructed Proofpoint’s management and representatives of Morgan Stanley to continue with negotiations with Thoma Bravo at $176.00 per share in cash and agreed to reconvene the following day to determine whether to finally approve the proposed transaction with Thoma Bravo. Later that day, Mr. Steele spoke with a representative of Strategic Party C by telephone and was informed that Strategic Party C had decided to terminate discussions with Proofpoint.

On April 25, 2021, After discussion among the Board of Directors and representatives of Skadden and Morgan Stanley, a representative of Morgan Stanley delivered Morgan Stanley’s oral opinion, subsequently confirmed in writing, dated April 25, 2021, to the Board of Directors that, as of such date and based upon and subject to the assumptions made, procedures followed, matters considered and qualifications and limitations on the scope of review undertaken by Morgan Stanley as set forth in the written opinion, the Per Share Merger Consideration to be received by Proofpoint Stockholders (other than holders of the Excluded Shares) pursuant to the Merger Agreement was fair, from a financial point of view, to such Proofpoint Stockholders. After additional discussions of the proposed transaction and the matters summarized for the Board of Directors at the meeting, the Board of Directors unanimously (1) determined that it is in the best interests of Proofpoint and Proofpoint Stockholders, and declared it advisable, to enter into the Merger Agreement and consummate the Merger upon the terms and subject to the conditions set forth therein; (2) approved the Merger Agreement, the Merger, the other transactions contemplated by the Merger Agreement, the execution and delivery of the Merger Agreement by Proofpoint, the performance by Proofpoint of its covenants and other obligations thereunder, and the consummation of the Merger upon the terms and conditions set forth therein; and (3) resolved to recommend that Proofpoint Stockholders adopt the Merger Agreement in accordance with the DGCL.

Later in the evening that day, the parties executed and delivered the Merger Agreement, Voting Agreement, Equity Commitment Letter, Guaranty and Debt Commitment Letter.

April 26, 2021, the parties issued a press release announcing the transaction.

From April 26, 2021, after the transaction was announced, and throughout the week of April 26, 2021, Morgan Stanley contacted fifteen (15) strategic buyers and fourteen (14) financial sponsors regarding a potential acquisition of Proofpoint in connection with the go-shop provided for in the Merger Agreement.

On April 26, 2021, one other financial sponsor contacted representatives of Morgan Stanley about a potential acquisition of Proofpoint, but ultimately declined to move forward. Also on April 26, 2021, Strategic Party E reached out to representatives of Morgan Stanley about a potential acquisition of Proofpoint. The following day, on a telephone call with representatives of Morgan Stanley, a representative of Strategic Party E noted Strategic Party E was unlikely to be interested in a transaction.

On April 27, 2021, after an inquiry from representatives of Morgan Stanley, Financial Sponsor A indicated an interest in engaging in a potential acquisition of Proofpoint.

On May 4, 2021, Proofpoint and Financial Sponsor A entered into a non-disclosure agreement.

On May 7, 2021, Strategic Party E confirmed to Proofpoint by telephone call that Strategic Party E would not participate in a potential transaction with Proofpoint.

On May 10, 2021, Financial Sponsor A requested certain diligence information about Proofpoint from representatives of Morgan Stanley by email. Later that day, as directed by Proofpoint, representatives of Morgan Stanley provided representatives of Financial Sponsor A with access to a virtual data room.

On May 17, 2021, Financial Sponsor A notified representatives of Morgan Stanley that Financial Sponsor A would not participate in a potential transaction with Proofpoint.