⚖️ For Fairness Sake ⚖️ Endeavor acquired by Silver Lake for $25 billion

A quick look at Centerview's fairness presentation to Endeavor

Endeavor acquired by Silver Lake for $25 billion.

This is a little more preliminary look since the 13E3 with Centerview’s fairness presentation was just filed a little while back. I will likely update this post as we get more information.

Endeavor / Silver Lake deal overview

BEVERLY HILLS and MENLO PARK – April 2, 2024 – Endeavor Group Holdings, Inc. (NYSE: EDR) (“Endeavor” or the “Company”), a global sports and entertainment company, today announced that it has entered into a definitive agreement to be acquired by Silver Lake, the global leader in technology investing, in partnership with the Endeavor management team and additional anchor investors.

Under the terms of the agreement, Silver Lake will acquire 100% of the outstanding shares it does not already own, other than rolled interests. Endeavor stockholders will receive $27.50 per share in cash, representing a 55% premium to the unaffected share price of $17.72 per share at market close on October 25, 2023, the last full trading day prior to Endeavor’s announcement of its review of strategic alternatives, and a 39% premium to Endeavor’s unaffected 30-day VWAP.

With the significant premium being delivered to stockholders, Endeavor is being acquired at an equity value of $13 billion. Silver Lake believes that when consolidating all of TKO’s value into Endeavor, the combined total enterprise value of $25 billion will make this the largest private equity sponsor public-to-private investment transaction in over a decade, and the largest ever in the media and entertainment sector. On the unaffected date, the equity value was $8.2 billion, and the premium to be paid by Silver Lake represents $4.6 billion more equity value to all Endeavor stockholders.

The consummation of the transaction is not subject to any financing condition. The transaction will be financed through a combination of new and reinvested equity from Silver Lake and additional capital anchored by Mubadala Investment Company, DFO Management, LLC, Lexington Partners, and funds managed by Goldman Sachs Asset Management; equity rolled over by members of the Endeavor management team including Emanuel, Whitesell, and Shapiro; and new debt financing fully committed by Goldman Sachs, USA, JP Morgan, N.A., Morgan Stanley Senior Funding, Inc., Bank of America, N.A., Barclays PLC, Deutsche Bank AG New York, and Royal Bank Canada.

Endeavor termination fee: $289mm (2.25% of deal equity value)

Silver Lake termination fee: $706mm (5.5% of deal equity value)

Advisors

Silver Lake

BDT & MSD Partners acted as lead financial advisor to Silver Lake.

Goldman Sachs & Co. LLC, JP Morgan, Morgan Stanley & Co. LLC, BofA Securities, Barclays, Deutsche Bank Securities Inc., and RBC Capital acted as lead financing arrangers and lead financial advisors to Silver Lake.

KKR Capital Markets acted as global financing advisor to Silver Lake.

The Raine Group is also acting as financial advisor.

Simpson Thacher & Bartlett LLP and Kirkland & Ellis LLP acted as Silver Lake’s legal advisors.

Endeavor

Latham & Watkins LLP acted as legal advisor to Endeavor.

Centerview Partners LLC acted as independent financial advisor to the Special Committee and Cravath, Swaine & Moore LLP acted as independent legal advisor to the Special Committee.

Debevoise & Plimpton LLP acted as legal advisor to Emanuel.

Freshfields Bruckhaus Deringer LLP acted as legal advisor to Whitesell.

Akin Gump Strauss Hauer & Feld LLP acted as legal advisor to Shapiro.

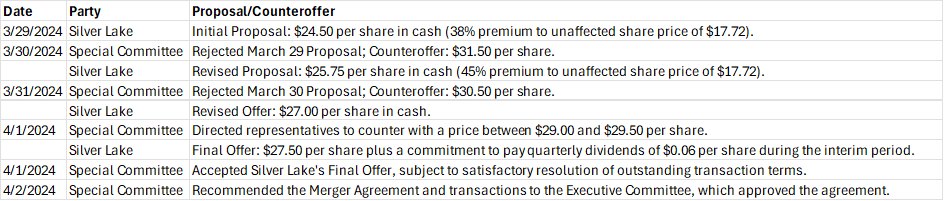

Offer timeline

The wringer

Endeavor filed a 13D3 on August 25, 2024 that contained Centerview’s fairness opinion.

In connection with Centerview’s services as the financial advisor to the Special Committee, the Company has agreed to pay Centerview an aggregate fee of $54 million, $3 million of which was payable upon the signing of the engagement letter, $3 million of which was payable upon the rendering of Centerview’s opinion and $48 million of which is payable contingent upon consummation of the Transactions. In addition, the Company has agreed to reimburse certain of Centerview’s expenses arising, and to indemnify Centerview against certain liabilities that may arise, out of Centerview’s engagement by the Special Committee.

It is fair to Centerview. This works out to ~0.22% of the $25 billion enterprise value, which would probably be at lower end of M&A sell-side fee tables.

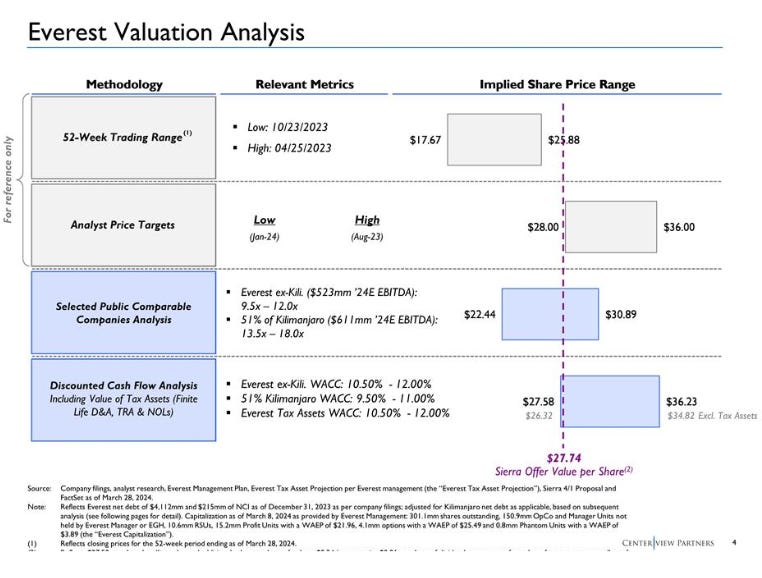

For its fee, Centerview goes with the standard valuation methods.

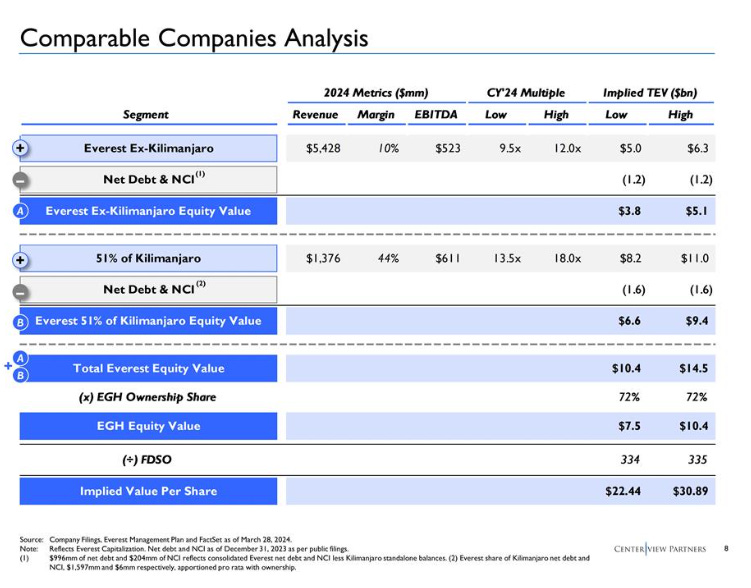

Trading comparables

DCF

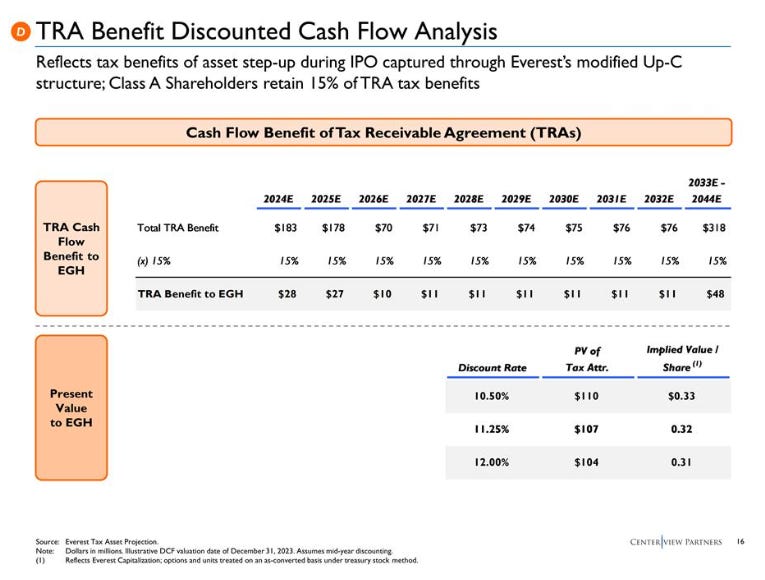

Reference

52 week high

Analyst price targets

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Quarterly projections not provided

A full option schedule was not provided in any filings

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

Valuation Summary

Is it Fair?

As my abuela used to say, only God and the Delaware Courts can decide that.

Offer is $27.50 per share in cash, representing a 55% premium to the unaffected share price of $17.72 per share at market close on October 25, 2023, the last full trading day prior to Endeavor’s announcement of its review of strategic alternatives, and a 39% premium to unaffected 30-day VWAP.

According to Centerview’s premium analysis that falls around the median for the premium to unaffected and 15th percentile for the premium for the 30-day VWAP

Silver Lake increased final offer by 12% to $27.50 from original $24.50 offer

The deal is not subject to a “majority of the minority” vote, because Silver Lake refused to grant one, so given Silver Lake and Managment’s current ownership, they just need to squeeze out the other public shareholders.

Swedish bank Handelsbanken, is suing Endeavor for selling itself too cheap, cited the omission of a shareholder vote in its lawsuit as evidence of the company trying to shortchange investors.

Endeavor said in a regulatory filing says it has received multiple shareholder requests seeking internal records of the deliberations on the deal.

“Lawyers who have been advising companies against giving minority shareholders a deal vote argue the worst that can happen, based on court precedent in Delaware where most companies are incorporated, is that the controlling shareholders may be ordered in court to pay 5% to 10% over the deal price, possibly years after the transaction has closed.

Skipping the vote, on the other hand, prevents hedge funds and other activist shareholders from making deal price demands and allows a transaction to close more quickly, the lawyers say.”

Endeavor is currently trading above the offer price of $27.50.

Let me know what you think about the quick read version in the comments below.

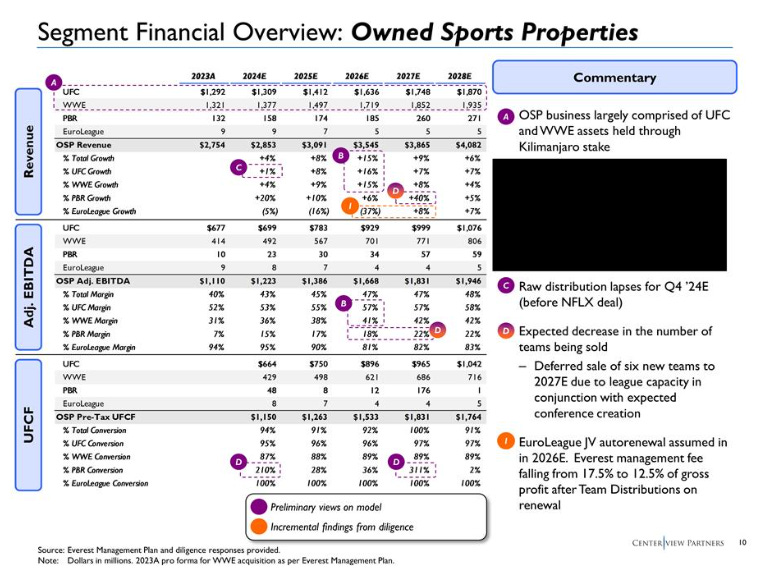

Management projected financials

Summary valuation

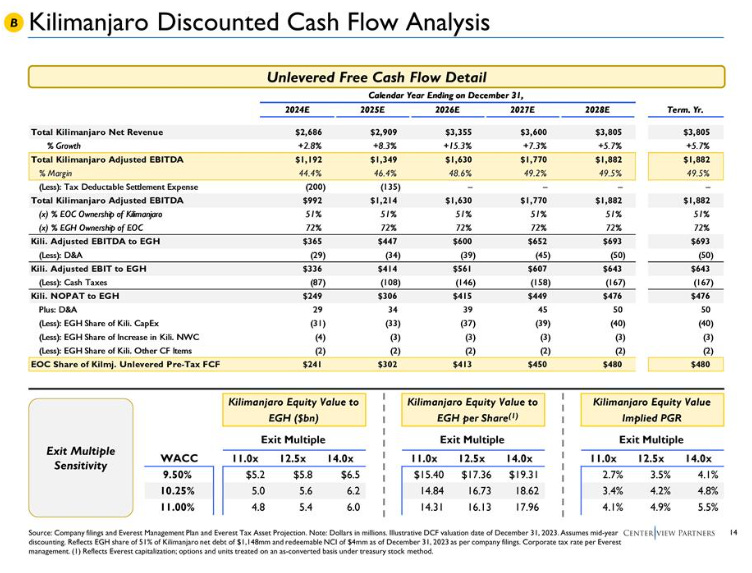

Discounted Cash Flow Analysis

Selected Companies Analysis

Endeavor doesn’t any companies in it s10K as competitors.

52 Week High

Analyst price targets

Background of the Merger

The Endeavor Agency, L.L.C. was founded in 1995 by Ariel Emanuel and several partners. In 2009, The Endeavor Agency, L.L.C. merged with William Morris Agency, LLC, forming William Morris Endeavor Entertainment, LLC (“WME”). Following the consummation of that merger, Mr. Emanuel and Patrick Whitesell became WME’s Co-Chief Executive Officers. In May 2012, affiliates of Silver Lake Group, L.L.C. (such affiliates collectively and together with Silver Lake Group, L.L.C., “Silver Lake”) made a strategic minority investment in WME, the first of several investments by affiliates of Silver Lake in the Company and its affiliates. Over the next eight years, WME continued to expand its business through, among other things, M&A activity, including its 2014 acquisition of IMG Worldwide and its 2016 acquisition, together with affiliates of Silver Lake and certain other co-investors, of UFC, as well as additional equity investments from affiliates of Silver Lake (among other investors), which ultimately led to the formation of OpCo, a holding company of the expanding business. As a result of its pre-IPO investments in support of the M&A activity described above, Silver Lake acquired a significant ownership interest in OpCo, resulting in OpCo being controlled by Silver Lake and Messrs. Emanuel and Whitesell.

On April 28, 2021, in connection with the IPO, shares of Class A Common Stock started trading on the New York Stock Exchange at a price per share of $24.00 and, pursuant to an internal reorganization, OpCo became an indirect subsidiary of the Company through an “Up-C” structure. Concurrently with the IPO, Silver Lake sold its equity interests in UFC to the Company and OpCo in exchange for additional equity interests in the Company and OpCo and acquired additional shares of Class A Common Stock pursuant to a private placement investment. Following the IPO and the foregoing related transactions, Silver Lake controlled approximately 68% of the voting interests of the Company. Additionally, as part of the reorganization transactions that occurred at the time of the IPO, the Board formed the Executive Committee and delegated all of the power and authority of the board of directors of the Company (the “Board”) to the Executive Committee as further described in the Company’s public filings (including its IPO prospectus) and as set forth in its Amended and Restated Certificate of Incorporation. The Board is currently comprised of Mr. Emanuel, Mr. Whitesell, Egon Durban, Stephen Evans, Ursula Burns, Jacqueline Reses and Fawn Weaver and the Executive Committee is comprised of Mr. Emanuel, Mr. Whitesell and Silver Lake’s director designees, currently Messrs. Durban and Evans. As a result of such delegation, the Executive Committee exerts significant control over the Company’s operations by acting as the governing body of the Company with full authority to approve actions customarily required to be approved by, or reserved for approval by, a board of directors under Delaware law (subject only to applicable laws, rules, regulations and certain approvals required by committees of the Board). The consent of the representatives of Silver Lake serving on the Executive Committee is required for certain actions, including, among other things, dispositions of certain assets of the Company and any merger, consolidation or sale of the Company.

Since the IPO, the Board and the Executive Committee, together with the Company’s management team, regularly review and evaluate the Company’s performance and operations, financial condition and opportunities and growth prospects in light of current business and economic conditions, as well as overall trends in the market, across a range of scenarios and potential future developments in the industries in which it operates. These reviews and evaluations typically include (without limitation and as applicable) various potential opportunities for acquisitions, dispositions, commercial partnerships, or other strategic combinations, and the operation and performance of various business units.

On July 11, 2023, the Executive Committee held a meeting, which was attended by members of Company management and representatives of Latham & Watkins LLP (“Latham”), outside counsel to the Company (which has represented, and is currently representing, Silver Lake in unrelated matters). At this meeting, the Executive Committee discussed, in light of the anticipated fall closing of the UFC/WWE transaction (which led to the formation of a separate publicly traded company, TKO Group Holdings, Inc. (“TKO”)) and the Company’s sale in April 2023 of its IMG Academy business unit to BPEA EQT at a free cash flow multiple in excess of the free cash flow multiple implied by the trading price of the Class A Common Stock on the public markets, commencing a strategic review process with respect to the creation and optimization of value of the Company’s other business units. The Executive Committee discussed how the review process would analyze (i) the quality and growth potential of each of the Company’s other business units on a standalone basis, (ii) potential alternatives with respect to unlocking and maximizing stockholder value across each business unit within the Company’s portfolio and (iii) the optimized ownership structure for each such business unit, including from a cash flow and cost perspective (collectively, the “Strategic Review Workstreams”). At the close of this meeting, the Executive Committee directed Company management to prepare to progress the Strategic Review Workstreams for further discussion at subsequent meetings.

Following this meeting, in light of the amount of work needed to progress the Strategic Review Workstreams, the Company asked Silver Lake if it would be willing to provide additional resources to the Company. Silver Lake agreed to provide three employees to the Company through a secondment to assist management in carrying out the Strategic Review Workstreams. The Silver Lake secondees worked alongside the Company’s management team on these workstreams from July 28, 2023 to October 30, 2023. The secondees were subject to certain restrictions and obligations including that: (i) during the secondment period, the secondees would be on full-time secondment to the Company and would not work or perform services for Silver Lake in the performance of their services to the Company; (ii) the secondees’ work product would belong to the Company; and (iii) during the secondment period, the secondees would work under the supervision of Company personnel and would not be supervised by, or report to, any Silver Lake personnel or communicate with any Silver Lake personnel without the prior approval of the Executive Committee.

On August 28, 2023, the Executive Committee held a meeting to discuss the progress of the Strategic Review Workstreams with representatives of Company management, the Silver Lake secondees and Latham in attendance. At this meeting, management provided an overview of certain of the Company’s business units, along with preliminary financial information about each such business unit’s operations and prospects.

On September 21, 2023, the Executive Committee held a meeting to discuss the progress of the Strategic Review Workstreams with representatives of Company management, the Silver Lake secondees and Latham in attendance. At this meeting, management provided an overview of certain of the Company’s business units that were not previously discussed, along with preliminary financial information about each such business unit’s operations and prospects.

Between August 28 and December 7, 2023, Company management refined and prepared preliminary financial analyses relating to certain of the Company’s business units, including preliminary financial budgets for fiscal year 2024 and preliminary financial projections for years 2025 through 2028, which were shared with the members of the Executive Committee and the Board at various intervals in respect of each of the Company’s business units (together with the preliminary financial information and analyses presented at the August 28 and September 21 meetings, the “Preliminary Financial Models”). Following the preparation of the Preliminary Financial Models, Company management continued to refine and prepare various financial analyses relating to the Company’s business units with a view towards developing long-range financial forecasts for each of the Company’s business units for fiscal years 2024 through 2028, which would ultimately be shared with the Executive Committee.

On October 23, 2023, the Executive Committee determined it would be in the best interests of the Company and its stockholders to publicly announce an evaluation of strategic alternatives to ensure that the Company maximized value for its stockholders. The Executive Committee, however, determined that it was not open to a sale or disposition of the Company’s interests in TKO due to, among other reasons, Silver Lake’s lack of interest in entertaining bids for assets held by the Company at the time. The remaining members of the Board were subsequently apprised by members of the Executive Committee of the formal review of strategic alternatives of the Company.

On October 25, 2023, the Company announced its decision to initiate a formal review of strategic alternatives (the “Strategic Alternatives Review”). In accordance with the direction from the Executive Committee, the press release noted that the Strategic Alternatives Review expressly excluded any sale or disposition of the Company’s interests in TKO.

Later on October 25, 2023, Silver Lake issued its own press release stating that (i) Silver Lake was working toward submitting a proposal to take the Company private, which would result in a de-listing and de-registration of the publicly traded securities of the Company (the “Silver Lake Announcement” and any such potential transaction between Silver Lake and the Company, a “Potential Transaction”) and (ii) Silver Lake was not interested in potential alternative opportunities involving a sale of Company securities by Silver Lake to a third party or entertaining bids for assets held by the Company. Because of Silver Lake’s position as a holder of a majority of the outstanding voting interests in the Company, coupled with Silver Lake’s affirmative control rights over the Company’s M&A activities as described above, Silver Lake’s announcement limited the Company’s ability to pursue a transaction (including a sale of itself or its business units) with buyers other than Silver Lake.

At the end of October 2023, members of the Executive Committee and Company management began discussions with Jacqueline Reses and Ursula Burns (collectively, the “Independent Directors”) about serving on a potential special committee of independent and disinterested directors to, among other things, review, evaluate and negotiate a Potential Transaction. As part of these discussions, the Independent Directors informed the Executive Committee that they would need to engage their own counsel to assist them with such matters. The Independent Directors decided to reach out to Cravath, Swaine & Moore LLP (“Cravath”) to discuss potentially retaining it in connection with such matters.

On November 2, 2023, the Independent Directors held a meeting via videoconference to discuss and consider certain organizational and other matters related to a Potential Transaction. A representative of Cravath attended the meeting. At the meeting, the representative of Cravath discussed with the Independent Directors the details of a Potential Transaction as reflected in the Silver Lake Announcement, including that Silver Lake had stated that it was not interested in selling its stake in the Company to a third party or entertaining bids for assets held by the Company. The representative of Cravath also reviewed with the Independent Directors various legal matters, including their fiduciary duties (including in the context of a potential “going private” transaction with a controlling stockholder), the Independent Directors’ role, the concepts of independence and disinterestedness under Delaware law and the possibility of conditioning a Potential Transaction on the affirmative vote of a majority of the minority stockholders (a “Majority of the Minority Vote”). The Independent Directors and representatives of Cravath held additional meetings via videoconference to further discuss these topics on November 3, 2023 and November 12, 2023.

Also on November 2, 2023, the Company, advised by Latham, entered into a confidentiality agreement with Silver Lake regarding a Potential Transaction, containing customary provisions. The confidentiality agreement did not contain “standstill” provisions or “don’t ask don’t waive” provisions.

Over the following weeks, the Executive Committee (including the representatives of Silver Lake serving on the Executive Committee) and the Independent Directors, as well as Cravath and Latham, continued to discuss the possible formation, mandate and authority of a special committee composed of the Independent Directors in connection with a Potential Transaction, including in light of the fact that Silver Lake had stated in the Silver Lake Announcement that it would not consider selling its stake in the Company to a third party or entertaining bids for assets held by the Company and a representative of Silver Lake also conveyed to a representative of Cravath that Silver Lake would not consider conditioning any Potential Transaction on a Majority of the Minority Vote.

On November 9, 2023, the Independent Directors informed the Company and representatives of Latham that they intended to engage Cravath as their legal counsel and as legal counsel to any special committee composed of the Independent Directors in connection with a Potential Transaction in light of, among other things, Cravath’s qualifications and experience in representing special committees in similar contexts and its absence of engagements with Silver Lake (including its portfolio companies) or the Company. Representatives of Cravath then sent a draft engagement letter to the Company and representatives of Latham. The Independent Directors subsequently engaged Cravath to represent them and any special committee composed of the Independent Directors formed by the Executive Committee in connection with a Potential Transaction. Over the subsequent weeks, the Independent Directors and Cravath continued to discuss with the Executive Committee and Latham finalizing the formation of a special committee and matters incidental thereto, although Silver Lake had indicated that it was not prepared for such a committee to be formed until Silver Lake was certain it would make a proposal.

Silver Lake was focused on securing the continued employment and/or Board service by the Company of Messrs. Emanuel and Whitesell and Mark Shapiro, President and COO of the Company, in pursuing a Potential Transaction in light of their expertise and familiarity with the Company’s operations, as well as their technical skills, reputations and relationships in the media and entertainment industry. Representatives of Silver Lake communicated this view to representatives of the Company and the Executive Committee. Because Silver Lake would only proceed with a Potential Transaction (which would be costly and time consuming to negotiate) if it could agree with Messrs. Emanuel, Whitesell and Shapiro on terms with regard to their post-transaction employment arrangements, Silver Lake decided to progress these discussions with Messrs. Emanuel, Whitesell and Shapiro before having further discussions about other terms of a Potential Transaction, including price.

During November and December 2023, Silver Lake, Messrs. Emanuel and Whitesell and their respective counsels (Debevoise & Plimpton LLP (“Debevoise”), as legal counsel to Mr. Emanuel, and Freshfields Bruckhaus Deringer LLP (“Freshfields”), as legal counsel to Mr. Whitesell), engaged in preliminary discussions regarding the terms of Messrs. Emanuel’s and Whitesell’s post-transaction employment and associated potential arrangements with the Company and Silver Lake, including the potential rollover of a portion of their equity interests in a Potential Transaction. During or around this same time frame, Silver Lake engaged in preliminary discussions with Mr. Shapiro regarding his post-transaction employment and associated potential arrangements with the Company, including the potential rollover of a portion of his equity interests in a Potential Transaction. In order to facilitate the foregoing discussions, the parties prepared non-binding illustrative term sheets (the “Employment Term Sheets”). At the end of December 2023, Silver Lake substantially paused discussion of the arrangements with Messrs. Emanuel, Whitesell and Shapiro, without executing any definitive agreements with respect thereto, because it decided to prioritize its informational review and arranging the financing for a Potential Transaction.

Starting in December, 2023, Silver Lake invited representatives of potential financing sources, including Mubadala, to enter into confidentiality agreements with respect to a Potential Transaction.

On December 18, 2023, representatives of Silver Lake delivered a financial, tax, legal and accounting due diligence request list to representatives of the Company. On December 20, 2023, representatives of Simpson Thacher & Bartlett LLP (“STB”), acting as legal counsel to Silver Lake, delivered an updated version of the legal due diligence request list to representatives of Latham.

Between December 18, 2023 and until the announcement of the Transactions, Silver Lake and its advisors conducted pre-signing financial, tax, legal and accounting diligence with cooperation from the Company and its representatives.

On December 30, 2023, the Company provided Silver Lake and its advisors with access to a virtual data room containing financial, tax, legal and accounting diligence information relating to the Company.

On January 4, 2024, members of Company management delivered a presentation to representatives of Silver Lake and certain of Silver Lake’s potential financing sources with respect to the Company’s business, operations, management and financial performance, among other topics.

On January 12, 2024, representatives of Cravath held a meeting via videoconference with the Independent Directors to again discuss process matters incidental to the formation of a special committee composed of the Independent Directors in connection with a Potential Transaction including, among other matters, the engagement of a financial advisor by the Independent Directors (which would also serve as financial advisor to any such special committee). The Independent Directors, together with input from the representatives of Cravath, discussed and considered several potential independent financial advisors, including, among others, Centerview Partners LLC (“Centerview”). Following such discussion, the Independent Directors determined that they would discuss with Centerview the possibility of Centerview acting as financial advisor in light of, among other things, its qualifications and experience in advising special committees in similar contexts and their understanding that Centerview had only limited engagements with Silver Lake (including its portfolio companies) or the Company (which understanding was subsequently confirmed in the written relationship disclosures received from Centerview). The Independent Directors also determined to request an update from the Executive Committee on what was transpiring between the Company and Silver Lake and the timing of forming a special committee.

On January 17, 2024, Cravath sent the Company a draft of an indemnity letter from Centerview in connection with the potential engagement of Centerview by the Independent Directors or any special committee composed of the Independent Directors formed by the Executive Committee (the “CVP Indemnity Letter”). Over the following day, Company management, representatives of Cravath, representatives of Latham and representatives of Centerview negotiated the CVP Indemnity Letter. The CVP Indemnity Letter was subsequently executed on January 19, 2024.

Also on January 19, 2024, representatives of Centerview had a preliminary informational meeting with the Independent Directors and Cravath, during which representatives of Centerview discussed their expectations regarding the potential process involved in a Potential Transaction. Later on January 19, 2024, Cravath shared a draft of a confidentiality agreement (the “CVP NDA”) with the Company and representatives of Latham. Between January 19, 2024 and February 20, 2024, representatives of Cravath, representatives of Latham and representatives of Centerview negotiated the CVP NDA (which CVP NDA was subsequently executed on February 26, 2024). Immediately following the execution of the CVP NDA, representatives of Cravath and Centerview were provided access to the same electronic data room containing Company information that Silver Lake was previously provided access to. On January 21, 2024, representatives of Centerview provided to the Independent Directors (via Cravath) written disclosures of relationships between Centerview, on the one hand, and Silver Lake (including its portfolio companies) and the Company, and certain of their respective affiliates, on the other hand.

On January 25, 2024, representatives of Latham and Cravath discussed whether the Executive Committee would commit to enter into a Potential Transaction only with the prior favorable recommendation of the special committee.

On January 26, 2024 and February 2, 2024, representatives of Cravath and Centerview met with the Independent Directors via videoconference to discuss the status of the potential formation of a special committee composed of the Independent Directors to evaluate a Potential Transaction, including the proposed mandate and authority of such a special committee, the possibility of conditioning a Potential Transaction on a Majority of the Minority Vote and other incidental matters.

Later on February 2, 2024, representatives of Cravath contacted Wachtell, Lipton, Rosen & Katz, special legal counsel to Silver Lake, to discuss the authority and role of any special committee as it related to the Executive Committee and any decision by the Executive Committee to approve a Potential Transaction or not. The representatives of Cravath communicated that the Independent Directors believed it was important that any such special committee be empowered to “say no”.

During the week of February 12, 2024, Mr. Durban informed the Independent Directors that the Executive Committee would agree that the proposed special committee would be empowered to recommend for or against a Potential Transaction and the Executive Committee would commit not to approve any such Potential Transaction without the favorable recommendation of the special committee.

On February 16, 2024, representatives of Cravath and Centerview met with the Independent Directors via videoconference to provide a status update and discuss various matters related to the formation of a special committee composed of the Independent Directors (including, among others, the scope of the special committee’s mandate and authority and the possibility of conditioning a Potential Transaction on a Majority of the Minority Vote) and other matters related to the Potential Transaction. Representatives of Cravath noted that the Executive Committee agreed that a special committee would be empowered to say “no” and that the special committee could continue to press for additionally conditioning a Potential Transaction on a Majority of the Minority Vote. The representatives of Cravath and Centerview also discussed the importance of Centerview having a sufficient amount of time to prepare and present a preliminary financial analysis before the proposed special committee received a financial proposal from Silver Lake. They also discussed the risks and potential implications of leaks and the desirability of focusing on Centerview’s review of the Company’s financial information and transaction agreement negotiations in advance of negotiating price.

On February 20, 2024, Mr. Durban met with the Independent Directors via telephone to discuss certain initial matters in connection with a Potential Transaction, including Silver Lake’s transaction thesis and potential financing sources. Also during this meeting, Mr. Durban expressed that Silver Lake would not agree to condition a Potential Transaction on a Majority of the Minority Vote.

On February 21, 2024, representatives of Cravath sent Centerview’s initial information request list to representatives of Latham, which Latham provided to Company management, and requested a meeting with Company management. Later on February 21, 2024, Mr. Durban met with the Independent Directors to discuss certain matters in connection with a Potential Transaction, including the formation of a special committee and the prospective timeline to negotiate such Potential Transaction.

Beginning on February 21, 2024 and until the announcement of the Transactions, Company management provided the Independent Directors and Centerview with various financial materials, including the Preliminary Financial Models.

On February 22, 2024, representatives of Cravath sent representatives of Latham a draft of a proposed engagement letter with respect to Centerview’s potential engagement as financial advisor to the Independent Directors or any special committee composed of the Independent Directors formed by the Executive Committee in connection with a Potential Transaction. Between February 22, 2024 and March 12, 2024, the Independent Directors and representatives of Cravath, with input from Latham, negotiated the engagement letter with Centerview, which engagement letter was ultimately executed on March 12, 2024.

Also on February 22, 2024, after continuing to refine and prepare various financial analyses relating to the Company’s business units (including the Preliminary Financial Models and subsequent financial analyses), members of Company management sent to the Executive Committee updated management projections for each of the Company’s business units, which incorporated actual fiscal year 2023 results and fiscal year 2024 budget, as well as Company management’s definitive financial forecasts for fiscal years 2024 through 2028 and certain extrapolations based on these fiscal years based on Company management’s latest view of the business (the “Final Financial Model”). For a description of the Final Financial Model, see the section entitled “The Special Factors — Certain Company Financial Forecasts” beginning on page 80.

On February 23, 2024, representatives of Cravath and Centerview met with the Independent Directors to discuss status updates on ongoing discussions and to plan next steps.

Later on February 23, 2024, the Executive Committee unanimously adopted resolutions to establish a special committee composed solely of the Independent Directors (the “Special Committee”), each of whom the Executive Committee had determined to be independent (under Delaware law) from Silver Lake and independent and disinterested with respect to a Potential Transaction, in order to assist the Executive Committee in fulfilling its responsibilities relating to the Strategic Alternatives Review. The Executive Committee delegated to the Special Committee the authority to (i) review, evaluate and negotiate the terms of any proposal relating to a Potential Transaction (or, as an alternative, review, consider and evaluate whether the Company should continue to operate as a standalone independent entity), but not the authority to review, evaluate or negotiate any other transaction other than the Potential Transaction, (ii) meet with Company management, members of the Executive Committee and outside advisors engaged by the Company or the Special Committee on a regular basis, (iii) make a determination as to whether a proposal relating to any Potential Transaction and any definitive agreements with respect to any Potential Transaction are fair to, and in the best interests of, the Company, its stockholders and the equityholders of Manager and OpCo and (iv) if the Special Committee deems appropriate, make a recommendation to the Executive Committee (or, if applicable, the Board) for or against the approval of the Potential Transaction and the execution and delivery of the definitive documentation providing for the Potential Transaction. The Executive Committee further resolved that neither the Executive Committee nor the Board would approve a Potential Transaction with Silver Lake without a prior favorable recommendation by the Special Committee.

Also on February 23, 2024, Company management approved the Final Financial Model and directed that it be provided to the Executive Committee. On February 24, 2024, members of Company management sent the Executive Committee the Final Financial Model.

On February 26, 2024, representatives of Latham shared with representatives of Cravath the Employment Term Sheets which had originally been prepared to facilitate negotiations between Messrs. Emanuel, Whitesell and Shapiro, on the one hand, and Silver Lake, on the other hand.

On February 27, 2024, members of Company management delivered a presentation to the representatives of Centerview (with representatives of Cravath and Latham and one member of the Special Committee attending) with respect to the Company’s historical business, operations, management and financial performance and the Final Financial Model, among other topics.

On February 29, 2024, members of Company management sent the Executive Committee a variance analysis highlighting certain material differences between information set forth in one of the Preliminary Financial Models and the Final Financial Model (the “Variance Analysis” and, together with the Preliminary Financial Models and the Final Financial Model, the “Financial Projections”). For a description of the Financial Projections, see the section entitled “The Special Factors—Certain Company Financial Forecasts” beginning on page 80.

Following the formation of the Special Committee, representatives of STB had discussions with each of Debevoise and Freshfields, the respective counsels of Mr. Emanuel and Mr. Whitesell, regarding the timing of a Potential Transaction, noting that Silver Lake was going to provide draft documents governing the terms upon which Messrs. Emanuel and Whitesell would each rollover a portion of their equity interests in a Potential Transaction as well as their post-transaction employment and associated arrangements with the Company and Silver Lake and commence negotiation of those documents. On March 1, 2024, Messrs. Emanuel and Whitesell and certain of their respective affiliated investment entities (together with the SLP Holders, the “Reporting Persons”) filed amendment No. 5 to the Schedule 13D initially filed by them on May 13, 2021 disclosing that such Reporting Persons were engaging in, and intended to continue engaging in, communications, discussions and negotiations with Silver Lake regarding a Potential Transaction, including the treatment of their and certain of their affiliates’ investments in the Company and arrangements with the Company and Silver Lake in the event a Potential Transaction were to occur.

On March 4, 2024, representatives of Silver Lake and Company management held a meeting via videoconference to discuss the Final Financial Model and the Variance Analysis, with representatives of Latham in attendance. Following this meeting, the Executive Committee approved the Final Financial Model and the Variance Analysis and directed that they be provided to the Special Committee and its advisors. Representatives of the Company then delivered to representatives of Cravath and Centerview the Final Financial Model and the Variance Analysis.

On March 5, 2024, representatives of Company management held a meeting with representatives of Centerview to discuss the Final Financial Model and the Variance Analysis, with representatives of Latham and Cravath in attendance.

On March 8, 2024, the Special Committee convened a meeting via videoconference with representatives of Centerview and Cravath in attendance. The representatives of Cravath discussed certain legal matters with the Special Committee, including the Special Committee’s purpose, mandate and authority and the fiduciary duties of the members of the Special Committee. The representatives of Centerview provided the Special Committee with an overview of Centerview’s preliminary findings with respect to the Company. The representatives of Centerview also discussed certain financial information and performance metrics of the Company and provided an overview of certain key outstanding questions and a potential overall transaction timeline.

On March 10, 2024, STB delivered to Cravath and Latham an initial draft of the Merger Agreement for the Potential Transaction. The draft Merger Agreement contemplated, among other things: (i) that the aggregate merger consideration would be financed through equity and debt financing; (ii) approval of the Transactions by Silver Lake (and certain other stockholders), acting via written consent; (iii) a termination fee equal to a to-be-negotiated percentage of the equity value of the Company implied by the transaction value, to be paid under certain specified circumstances, including in connection with a change of recommendation by the Executive Committee; (iv) a termination fee equal to 4% of the equity value of the Company implied by the merger consideration payable by the Parent Entities to the Company to be paid under certain specified circumstances, including if the Parent Entities breach the Merger Agreement in a manner that causes a failure of a closing condition (and the Parent Entities fail to cure such breach within the applicable cure period) or fail to obtain the required debt financing and (v) a covenant requiring the Company Entities to sell certain assets to be identified by the Parent Entities during the period between signing and closing, if directed to do so by the Parent Entities. The initial draft of the Merger Agreement did not include the price per share to be paid to the Company’s equityholders in connection with the Potential Transaction or contemplate that the Potential Transaction would be conditioned on a Majority of the Minority Vote.

From March 10, 2024 until the signing of the definitive transaction agreements, Silver Lake and its representatives (including STB), on the one hand, and the Special Committee and its advisors (including Centerview and Cravath) and the Company and its advisors (including Latham), on the other hand, negotiated the terms of the Merger Agreement. For a summary of the final terms of the Merger Agreement, see the section entitled “The Merger Agreement” beginning on page 122.

On March 13, 2024, the Special Committee met via videoconference with representatives of Cravath and representatives of Centerview. Representatives of Centerview provided a status update on its ongoing review of the Company’s financial information and discussed its preliminary views with the members of the Special Committee. Next, representatives of Cravath discussed the draft Merger Agreement with the Special Committee, including (i) the absence of a Majority of the Minority Vote condition and other closing conditions, (ii) termination rights and termination fees, (iii) deal protection provisions and (iv) other representations, warranties and covenants.

On March 17, 2024, Cravath and Latham delivered a revised draft of the Merger Agreement to STB. Among other things, the revised draft of the Merger Agreement prepared by Cravath and Latham: (i) proposed that the Potential Transaction be conditioned on a Majority of the Minority Vote; (ii) reflected certain changes to the representations and warranties and to the nature and scope of the interim operating covenants applicable to the Company between signing and closing, including an exception to the interim operating covenants to permit the Company to pay dividends to holders of Class A Common Stock; (iii) reflected an increase of the termination fee payable by the Parent Entities to the Company under certain circumstances from 4% to 8% of the equity value of the Company implied by the merger consideration, and expanded the circumstances under which such fee is payable to include termination by the Company for the Parent Entities’ failure to deliver a written consent approving the Transactions within twelve hours after the execution of the Merger Agreement and termination by the Company or the Parent Entities in the event the parties fail to obtain required regulatory approvals prior to the outside date for the Potential Transaction; (iv) expanded the scope of the Parent Entities’ obligations to obtain required regulatory approvals (including gaming regulatory approvals) prior to closing; (v) removed the asset sale covenant described above; (vi) provided that actions taken by or at the direction of directors affiliated with Silver Lake and members of management who proposed to “rollover” equity interests in the Potential Transaction would not constitute a Company breach of the Merger Agreement under certain circumstances; and (vii) provided that the Special Committee would be the party controlling Company rights under certain provisions related to deal protection and exercise of Company rights.

On March 17, 2024, representatives of STB, at the direction of Silver Lake, informed representatives of Cravath that Silver Lake had rejected the Special Committee’s request to condition the Potential Transaction on a Majority of the Minority Vote.

During the subsequent weeks through April 2, 2024, representatives of Cravath and Latham, on the one hand, and representatives of STB, on the other hand, discussed and negotiated the Merger Agreement and certain ancillary documents with respect to the Potential Transaction and exchanged several drafts of the Merger Agreement and such ancillary documents.

On March 19, 2024, Cravath and Latham delivered an initial draft of the Company’s confidential disclosure letter to be delivered concurrently with the execution of the Merger Agreement and Voting and Support Agreement to STB. From March 19, 2024 until the signing of the definitive agreements, the parties negotiated the final terms of the Company’s confidential disclosure letter to be delivered concurrently with the execution of the Merger Agreement and the Voting and Support Agreement.

Also on March 19, 2024, STB provided to Debevoise and Freshfields initial drafts of the definitive documentation regarding the potential rollovers and post-closing arrangements for each of Messrs. Emanuel and Whitesell. From this date through the signing of definitive agreements, representatives of STB and Silver Lake discussed and negotiated (i) with Mr. Emanuel and representatives of Debevoise and (ii) with Mr. Whitesell and representatives of Freshfields, the terms of the definitive documents that would govern their respective rollovers and post-closing arrangements. On March 21, 2024, STB provided an initial draft of a proposed employment agreement for Mr. Shapiro to Akin Gump Strauss Hauer & Feld LLP (“Akin”), as legal counsel to Mr. Shapiro. On March 22, 2024, STB provided Akin with an initial draft of a proposed rollover agreement for Mr. Shapiro. For the final terms of such arrangements reflecting the foregoing negotiations, including the incentives provided to Messrs. Emanuel and Shapiro for the sale of certain assets that could occur during the interim period, see the section entitled “Other Agreements — Other Management Documents” beginning on page 163.

On March 21, 2024, the Special Committee convened a meeting via videoconference with representatives of Centerview and Cravath in attendance to discuss the Company’s proposed treatment of outstanding equity awards in the Potential Transaction and discuss Centerview’s ongoing review of the Company’s financial information. After discussion, the Special Committee approved sharing with Silver Lake the Company’s draft equity award treatment proposal, but maintained that the Special Committee would ultimately make a final determination as to the treatment of equity awards as part of its assessment of the Potential Transaction and in light of all the terms of such Potential Transaction. Next, the representatives of Centerview provided the Special Committee with an update regarding its review of the Company’s financial information. Representatives of Centerview also provided the Special Committee with an update on additional information gathering that Centerview was performing, including ongoing discussions with Company management about current expectations and structure (including implications on Tax Receivable Agreement payment expectations and the use of net operating losses).

On March 23, 2024, representatives of STB provided an initial draft of the Equity Commitment Letter and an initial draft of the Limited Guarantee to representatives of Latham and Cravath. From March 23, 2024 through the signing of the definitive agreements, the parties negotiated the final terms of the Equity Commitment Letter and Limited Guarantee.

On March 25, 2024, the Special Committee convened a meeting via videoconference with representatives of Centerview and Cravath in attendance. Representatives of Cravath provided an update on the status of and key open points in various transaction documents, including the Merger Agreement, employment arrangements, Equity Commitment Letter and Limited Guarantee, including: (i) Silver Lake’s transaction financing plan, (ii) the fact that Silver Lake had not yet identified specific regulatory approvals applicable to a Potential Transaction, (iii) the definition of material adverse effect, (iv) Silver Lake’s proposal that the closing be conditioned on the receipt of certain unspecified third party consents, (v) the absence of a Majority of the Minority Vote requirement, (vi) the proposed “inside” and “outside” dates for closing, (vii) the absence of a proposed size of the “Company termination fee”, (viii) the proposed size of the “reverse termination fee” and the circumstances in which it would be payable, (ix) the regulatory efforts covenant, (x) Silver Lake’s proposal requiring the Company to pursue certain asset sales, (xi) covenants relating to the interim operations of the Company, stockholder litigation, financing and financing cooperation, (xii) the extent to which actions taken by certain affiliates of the buyer group (deemed to be “designated individuals”) would be taken into account in determining whether the Company had breached its covenants or representations and warranties under the Merger Agreement and (xiii) the role of the Special Committee in enforcement and defense of the Merger Agreement. Representatives of Centerview provided an update on Centerview ongoing review of the Company’s financial information.

On March 27, 2024, representatives of STB provided an initial draft of the Debt Commitment Letter to representatives of Latham and Cravath. From March 27, 2024 through the signing of the definitive agreements, the parties negotiated the final terms of the Debt Commitment Letter.

Between March 27, 2024 and the signing of the definitive agreements on April 2, 2024, representatives of Centerview, at the direction of the Special Committee, and Mr. Durban spoke numerous times to discuss various matters related to the Potential Transaction, including the status of financing sources and the potential timeline for negotiating and signing a Potential Transaction.

From March 28, 2024 until the signing of the definitive agreements, Mr. Emanuel called members of the Special Committee on several occasions and conveyed his support for the Special Committee process and a Potential Transaction.

On March 28, 2024, the Special Committee met via videoconference with representatives of Centerview and Cravath to discuss process updates and the status of various transaction documents, including the Merger Agreement. The representatives of Cravath noted that the parties remained apart on many of the issues described at the March 25, 2024 meeting of the Special Committee, including those related to deal certainty.

On March 29, 2024, the Special Committee met via videoconference with representatives of Centerview and Cravath to discuss the status of negotiations and key terms of the Merger Agreement, including Silver Lake’s proposal regarding regulatory approvals necessary to close the Transactions and potential alternative approaches.

Later on March 29, 2024, the Company delivered to representatives of Centerview an analysis of the unlevered free cash flow of the Company (including the approximately 51% equity interest in TKO held by the Company (such interest of TKO, “Owned TKO”)) allocable to the holders of the Diluted Securities (as defined below) (such analysis, the “FCF Allocation”). For a description of the FCF Allocation, see the section entitled “The Special Factors — Certain Company Financial Forecasts” beginning on page 80.

Later on March 29, 2024, the Special Committee met again with representatives of Centerview and Cravath to discuss Centerview’s review of the Company’s financial information. The representatives of Centerview then presented Centerview’s preliminary financial analyses of the Company on the basis of the Final Financial Model and FCF Allocation. For more information regarding Centerview’s final valuation analyses, which were presented to the Special Committee on April 2, 2024 and were determined by the Special Committee to be substantially the same as the analyses presented on March 29, 2024 (but with the inclusion of a graphic demonstrating the offer value per share of the Final Offer (as defined below)), see the section entitled “The Special Factors — Opinion of Centerview — Summary of Centerview Financial Analysis” beginning on page 73. The representatives of Cravath also reviewed with the Special Committee the potential timeline for signing and announcing the Transactions and factors that would influence such timeline.

Later on March 29, 2024, Silver Lake submitted a proposal to the Company to acquire 100% of the outstanding equity interests of the Company (other than equity interests to be rolled over by Silver Lake or Company management), at a price per share of $24.50 payable in cash (the “March 29 Proposal”), which proposal assumed the entry into satisfactory management agreements with each of Mr. Emanuel, Mr. Whitesell and Mr. Shapiro substantially concurrently with the execution of the Merger Agreement. The proposal represented a 38% premium to the unaffected share price of $17.72 per share at market close on October 25, 2023, and a 37% premium to the Company’s unaffected five-day VWAP of $17.88, in addition to being a 5% discount to Company’s trading price as of the close of business earlier that day, and a 0%, 0% and 1% premium to 30-, 60- and 90-day VWAP, respectively, of the Company’s shares as of March 29, 2024.

In the morning on March 30, 2024, Karen King, the Chief Legal Officer of Silver Lake, contacted a representative of Cravath to discuss certain open terms in the Merger Agreement. Throughout March 30, 2024, and until the signing of the definitive agreements, Ms. King and a representative of Cravath periodically communicated to negotiate terms of the transaction documents and discuss process matters related to the Potential Transaction.

Later in the morning on March 30, 2024, the Special Committee convened a meeting with representatives of Centerview and Cravath in attendance to discuss the Merger Agreement and certain other transaction agreements and the March 29 Proposal. Representatives of Cravath discussed with the Special Committee certain key open issues in the drafts of the Merger Agreement and other transaction agreements, as well as potential alternatives to Silver Lake’s proposal in respect of gaming regulatory approvals. The representatives of Centerview summarized the March 29 Proposal and presented their preliminary financial analyses of such proposal. Following this meeting, and at the direction of the Special Committee, representatives of Centerview informed Silver Lake that the Special Committee had rejected the March 29 Proposal, but that the Special Committee would be willing to consider a Potential Transaction at a price of $31.50 per share, in cash.

In the afternoon on March 30, 2024, a representative of Cravath met with the Special Committee to discuss certain open issues in the transaction agreements, including: (i) the treatment of gaming regulatory approvals (including for purposes of the closing conditions and regulatory efforts covenant), (ii) the “outside date” in the Merger Agreement, (iii) Silver Lake’s proposal that the Company be required to pursue sales of certain assets of the Company if directed to do so by the Parent Entities, (iv) the fact that, under the terms of the draft debt commitment letter, the Parent Entities’ debt commitments would be reduced if the Company completed certain specified assets sales, without any obligation for the Parent Entities to replace those commitments if the asset sales occurred prior to closing, and (v) the treatment of the Parent Entities’ proposed preferred equity financing under the transaction documents.

Later on March 30, 2024, Silver Lake submitted a revised proposal to the Company to acquire 100% of the outstanding equity interests of the Company (other than equity interests to be rolled over by Silver Lake or Company management), increasing the proposed price per share from $24.50 to $25.75 in cash (the “March 30 Proposal”). The revised proposal represented a 45% premium to the unaffected share price of $17.72 per share at market close on October 25, 2023, and a 44% premium to the Company’s unaffected five-day VWAP of $17.88, in addition to being a 0% premium to Company’s trading price as of the close of business on March 29, 2024, and a 5%, 5% and 6% premium to 30-, 60- and 90-day VWAP, respectively, of the Company’s shares as of March 29, 2024.

In the evening on March 30, 2024, following receipt of the March 30 Proposal, the Special Committee convened a meeting with representatives of Centerview and Cravath in attendance to discuss and consider the March 30 Proposal. During the meeting, the Special Committee determined to reject the March 30 Proposal and instructed the representatives of Centerview to conduct further analyses of the March 30 Proposal. After receiving an unsolicited call from Mr. Durban during the meeting, a representative of Centerview, at the direction of the Special Committee, informed Mr. Durban that the Special Committee was disappointed with the March 30 Proposal. Also at the meeting, Cravath discussed with the Special Committee certain legal matters, including open issues in the Merger Agreement that had been discussed at the Special Committee’s meeting that afternoon and the definition of “material adverse effect” and associated disclosures to be made by the Company.

In the morning on March 31, 2024, the Special Committee convened a meeting to discuss the March 30 Proposal and next steps. The representatives of Centerview presented certain preliminary financial analyses of the March 30 Proposal requested by the Special Committee the prior day. The Special Committee then discussed a potential counteroffer and, on the basis of the discussion, directed the representatives of Centerview to make a counterproposal on the Special Committee’s behalf of $30.50 per share to Silver Lake. The representatives of Cravath also provided an update on the status of various transaction documents, and noted Silver Lake had reiterated its position that it would not accept a Majority of the Minority Vote closing condition. Subsequently, representatives of Centerview presented the Special Committee’s counterproposal to Mr. Durban, who responded by indicating that he had conferred with Silver Lake’s proposed preferred equity and other financing sources and believed that Silver Lake could increase its proposed purchase price-per share from $25.75 (as reflected in the March 30 Proposal) to $27.00.

Later in the morning on March 31, 2024, the Special Committee met two times to review Silver Lake’s oral proposal, which was subsequently followed by a written offer to acquire 100% of the outstanding equity interests of the Company (other than equity interests to be rolled over by Silver Lake or Company management) for $27.00 in cash. In between the meetings, Mr. Emanuel called a member of the Special Committee to convey his support for the Potential Transaction and, during the call, informed such Special Committee member of his understanding that Silver Lake’s financing sources would not support a purchase price in the range of $28.00 per share or above. At the second of these meetings, the Special Committee, following deliberation and discussion, directed representatives of Centerview to counter with a price between $29.00 and $29.50 per share, contingent on agreement on other deal terms.

Throughout the remainder of March 31, 2024, at the direction of the Special Committee, representatives of Centerview spoke with Mr. Durban and Silver Lake’s advisors to communicate the Special Committee’s counterproposal and to negotiate price. During the course of these conversations, Mr. Durban indicated that Silver Lake’s authority from its limited partners did not permit it to offer a headline purchase price that exceeded $27.50 per share and that, in addition, Silver Lake did not believe that the Company’s implied value supported such a price. The Special Committee also convened three additional meetings with representatives of Centerview and representatives of Cravath to discuss the ongoing negotiations regarding price and transaction terms.

Throughout the day on April 1, 2024, the Special Committee convened four meetings to discuss the Potential Transaction and the ongoing negotiations with respect thereto. Among the matters discussed were the factors in favor of and against the Potential Transaction at a price of $27.50 per share. The Special Committee also considered that the Reporting Persons had stated that they would make public disclosures on Schedule 13D/A the following day, Tuesday April 2, 2024, and the risk that additional negotiations could cause Silver Lake to abandon the negotiations and the Potential Transaction altogether. The members of the Special Committee also considered alternative mechanisms for obtaining value for the Unaffiliated Stockholders. Among the potential alternatives to an increase in the headline purchase price considered was a requirement that the Company pay dividends to the Company’s stockholders after the signing of the Merger Agreement and prior to the closing of the Transactions. Because Silver Lake had previously refused to grant the Company the right to declare or pay dividends in respect of the Class A Common Stock between signing and closing (and the Special Committee and the Company had accepted this position during the course of negotiations), and Silver Lake had also stated during negotiations that it did not intend to permit the Company to declare or pay any such dividends, any such dividends would represent additional economic value for the Unaffiliated Stockholders.

Also throughout the day on April 1, 2024, at the direction of the Special Committee, the representatives of Cravath and Centerview had numerous discussions with Silver Lake, members of Company management, STB and Latham to negotiate and discuss a potential dividend to be paid between signing and closing to the holders of Class A Common Stock and certain other transaction terms.

Later on April 1, 2024, following several such discussions, Silver Lake submitted a proposal to acquire 100% of the outstanding equity interests of the Company, other than (and contingent on) equity interests that are rolled over by Silver Lake or certain members of Company management, (i) at a per-share price of $27.50 plus (ii) a commitment by the Company to pay regular quarterly dividends during the period between the signing of definitive transaction agreements and the closing of the Transactions, in a per-share amount equal to $0.06, with a guarantee that at least four such dividend payments would be made to Company stockholders even if less than four quarters elapsed before the Transactions closed (the “Final Offer” and, clauses (i) and (ii) collectively, the “Public Stockholder Consideration”). For more information regarding the obligation of the Company to pay dividends, see the section entitled “The Merger Agreement — Dividends” beginning on page 129.

Following receipt of the Final Offer, the Special Committee convened a meeting on April 1, 2024, with representatives of Centerview and Cravath in attendance. Representatives of Centerview discussed the Final Offer and discussion of the factors for and against accepting the Final Offer among the Special Committee and its advisors ensued. After deliberation, the Special Committee unanimously determined to accept the Final Offer, subject to the satisfactory resolution of the outstanding transaction terms (including in respect of the Parent Entities’ financing commitments in the event of pre-closing asset sales), which determination was communicated by a member of the Special Committee to Mr. Durban.

During the remainder of April 1, 2024 and throughout the course of the morning of April 2, 2024, the Special Committee’s, the Company’s and Silver Lake’s advisors finalized the Merger Agreement, each of the exhibits to the Merger Agreement, the disclosure schedules and each of the ancillary documents to be entered into in connection therewith. In the final Merger Agreement, Silver Lake agreed that if the debt commitments under the debt commitment letter were reduced upon the Company completing certain specified assets sales, the Parent Entities would replace those commitments. Additionally on April 1, 2024, representatives of Centerview provided to the Special Committee (via Cravath) updated written disclosures of its relationships with Silver Lake (including its portfolio companies), the Company and certain of their respective affiliates.

Early in the morning on April 2, 2024, the Special Committee convened a meeting via videoconference with the representatives of Centerview and Cravath attending. The representatives of Cravath reviewed with the members of the Special Committee their fiduciary duties and other legal matters relevant to a potential take-private of the Company. The representatives of Cravath then reviewed with the Special Committee the terms of the draft Merger Agreement and other transaction documents for the Potential Transaction. The representatives of Centerview then reviewed with the Special Committee Centerview’s financial analyses of the Public Stockholder Consideration (using materials substantially similar to those reviewed with the Special Committee on March 29, 2024), and rendered to the Special Committee an oral opinion, which was subsequently confirmed by delivery of a written opinion dated such date that, as of such date and based upon and subject to various assumptions made, procedures followed, matters considered, and qualifications and limitations upon the review undertaken in preparing its opinion, the Public Stockholder Consideration to be paid to the holders of the outstanding shares of Class A Common Stock (other than Opinion Excluded Shares) pursuant to the Merger Agreement was fair, from a financial point of view, to such holders. For a more detailed discussion of Centerview’s opinion see the section entitled “The Special Factors — Opinion of Centerview” beginning on page 71.

Later in the morning on April 2, 2024, the Special Committee held a meeting via videoconference with representatives of Cravath and Centerview in attendance to review and discuss the changes to the terms of the transaction documents.

Even later in the morning on April 2, 2024, the Special Committee held another meeting via videoconference with representatives of Cravath and Centerview in attendance. At the meeting, Cravath reviewed and discussed with the Special Committee the final forms of the Merger Agreement and each of the other transaction documents to be entered into in connection therewith, which final forms had been provided to the Special Committee. The Special Committee also reviewed the updated relationship disclosures of its relationships with Silver Lake (including its portfolio companies), the Company and certain of their respective affiliates provided by Centerview the prior day. Following further discussion and consideration, including consideration of the reasons in favor of the Mergers described the section below entitled “The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers” beginning on page 62, the Special Committee determined to recommend in favor of the Potential Transaction and unanimously adopted resolutions recommending that the Executive Committee (i) approve the Merger Agreement and the Transactions, including the Mergers, (ii) recommend the adoption and approval of the Merger Agreement and the Transactions, including the Mergers, by the stockholders of the Company and (iii) approve the execution, delivery and performance by the Company, Manager and OpCo of the Merger Agreement and the consummation of the Transactions upon the terms and subject to the conditions set forth therein.

Immediately following the meeting of the Special Committee, a meeting of the Executive Committee was convened. The attendee directors were Messrs. Emanuel, Whitesell, Durban and Evans. Representatives of Latham were also in attendance. The representatives of Latham reviewed with the Executive Committee the principal terms of the proposed Merger Agreement, Voting and Support Agreement, Shapiro A&R Employment Agreement Amendment, Shapiro Employment Agreement, Emanuel Letter Agreement and Whitesell Letter Agreement. Representatives of Latham also noted that Messrs. Emanuel and Whitesell were each represented by independent counsel during the negotiations of the proposed Transactions and the foregoing documents (including the Emanuel Letter Agreement and the Whitesell Letter Agreement, as applicable) and accordingly were fully informed of all negotiations and material terms thereof. Representatives of Latham then reviewed the fiduciary duties owed by the members of the Executive Committee to the Company’s stockholders in connection with the proposed Transactions under Delaware law. Representatives of Latham further noted that each member of the Executive Committee had disclosed its respective conflicts of interest regarding the Potential Transaction and then reviewed with the Executive Committee the Amendment No. 3 to the Executive Committee Charter, pursuant to which the members of the Executive Committee agreed that they would not be required to recuse themselves from the meeting of the Executive Committee to approve the Potential Transaction notwithstanding their respective conflicts of interest. The representatives of Latham then informed the members of the Executive Committee that the Special Committee had concluded their negotiations and unanimously determined that the Merger Agreement and the Transactions were advisable, fair and in the best interests of the Company and its Unaffiliated Stockholders and recommended that the Executive Committee approve the Merger Agreement and the Transactions and recommend the adoption and approval thereof to the stockholders of the Company. After discussion, the Executive Committee, acting upon the unanimous recommendation of the Special Committee, (i) determined that the terms of the Merger Agreement and the transactions contemplated thereby, including the Mergers, are fair to and in the best interests of the Company and its Unaffiliated Stockholders, (ii) declared the Merger Agreement and transactions contemplated thereby advisable, (iii) adopted and approved the Merger Agreement and approved the execution and delivery by the Company of the Merger Agreement and the other agreements and document to be entered into in connection therewith, the performance by the Company of its covenants and agreements contained therein and the consummation of the Mergers and the Transactions upon the terms and subject to the conditions set forth therein, (iv) resolved to recommend the adoption of the Merger Agreement and approval of the Mergers and the other transactions contemplated by the Merger Agreement by the stockholders of the Company and (v) directed that the Merger Agreement be submitted to the stockholders of the Company entitled to vote for its adoption, which could be by written consent of the requisite stockholders in lieu of a meeting in accordance with Section 228 of the DGCL.

Later on April 2, 2024, the Company Entities, Parent Entities, Merger Subs and the other parties thereto executed the Merger Agreement and the other applicable transaction documents. Shortly thereafter, the Company halted trading of its stock and the Company and Silver Lake issued a joint press release announcing the