Dunkin’ goes private again in $11.3 billion deal

Having grown up in the northeast, those old Dunkin commercials will always be an indelible memory for me. So, when you have the chance to become the May-ah of Dunks, you just have to take it right?

Dunkin’ / Inspire Deal overview

On October 30, 2020, Inspire announced it will acquire Dunkin’ Brands by commencing a tender offer for $106.50 per share in cash in a transaction valued at approximately $11.3 billion including the assumption of Dunkin’ Brands’ debt.

Premium of approximately 30% to Dunkin’ Brands’ 30-day volume-weighted average price

Premium of approximately 20% to Dunkin’ Brands’ closing stock price on October 23, 2020

Inspire is funding the deal with ~$2.8 billion of new debt, $1.55 billion of existing cash and $4.9 billion of equity from sponsor Roark Capital Management. The company will also assume roughly $3 billion of securitized debt at Dunkin' Brands.

On November 19, 2020 Inspire priced a $2.575 billion seven-year covenant-lite TLB at L+325 with a 1% Libor floor and an original issue discount, or OID, of 99.

A little Dunkin’ deal history:

1950: DD was founded in Quincy, MA

1968: The company initially went public

1989: The company fended off a hostile takeover company and ended up accepting an all-cash offer of ~$325 million, from Allied-Lyons, a British liquor company that also owned Baskin-Robbins and Tetley tea company

2005: Acquired by Bain Capital Partners, the Carlyle Group, and Thomas H. Lee Partners for ~$2.4 billion

2010: IPO’d at $19 a share, for a ~$2.4 billion valuation. Approximately the same amount Bain, Carlyle, and Thomas H. Lee paid in 2005

Key points in the Background on the offer

TL;DR: CEOs of Inspire and Dunkin’ has several conversation in 2020 that ultimately led to a negotiated deal.

Between January and early July 2020, Paul Brown, CEO of Inspire, and David Hoffmann, CEO of Dunkin’, had five conversations relating to, among other things, in January, a potential partnership opportunity relating to certain technology initiatives of Dunkin’ Brands and Parent, and later, the current business environment and the impacts of COVID-19 on their respective businesses

Mr. Brown and Mr. Hoffmann met for dinner on July 13, 2020, where Brown indicated that Inspire was interested in potentially acquiring Dunkin’ Brands in an all-cash transaction in the high $70s

October 11, 2020, Dunkin’ Brands learned that certain news sources were seeking comment from third parties regarding a rumors of a potential acquisition of Dunkin’ Brands. It wasn’t until the afternoon of October 25, 2020, that The New York Times and various other media outlets reported that Inspire had made an offer to acquire Dunkin’ Brands for $106.50 per Share

Inspire really wanted the “No-shop” in the merger agreement was continued point of negotiation

Inspire refusal to sign a merger agreement that permitted Dunkin’ Brands to pay its regular quarterly dividend during the period between the signing and closing of the proposed transaction

The need to incentivize members of Dunkin’ Brands management to remain with Dunkin’ Brands through the closing of the proposed transaction to avoid a rapid amortization event under the Dunkin’ Brands’ securitization facility which would permit Parent to not close the proposed transaction and not pay a reverse termination fee

De facto “market check” that occurred as a result of the October 25, 2020 The New York Times story did not result in any expressions of interest because of the story which indicated an apparent unwillingness of any likely buyer to pursue a transaction at a higher valuation

BoD was focused on making sure Termination fee would not prohibit other offers

Termination fee of $268,000,000 (~3% of equity value)

Reverse Termination fee of $469,000,000 (~5% of equity value)

Offer timeline

The wringer

Dunkin’ filed 14D9 on November 16, 2020 that contained BofA Securities fairness opinion. BofA delivered an oral and written opinion to the BoD on October 30, 2020. The initial submission is missing some key information that is typically included, financial Projections and trading and transaction multiples. Investors quickly picked up on this omission and a lawsuit was filed on the same day. It is not until December 3, 2020 that the company files the missing data.

It is definitely fair to BofA, as Dunkin has agreed to pay an aggregate fee of approximately $41,980,000, $750,000 of which was payable upon delivery of its opinion and the remainder of which is contingent upon consummation of the Transactions. So, a 0.37% fee based on the $11.3 billion EV at announcement, falls roughly in the middle of the typical M&A sell-side fee schedule.

For its fee, BofA goes through the standard valuation methods typically accepted and then throws in a couple extra for good measure.

Trading comparables

Transaction comparables

DCF

52-week High and Low

Research Analysts’ one-year price

Implied present value of the future value per share at the end of 2022

Management Project Financials

Obviously 2020 is a down year due to COVID, 2020 revenue projected down ~5%, but Management expects revenue to recover in 2021 basically up ~1% from 2019 pre-pandemic levels. ‘22-‘25 revenue growth is projected to be ~100bps per year more aggressive than pre-pandemic ‘18-‘19 growth. EBITDA margin also expected to bounce back to 2019 levels in 2021 and increase ~50bps ever year.

BofA has also disclosed they are using Net Debt of $2,683 million for their analysis.

A few caveats before we begin diving into the numbers

I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

A full option schedule was not provided in any filings

BofA rounded all ranges to the nearest $0.05

Also, as the saying goes, “you pay for what you get”, and I am currently doing this for free. That said we are in the ballpark for all of the analyses, so let’s dive in.

Summary valuation

Trading comparables

Dunkin lists its competitors in the Quick Service Restaurant (QSR) sector in its 10-K as the following:

BofA went with some other comps more focused on Franchises and broke them into 3 buckets:

Mature Growth Franchise Companies

High Growth Franchise Companies

Other Coffee Companies.

Based on P/E, the offer is above the average and median for all the comps, with Wingstop the real outlier to the group.

Based on EBITDA, the offer is above the average and median for all the comps. Domino’s trades at a higher multiple and Wingstop is still an outlier.

Based on EBITDA-Capex the offer is below the average but above the median for all the comps. Domino’s and Starbucks trade at a higher multiple and Wingstop is still an outlier.

Overall, compared to the comps selected by BofA the Dunkin offer is near the top for all valuation multiples. There might be a minor typo in the filing, which references ‘21 EBITDA-Capex of $458, but should probably be $504 - $25 = $479.

Dunkin was trading at $88.79 on October 24, 2020 when the offer was accepted, so it was already trading above almost all of the multiple ranges that BofA chose.

Transaction comparables

BofA gave us 8 deals ranging from Berkshire/Portillo in July 2014 to Inspire/Sonic in December 2018. This is the largest transaction since Restaurant Brands International acquired Tim Hortons in 2014.

BofA chose multiple ranges of 16x-21x LTM and 15x-19x NTM for their analysis.

Dunkin implied transaction multiples, @ $106.50 offer, of ~25x LTM 9/30 EBITDA and ~23x NTM 9/30 EBITDA do look healthy in comparison. It is probably the highest takeout in the sector in the last decade.

DCF

Management projections gives us pretty much everything needed to recreate the DCF.

BofA chose a WACC range of 6.1%-8.1% and Exit Multiple range of 15x-18x. BofA has also told us they are calculating the Cost of Equity at 9%. I would have like to benchmark Equity Research WACCs and see that range as well for just for comparison’s sake.

The exit multiple range is triangulating around BofA’s Trading and Transaction multiple ranges, and obviously discounting Dunkin’s current multiples. That said I do think most firms and acquirors would view the current market environment as a bit frothy.

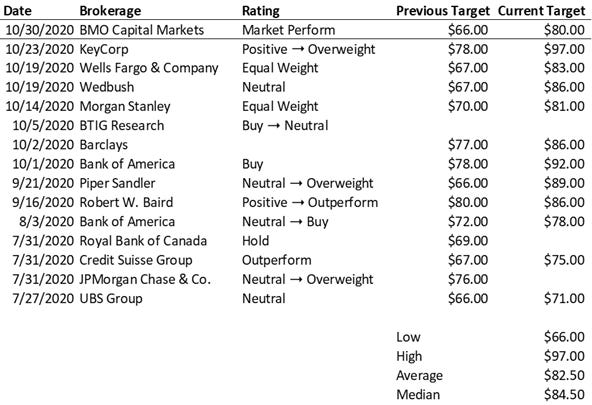

Research Analyst 1-year price targets

BofA took the Low (BMO prior to the 10/30 upgrade after potential deal leaked) and High (KeyCorp) and then applied a 9% discount rate to get the PV.

Implied present value of the future value per share at the end of 2022

Applying NTM EPS multiples ranging from 22.0x to 28.0x

Estimated adjusted EPS for fiscal year 2023 derived from the Company Forecasts

Discounting the result using an illustrative discount rate of 9.0%, reflecting the Company’s estimated cost of equity

Resulted in a range of illustrative values for the Shares of between $71.55 and $90.05

I have performed this type of analysis numerous times, and primary the issue here is that they do not give the date that they present value to. Typically, you would discount back to a date on or around the fairness opinion or possibly last earnings. Very hard to tie out the numbers without the dates. Dunkin’ also has a wonky fiscal year, ending on the last Saturday of the indicated year.

Valuation summary

As you can see in the valuation summary below, the offer price of $106.50, is above all the selected valuation ranges. The 20% premium to what was essentially the 52-week high stock price, falls within the range of acceptable premiums.

I think it is also reasonably safe to assume that Inspire found relatively sizeable synergies to justify the offer price, if they used similar assumptions. Back of the envelop math would suggest at least $125-$150mm of annual synergies would be needed to justify the offer price.

Is it fair?

So, after all that, is it fair? As my rabbi always says, that is up to God and the Delaware courts to decide.

That said, on December 14, 2020 a total of 68,078,433 Shares were tendered, representing ~82.6% of the Shares outstanding as of the expiration of the Offer.

That result is probably not a big surprise, since the top 10 holders account for ~51% of the shares outstanding.

So that’s what the wringer spit out, let me know below and in the comments what you think.