⚖️ For Fairness Sake ⚖️ Squarespace acquired by Permira for $7.2 billion

A quick look at Squarespace's fairness opinion

Squarespace acquired by Permira for $7.2 billion.

This is a great look at the actual fairness opinion presentation Centerview gave to the Board, that was filed, which you usually don’t get to see.

Squarespace / Permira deal overview

NEW YORK, May 13, 2024 — Squarespace, Inc. (NYSE: SQSP), the design-driven platform helping entrepreneurs build brands and businesses online, today announced that it has entered into a definitive agreement to go private by Permira, the global private equity firm, in an all-cash transaction valued at approximately $6.9 billion.

Under the terms of the agreement, Squarespace stockholders will receive $44.00 per share in cash representing a transaction valued at over $6.6 billion on an equity value basis and approximately $6.9 billion on an enterprise value basis. The purchase price represents a premium of approximately 29% over Squarespace’s 90-day volume weighted average trading price, and a premium of 15% over Squarespace's closing share price of $38.19 on the NYSE on May 10, 2024.

Advisors

Squarespace

JP Morgan is acting as financial advisor to Squarespace.

Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal counsel to Squarespace.

Centerview Partners LLC is acting as financial advisor.

Richards, Layton & Finger is acting as legal counsel, to the Special Committee of the Squarespace Board of Directors.

Premira

Goldman Sachs & Co LLC is acting as financial advisor to Permira, and Latham & Watkins LLP is acting as legal counsel to Permira Advisers.

Blackstone Credit & Insurance (“BXCI”), Blue Owl Capital, and Ares Capital Corp are acting as Joint Lead Arrangers on the debt financing.

Wilson Sonsini Goodrich & Rosati is acting as legal counsel to Anthony Casalena.

Paul, Weiss, Rifkind, Wharton & Garrison is acting as legal counsel to General Atlantic.

Cooley is acting as legal counsel to Accel.

Update:

SQUARESPACE AND PERMIRA AMEND MERGER AGREEMENT TO INCREASE OFFER PRICE TO $46.50 PER SHARE IN CASH

Stockholders to receive an increase of $2.50 per share over the previously announced transaction

Purchase price reflects a 36% premium over the 90-day volume weighted average trading price of $34.09 on May 10, 2024, the last trading day prior to the announcement of the original transaction

Amended transaction represents ‘best and final’ offer and provides enhanced, immediate and certain value to Squarespace stockholders

Permira to commence tender offer for all of Squarespace’s outstanding shares

Amended terms unanimously approved by an independent special committee of Squarespace’s Board of Directors

NEW YORK, September 9, 2024 — Squarespace, Inc. (NYSE: SQSP) and Permira today announced that they have agreed to amend their previously announced definitive agreement. Under the terms of the amended agreement, Squarespace stockholders will receive $46.50 per share in cash and an aggregate transaction value of approximately $7.2 billion.

The revised offer price represents an increase of 5.7% over the previously agreed offer price of $44.00 per share, a premium of 36.4% over Squarespace's 90-day volume weighted average trading price of $34.09 and a premium of 21.8% over Squarespace's 52-week high share price of $38.19 as of May 10, 2024. The transaction also represents over 20x enterprise value / 2025 unlevered free cash flow, representing a significant premium to peers.

Background of the merger

TL;DR: In late 2022 to early 2024, Permira expressed interest in acquiring Squarespace, engaging in discussions with CEO Anthony Casalena. On February 13, 2024, Permira submitted a non-binding proposal to acquire Squarespace for $40.50 per share, representing a 28% premium over the closing price that day. The proposal suggested that Permira was open to a rollover of equity from Squarespace management. The Board deemed this initial offer unattractive and encouraged Permira to submit a higher bid. March 26, 2024, the Special Committee determined not to contact strategic buyers at this time given the low likelihood that such outreach would lead to a successful transaction and authorized Centerview to proceed to initiate outreach to eight prospective financial sponsors, consisting of Permira, Party A, Party B, Party C, Party D, Party E, Party F and Party G, which the Special Committee believed were the most likely to be interested in a potential strategic transaction with Squarespace and able to provide an attractive valuation. On April 9, 2024, Permira signed a non-disclosure agreement (NDA), allowing them to conduct due diligence and engage in management presentations. April 19, 2024: The Special Committee confirmed that all scheduled management presentations had been completed. Initial bid letters were sent to Permira, Party A, Party B, Party F, and Party G, with the deadline for submissions set for April 26, 2024. On April 26, 2024, Permira revised its offer to $42.50 per share, including a rollover of at least 75% of Mr. Casalena's equity stake. This was followed by an increase to $43.25 per share on April 29, 2024 (22% premium to April 26 closing price). None of Party A, Party B, Party F or Party G submitted a bid by the April 26 bid deadline.

On May 9, 2024, Permira made its final proposal of $44.00 per share (20% premium to the closing share price on May 9), including Rollover/reinvestment commitments totaling $700 million from General Atlantic and Accel, which was accepted by the Company. As discussions progressed, Squarespace announced its Q2 financial results on August 2, 2024, and a revised proxy statement.

On August 14, 2024, Glazer Capital publicly opposed the merger, prompting the Special Committee to consider stockholder feedback, especially since shares were trading above the proposed offer. The definitive proxy statement was filed on August 22, 2024, but feedback suggested difficulties in securing approval at the $44 price. On September 2, 2024, Permira noted that Permira was not institutionally supportive of a price increase and believed such support would be difficult to obtain internally. On September 6, 2024, ISS recommended against the merger. On September 6, 2024, Permira submitted a revised proposal to increase the purchase price to $46.50 per share. Following further discussions, the Special Committee and Board approved the A&R Merger Agreement on September 8, 2024, determining it to be in the best interests of stockholders. The agreement was executed on September 9, 2024, followed by a public announcement.

Potential bidders

The Special Committee determined not to contact strategic buyers given the low likelihood that such outreach would lead to a successful transaction and authorized Centerview to initiate outreach to eight prospective financial sponsors, consisting of Permira, Party A, Party B, Party C, Party D, Party E, Party F and Party G.

Party D: Executed an NDA on April 2, 2024

Party F: Executed an NDA on April 4, 2024, participated in a managment presentation

Party A, Party B, Party E, Party G: All executed NDAs on April 9, 2024.

Party A, Party B, and Party G participated in management presentations

April 12, 2024, Centerview reported that Party D and Party E had withdrawn from the process and that Party C had not been responsive to requests from Centerview to confirm their interest in considering a potential transaction

Initial bid letters were sent to Permira, Party A, Party B, Party F, and Party G, with the deadline for submissions set for April 26, 2024.

None of Party A, Party B, Party F or Party G submitted a bid by the April 26 bid deadline.

The wringer

Squarespace filed PREM14A and a SC13E3 on June 17, 2024 that contained Centerview’s fairness opinion.

In connection with Centerview’s services as the financial advisor to the Special Committee, Squarespace has agreed to pay Centerview an estimated aggregate fee of approximately $43 million, $2.5 million of which was payable upon the rendering of Centerview’s opinion and the remainder of which is payable contingent upon consummation of the Merger (the “Transaction Fee”) (which includes a $500,000 retainer, which is creditable against the Transaction Fee). Squarespace has also agreed to reimburse certain of Centerview’s expenses arising, and to indemnify Centerview against certain liabilities that may arise, out of Centerview’s engagement.

It is fair to Centerview. This works out to ~0.6% of the $6.9 billion enterprise value, which would probably be at higher end of M&A sell-side fee tables.

For its fee, Centerview goes with a more limited set of valuation methods.

Trading comparables

DCF

Reference

52 week high

Analyst price targets

A few caveats before we begin diving into the numbers. I am not going to be able tie out all the share price ranges due to several factors:

Financials projections are rounded to the ones

Quarterly projections not provided

A full option schedule was not provided in any filings

Again, the old saying still applies, “you get what you pay for” and this is free. That said, we are in the ballpark for all analysis, so let’s dive in.

Valuation Summary

13E3 filing (June 17, 2024)

14D9 filing (September 16, 2024)

Is it Fair?

As my backup dancers used to say, only God and the Delaware Courts can decide that.

Glazer Capital, LLC publicly announced that it beneficially owned 2.5 million shares of the Company and had issued an open letter to the Board detailing its opposition to the Merger.

ISS also came out and reccomended that shareholders vote against the initial offer.

This resulted in a increased offer of $46.50, 5.7% over the previously agreed offer price of $44.00 per share. A premium of 36.4% over Squarespace's 90-day volume weighted average trading price of $34.09 and a premium of 21.8% over Squarespace's 52-week high share price of $38.19 as of May 10, 2024.

$44.00 offer was ~29% over Squarespace’s 90-day volume weighted average trading price, and a premium of 15% over Squarespace's closing share price of $38.19 on the NYSE on May 10, 2024.

Squarespace did run a limited market check, that did not result in any other offers.

Update:

Permira announced the success of its funds’ cash tender offer for all outstanding shares of common stock of Squarespace, Inc. (NYSE: SQSP). The tender offer expired one minute after 11:59 p.m., New York City time, on October 11, 2024.

As of expiration, 46,971,451 shares had been validly tendered and not withdrawn from the tender offer. The tendered shares together with the shares rolled over, or sold directly, by affiliates of Anthony Casalena, General Atlantic and Accel represent approximately 97.5 percent of the aggregate voting power of Squarespace’s total outstanding shares, 84.4 percent of the aggregate voting power of Squarespace’s total outstanding Class A shares, and 100 percent of the aggregate voting power of Squarespace’s total outstanding Class B shares. The tendered shares included approximately 77.7 percent of the aggregate voting power of Squarespace’s total outstanding shares held by Squarespace’s unaffiliated shareholders. All shares that were validly tendered will be accepted for purchase on October 14, 2024. Payment for those shares will be made in accordance with the terms of the tender offer.

The Permira funds will proceed to complete a second-step merger in which any remaining shares of Squarespace common stock will be converted into the right to receive an amount in cash equal to the per share price paid in the tender offer, without interest and less any required withholding taxes. Upon completion of the transaction, which is expected to happen on October 17, 2024, Squarespace will become a privately held company.

Management projected financials

Original proxy filing (June 17, 2024)

13E3 filing (June 17, 2024)

14D9 filing (September 16, 2024)

Summary valuation

13E3 filing (June 17, 2024)

14D9 filing (September 16, 2024)

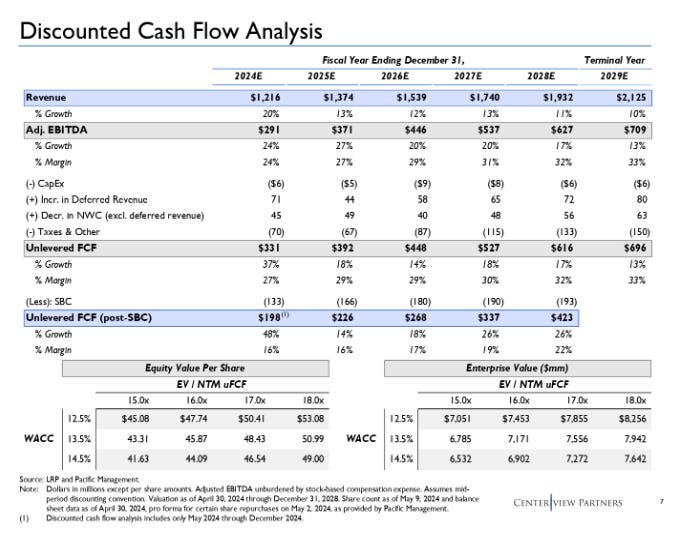

Discounted Cash Flow Analysis

Original proxy filing (June 17, 2024)

Centerview performed a discounted cash flow analysis of Squarespace based on the Forecasts. A discounted cash flow analysis is a traditional valuation methodology used to derive a valuation of an asset by calculating the “present value” of estimated future cash flows of the asset. “Present value” refers to the current value of future cash flows and is obtained by discounting those future cash flows by a discount rate that takes into account macroeconomic assumptions and estimates of risk, the opportunity cost of capital, expected returns and other appropriate factors. For purposes of this analysis, stock-based compensation was treated as a cash expense.

In performing this analysis, Centerview calculated a range of implied enterprise values for Squarespace by discounting to present value as of April 30, 2024 (using discount rates ranging from 12.5% to 14.5%, based upon Centerview’s analysis of Squarespace’s weighted average cost of capital, determined using the capital asset pricing model and based on considerations that Centerview deemed relevant in its professional judgment and experience): (i) the forecasted unlevered free cash flows (after treating stock-based compensation as a cash expense) of Squarespace based on the Forecasts over the period beginning May 1, 2024 and ending on December 31, 2029, as approved by the Special Committee and utilized by Centerview at the direction of the Special Committee (see the section of this proxy statement captioned “Special Factors—Unaudited Prospective Financial Information”) and (ii) a range of implied terminal values of Squarespace at the end of the forecast period shown in the Forecasts, applying a range of terminal multiples to Squarespace’s NTM uFCF as of December 31, 2028 (which reflects projected uFCF for fiscal year 2029), ranging from 15.0x to 18.0x. Centerview then (a) subtracted from this range the face value of Squarespace’s net debt of approximately $265 million as of April 30, 2024 (pro forma for certain share repurchases on May 2, 2024) as set forth in the Internal Data and (b) divided this range of implied equity values by the number of fully diluted outstanding shares of Common Stock as of May 9, 2024, calculated on a treasury stock basis based on the Internal Data to derive a range of implied values per share of Common Stock of approximately $41.65 to $53.10, rounded to the nearest $0.05. Centerview compared this range to the Per Share Price of $44.00 per share proposed to be paid to the Unaffiliated Company Stockholders (other than with respect to the Excluded Shares) pursuant to the Merger Agreement.

13E3 filing (June 17, 2024)

14D9 filing (September 16, 2024)

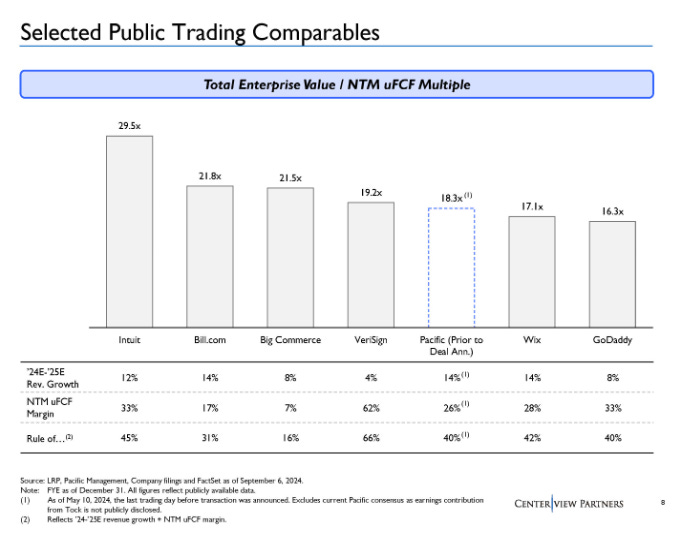

Selected Companies Analysis

Squarespace lists the following companies in it s10K as competitors.

Online presence solutions such as Wordpress, Wix and Weebly;

Appointments solutions such as MindBody;

Hospitality services such as Resy and OpenTable;

Software solutions for selling goods online such as Shopify and BigCommerce;

Domain registration and website hosting services such as GoDaddy; and

Email marketing solutions such as MailChimp.

Original proxy filing (June 17, 2024)

13E3 filing (June 17, 2024)

14D9 filing (September 16, 2024)

52 week trading range

Original proxy filing (June 17, 2024)

Historical Price Trading Analysis. Centerview reviewed historical trading prices of the shares of Common Stock during the 52-week period ended May 10, 2024, which reflected low and high closing stock prices for the shares of Common Stock during such period of $27.41 (on November 1, 2023) and $38.19 (on May 10, 2024) per share of Common Stock.

14D9 filing (September 16, 2024)

Analyst price targets

Original proxy filing (June 17, 2024)

Analyst Price Targets Analysis. Centerview reviewed price targets for the shares of Common Stock in publicly available Wall Street research analyst reports as of market close on May 10, 2024, noting that these price targets ranged from $38.00 per share of Common Stock to $50.00 per share of Common Stock.

13E3 filing (June 17, 2024)

14D9 filing (September 16, 2024)

14D9 filing (September 16, 2024)

Background of the Merger

The Squarespace Board regularly evaluates Squarespace’s strategic direction and ongoing business plans with a view toward strengthening Squarespace’s businesses and enhancing stockholder value. As part of this evaluation, the Squarespace Board has, from time to time, considered a variety of strategic alternatives. Since Squarespace’s direct listing, no third parties have expressed an intent to engage in a potential strategic transaction with Squarespace, and no proposals have been made to either Squarespace’s management or the Squarespace Board for an acquisition of the entire company or a controlling stake in Squarespace or a merger with Squarespace, except as described below.

Permira regularly evaluates potential acquisition targets as part of its normal investment activities. As part of this evaluation, Permira has, from time to time, internally considered a potential acquisition of Squarespace and performed “outside-in” reviews of Squarespace and built a rapport with Anthony Casalena, the Chief Executive Officer of Squarespace, as part of its consideration of the industry at-large. While Permira has previously internally expressed interest in engaging in a strategic transaction with Squarespace with its investment committee, no proposals were made to either Squarespace’s management or the Squarespace Board for an acquisition of the entire company or a controlling stake in Squarespace or a merger with Squarespace, except as described below.

On October 12, 2022, as part of Mr. Casalena’s ordinary course business practice of having discussions with industry participants, Mr. Casalena had an initial meeting with David Erlong and Dipan Patel, each a partner, of Permira following an initial inquiry from the Permira team to Mr. Casalena. During this meeting, the parties engaged in general discussions regarding Squarespace’s industry and business as well as Permira’s business as a private equity investor. The parties did not discuss a potential transaction involving Squarespace during the meeting.

On November 18, 2022, January 26, 2023 and July 25, 2023, Mr. Casalena met with Mr. Erlong and they generally discussed Squarespace’s business and Permira’s business as a private equity investor. The parties did not discuss a potential transaction involving Squarespace during these meetings.

On November 29, 2023, Mr. Casalena and Mr. Erlong held a meeting during which Mr. Erlong indicated that Permira was potentially interested in a potential transaction with Squarespace. Mr. Casalena did not substantively respond to Permira’s potential interest in a potential transaction at the meeting and no specific terms of a potential transaction were discussed during this meeting.

On December 13, 2023, Mr. Casalena and Mr. Erlong had a follow-up telephone call during which they further discussed Permira’s potential interest in a potential transaction with Squarespace. Mr. Casalena asked basic questions about the high-level typical timeline and process for a transaction to which Mr. Erlong replied with a basic outline. No specific terms of a potential transaction were discussed during this call.

On December 22, 2023, Mr. Casalena and Mr. Erlong had a follow-up telephone call during which they discussed Permira’s potential interest in a potential transaction with Squarespace and Mr. Casalena noted that he would reflect on the expressed interest. No specific terms of a potential transaction were discussed during this call.

In early 2024, Mr. Casalena had some brief discussions or calls with chief executive officers of a few portfolio companies of Permira to discuss their general experiences with Permira as an equity investor.

In January and early February 2024, Mr. Casalena met individually with each of the other members of the Squarespace Board during which he discussed with them Squarespace’s business prospects and strategic direction, including a potential transaction with Permira. During these meetings, Mr. Casalena informed the Squarespace Board members of his discussions with Permira representatives.

On February 13, 2024, Mr. Erlong called Mr. Casalena to let him know Permira would be sending a formal proposal for a potential strategic transaction. Shortly after such call, Squarespace received a non-binding letter from Permira indicating Permira’s interest in acquiring Squarespace for $40.50 per share in cash, which was a 28% premium to Squarespace’s closing share price as of February 13, 2024, a 35% premium to Squarespace’s 90-day volume weighted average closing price and a 37% premium to Squarespace’s 52-week volume weighted average closing price (the “February Proposal”). The February Proposal indicated that Permira would welcome a roll-over from Squarespace management at the appropriate time and that Permira was willing to partner with other existing Squarespace investors in connection with a potential transaction. The February Proposal also provided that if existing investors were interested in a roll over of equity in a transaction with Permira, Permira would condition the transaction on approval by a special committee composed of independent directors of the Squarespace Board and a majority vote of the Unaffiliated Company Stockholders. Squarespace’s Class A Common Stock closed trading on February 13, 2024 at $31.61 per share.

On February 14, 2024, Mr. Casalena sent the February Proposal to the Squarespace Board and had a meeting with a representative from J.P. Morgan Securities LLC (“JPM”), Squarespace’s financial adviser on an ongoing basis since Squarespace’s direct listing. During the meeting, Mr. Casalena and the JPM representative discussed next steps regarding the February Proposal.

On February 16, 2024, the Squarespace Board held a meeting, also attended by members of management of Squarespace, representatives of JPM and Skadden, Arps, Slate, Meagher & Flom LLP (“Skadden”), Squarespace’s outside legal counsel. Representatives of JPM presented an overview of the February Proposal and various considerations related to potential next steps. Representatives of Skadden reviewed the Squarespace Board’s fiduciary duties in considering a potential strategic transaction and discussed considerations and process related to the potential formation of a special committee of the Squarespace Board in light of the fact that the February Proposal contemplated that existing Squarespace investors may participate in the potential transaction. During the meeting, the Skadden representatives disclosed that Skadden has historically represented and currently represents Permira on matters unrelated to Squarespace, noting that over the last two years, Skadden has advised Permira or its majority owned portfolio companies and affiliates on various public and non-public matters, including multiple publicly disclosed M&A transactions. In the last two years, Skadden has not provided advice to either General Atlantic or Accel. In addition, the Skadden representatives noted that, over the last two years, Skadden has advised the Company on various non-public matters. The Squarespace Board discussed the February Proposal and potential options with respect to responding thereto. During the meeting, Mr. Casalena noted again that he had discussions with Permira representatives regarding Squarespace. The Squarespace Board agreed to further consider the February Proposal and potential responses thereto at the upcoming regularly scheduled Squarespace Board meeting on February 22, 2024.

On February 22, 2024, the Squarespace Board held a meeting, also attended by members of management of Squarespace, and representatives of JPM and Skadden. Representatives of JPM discussed the February Proposal and certain process considerations. After the representatives of JPM left the meeting, Mr. Casalena further discussed with the Squarespace Board his prior interactions with Permira and its representatives, including discussions with respect to Permira’s potential interest in a transaction with Squarespace. Representatives of Skadden advised the Squarespace Board about a potential strategic review process and the role of a special committee in such a process. Mr. Casalena stated that, in light of the February Proposal and his controlling equity interest in Squarespace, if the Squarespace Board determined to consider a potential transaction, he would be supportive of the formation of a special committee comprised of independent and disinterested directors and conditioning any transaction on the approval of such special committee as well as a majority of the Unaffiliated Company Stockholders. Representatives of Skadden discussed with the Squarespace Board information relevant to assessing the independence of the proposed members of such a committee, Michael Fleisher, Jonathan Klein and Neela Montgomery, including their independence with respect to Permira as well as Mr. Casalena, General Atlantic and Accel in light of the fact that the February Proposal indicated that Permira would consider participation in a transaction by existing Squarespace investors, and the Squarespace Board determined that they were each independent and disinterested for purposes of serving on a special committee. The Squarespace Board (i) authorized the formation of a special committee (the “Special Committee”), (ii) authorized the Special Committee to consider, review and evaluate any strategic transactions or alternatives thereto, (iii) designated Michael Fleisher, Jonathan Klein and Neela Montgomery to serve as members of the Special Committee, with Mr. Fleisher to serve as Chair of the Special Committee, (iv) delegated to the Special Committee all the powers of the Squarespace Board to evaluate, negotiate or determine not to proceed with any potential strategic transaction, (v) authorized the Special Committee to retain its own advisors, (vi) authorized and empowered the Special Committee to do all acts as may be necessary or appropriate in its judgment to carry out the duties of the Special Committee, including the power under Section 203 of the DGCL to authorize and approve any potential transaction or any alternative thereto for purposes of Section 203 of the DGCL and (vii) resolved that for so long as the Special Committee exists, the Squarespace Board would not approve or implement any strategic transaction unless the Special Committee, in its sole discretion, recommended such strategic transaction. Thereafter, the Squarespace Board determined to authorize JPM to inform Permira that the February Proposal was not sufficiently attractive for the Squarespace Board to pursue a transaction.

On February 24, 2024, JPM representatives informed Permira that the February Proposal was not sufficiently attractive for the Squarespace Board to pursue a transaction but that Permira was welcome to submit requests for information if Permira believed additional information would support Permira making a higher proposal. Later that day, Permira submitted to representatives of JPM a list of due diligence materials that Permira was requesting access to in order to evaluate whether to improve on the February Proposal.

On February 28, 2024, Mr. Fleisher interviewed legal advisors to serve as the Special Committee’s counsel, including representatives of Richards, Layton & Finger, P.A. (“RLF”). During Mr. Fleisher’s interview of RLF, representatives of RLF provided high-level disclosures regarding its relationships with Squarespace, Mr. Casalena and Permira, noting that, in the past two years, RLF had not done work for Squarespace or Mr. Casalena and that RLF had done work for Permira for which RLF had received aggregate fees which were described as not being material to RLF from a financial perspective.

On March 1, 2024, the Special Committee held a meeting, also attended by Courtenay O’Connor, general counsel of Squarespace. At the meeting, the Special Committee determined to engage RLF to serve as legal counsel to the Special Committee based on RLF’s expertise, experience, independence, qualifications and reputation. On March 4, 2024, the Special Committee executed a formal engagement letter with RLF with respect to RLF’s engagement as legal counsel to the Special Committee.

On March 4, 2024, Mr. Casalena met with Carolyn Everson, a senior advisor of Permira, at a conference and discussed her experience with Permira, as well as Squarespace’s history. The parties did not discuss a potential transaction involving Squarespace during the meeting.

On March 8, 2024, the Special Committee held a meeting, also attended by Ms. O’Connor and representatives of RLF. At the meeting, the Special Committee and the RLF representatives discussed the strategic review process. An RLF representative advised the Special Committee members of their fiduciary duties in the context of a potential transaction involving Squarespace. An RLF representative noted that the Special Committee had been delegated the full power and authority of the Squarespace Board with respect to considering a potential transaction with Permira or alternatives thereto. The Special Committee discussed Permira’s interest in a potential acquisition of Squarespace and the preliminary discussions between Mr. Casalena and Permira that had occurred. The Special Committee also discussed the process for interviewing and evaluating potential financial advisors. During the meeting, an RLF representative summarized the work that RLF had done for Permira, for which RLF had received aggregate fees which were described as not being material to RLF from a financial perspective, and noted that RLF had not done any work for Squarespace or Mr. Casalena in the past two years. During the meeting, an RLF representative also noted that RLF would be sending to each member of the Special Committee a questionnaire that was intended to help confirm the independence of each Special Committee member with respect to Permira, Mr. Casalena, General Atlantic, Accel and each of their respective affiliates. Later that day, RLF circulated a director questionnaire to the members of the Special Committee.

On March 13 and 14, 2024, the Special Committee held meetings, attended by representatives of RLF. During the meetings, the Special Committee interviewed prospective financial advisors to the Special Committee, including Centerview Partners LLC (“Centerview”). During the meeting, Centerview provided high-level disclosures regarding its relationships with Squarespace, Mr. Casalena, Permira, General Atlantic and Accel.

On March 15, 2024, the Special Committee held a meeting, attended by representatives of RLF and (for a portion of the meeting) Ms. O’Connor. During the meeting, the Special Committee members discussed the authority that had been delegated to the Special Committee to conduct the strategic review process and the role of the Special Committee’s advisors in that process. After Ms. O’Connor left the meeting, the Special Committee members discussed the financial advisors the Special Committee had interviewed and determined to engage Centerview based on Centerview’s expertise, experience, qualifications, independence and reputation, subject to review of written relationship disclosures and negotiation of an engagement letter.

On March 16, 2024, Centerview provided written disclosures to the Special Committee and RLF regarding its relationships with Permira, Mr. Casalena, Squarespace, as well as Accel and General Atlantic and their respective affiliates.

On March 19, 2024, Mr. Fleisher, Mr. Casalena, Ms. O’Connor and Nathan Gooden, the chief financial officer of Squarespace, and representatives of Centerview and RLF held an introductory meeting to discuss Squarespace and the roles of management and the various advisors in the strategic review process, including that the Special Committee and its advisors would lead the process. The group asked for Mr. Casalena’s views on the strategic review process and goals for Squarespace given his role as its chief executive officer and largest stockholder with a majority of the voting power of Squarespace. Mr. Casalena indicated that he would like to retain a substantial stake in Squarespace following any transaction and that continuing to have a significant voice in the governance and control of the day-to-day management of Squarespace was also important to him.

Also, on March 19, 2024, a representative of Permira called a representative of General Atlantic, who later talked with Anton Levy, a member of the Squarespace Board and a representative of General Atlantic, to inquire about the status of Permira’s diligence requests.

On March 20, 2024, Mr. Erlong called Mr. Casalena to check on the current status of discussion and process and asked if he would be willing to meet with a senior partner of Permira. On March 20, 2024, Mr. Casalena discussed whether he should have additional meetings with Permira with Mr. Fleisher, and Mr. Fleisher asked Mr. Casalena not to meet with any Permira representatives until authorized by the Special Committee to do so. Later that day, Mr. Casalena contacted Mr. Erlong to let him know that the Special Committee had been established and that he would not be able to meet with Permira representatives any further unless authorized by the Special Committee to do so.

On March 21 and March 26, 2024, Mr. Erlong discussed with JPM the formation of the Special Committee and potential next steps in the Special Committee’s process. During these discussions, Mr. Erlong also discussed Permira’s concept of potentially tying certain of Mr. Casalena’s post-closing governance rights to a yet-to-be-determined performance metric if Mr. Casalena were to agree to a rollover. On or before March 26, 2024, JPM discussed Permira’s concept with Mr. Casalena.

On March 22, 2024, the Special Committee held a meeting, attended by representatives of RLF, and (for a portion of the meeting) representatives of Centerview and Ms. O’Connor. Mr. Fleisher reported that Squarespace’s management team was preparing a management presentation to be reviewed by the Special Committee in connection with the Special Committee’s strategic review process, and that subject to the Special Committee’s approval, the management presentation could be shared with potential bidders in connection with the strategic review process. The Special Committee discussed the strategic review process and the respective roles of the Special Committee, the Special Committee’s advisors, Squarespace’s advisors and Squarespace’s management in the process, and directed the Special Committee’s advisors to communicate to Squarespace’s management and advisors that the Special Committee and its advisors would lead and oversee the process. A representative of RLF reported that RLF had received a response to the director questionnaire from each member of the Special Committee and that none of the members of the Special Committee had reported any conflicts for purposes of serving on the Special Committee with respect to Permira, Mr. Casalena, General Atlantic, Accel and each of their affiliates. The Special Committee members discussed next steps in the process, including the timing for reaching out to third parties to gauge interest in a potential transaction. The Special Committee members and the Special Committee’s advisors discussed the introductory meeting held on March 19, 2024 with Mr. Casalena, including Mr. Casalena’s desire to retain a substantial stake in Squarespace following any transaction and have significant governance rights and control of the day-to-day management of Squarespace. The Special Committee members and their advisors discussed that, based on Mr. Casalena’s governance and control preferences as stated during the introductory meeting and the fact that strategic buyers had not contacted Squarespace about potential transactions since going public, it was unlikely that a strategic party would be willing to engage in a transaction with Squarespace. The Special Committee directed Centerview to prepare a list of proposed parties to include in the Special Committee’s outreach process for consideration by the Special Committee. After the Centerview representatives and Ms. O’Connor left the meeting, the Special Committee and the RLF representatives discussed the status of negotiations with Centerview regarding its engagement letter and reviewed Centerview’s relationship disclosures that had been previously provided to the Special Committee.

Following Permira’s inquiry on March 19, 2024 about its diligence requests, Mr. Levy discussed with Mr. Fleisher Permira’s inquiry. Mr. Fleisher determined to discuss the matter at the meeting of the Special Committee scheduled for March 26, 2024 and Mr. Levy agreed to continue to keep Mr. Fleisher informed of any outbound or inbound communications with Permira or any other potential bidders, including communications pertaining to General Atlantic.

On March 26, 2024, the Special Committee held a meeting, attended by representatives of RLF and representatives of Centerview. The Special Committee members discussed Permira’s recent outreach to representatives of Squarespace (including Mr. Levy) and its advisors regarding its due diligence requests and determined to inform Permira that responses would be provided in due course and that further inquiries and requests should be directed to the Special Committee and its advisors. The Special Committee and its advisors discussed the list of potential bidders that had been prepared by Centerview and timing considerations with respect to the outreach process. The Special Committee and its advisors considered and discussed the merits and risks of contacting both the financial sponsors and the strategic buyers on Centerview’s list. The Special Committee and its advisors discussed the range of potential prices and types of transactions that would be reasonably attainable. The Special Committee determined that it would be unlikely that strategic buyers would be willing to engage in the process given that such parties had never before contacted Squarespace about a potential strategic transaction, coupled with Mr. Casalena’s desire to maintain a significant equity stake in, significant governance rights over, and control of the day-to-day management of, Squarespace following a potential transaction. The Special Committee also discussed the increased likelihood of leaks and disclosure of sensitive information to Squarespace’s competitors that could be associated with an outreach to strategic bidders. After further discussion, the Special Committee determined not to contact strategic buyers at this time given the low likelihood that such outreach would lead to a successful transaction and authorized Centerview to proceed to initiate outreach to eight prospective financial sponsors, consisting of Permira, Party A, Party B, Party C, Party D, Party E, Party F and Party G, which the Special Committee believed were the most likely to be interested in a potential strategic transaction with Squarespace and able to provide an attractive valuation. The Special Committee members and the Special Committee’s advisors discussed alternative methods to gauge interest from strategics as part of the Special Committee’s strategic review process, including the ability to potentially negotiate for a go-shop in the merger agreement. The materials that were presented by representatives of Centerview at this meeting are filed as Exhibit 16(c)(iii) to the Rule 13e-3 Transaction Statement on Schedule 13e-3 filed by Parent, Merger Sub and Squarespace with respect to the transactions contemplated by the Merger Agreement (including all exhibits and any amendments or supplements thereto, the “Schedule 13e-3”), of which this proxy statement forms a part.

On March 27, 2024, representatives of RLF, Skadden, Centerview and JPM held a meeting to discuss roles and responsibilities of each advisor during the strategic review process. During the meeting it was communicated and agreed among the advisors that the Special Committee, with the advice of RLF and Centerview, would lead the strategic review process and Centerview, at the direction of the Special Committee, would lead the outreach to, and subsequent negotiations with, potential bidders.

Also on March 27, 2024, against the backdrop that Mr. Casalena expected to maintain a significant equity stake in, significant governance rights over, and control of the day-to-day management of, Squarespace following a potential transaction, Mr. Casalena provided the Special Committee with a preliminary overview of certain key governance terms that would be important to him in deciding whether, as a stockholder, to vote in favor of a potential transaction and that he would want to reach an agreement on with any potential buyer prior to supporting any transaction.

On March 29, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview and (for a portion of the meeting) Ms. O’Connor. Ms. O’Connor reported that Squarespace’s management team was in the process of preparing a management presentation for the Special Committee to review, provide feedback on and, subject to the Special Committee’s prior approval, share with potential bidders after each such bidder executed a non-disclosure agreement with Squarespace (each, an “NDA”). Ms. O’Connor also reported that Squarespace was organizing and reviewing due diligence materials for prospective bidders to review after signing an NDA. After Ms. O’Connor left the meeting, representatives of Centerview provided an update on each of the potential bidders that Centerview had contacted at the Special Committee’s direction, including additional detail on the status of discussions between Centerview and each of Permira, Party A, Party B, Party C, Party D, Party E, Party F and Party G, respectively. The Special Committee discussed whether to broaden the scope of initial outreach to financial sponsors and, after considering the risk of leaks and the low likelihood that other parties would be ready, willing and able to timely pursue a transaction that could be competitive with the February Proposal, determined not to contact any additional potential bidders at such time. The Special Committee members also discussed the overview of certain preliminary governance terms that Mr. Casalena had provided to the Special Committee on March 27, 2024 and timing considerations related to when and how best to share this information with potential bidders.

On March 29, 2024, Permira executed an NDA. The Permira NDA contained customary terms, including a standstill, but did not prevent Permira from bringing non-public proposals to Squarespace in a manner that did not require public disclosure.

On April 1, 2024, the Special Committee executed an engagement letter with respect to Centerview’s engagement as financial advisor to the Special Committee.

On April 2, 2024, Party D executed an NDA. The Party D NDA contained customary terms, including a standstill, but did not prevent Party D from bringing non-public proposals to Squarespace in a manner that did not require public disclosure.

On April 4, 2024, Party F executed an NDA. The Party F NDA contained customary terms, including a standstill, but did not prevent Party F from bringing non-public proposals to Squarespace in a manner that did not require public disclosure.

On April 5, 2024, the Special Committee held two meetings. The first meeting was attended by representatives of RLF and Centerview and (for a portion of the meeting) Ms. O’Connor. The Special Committee members discussed Squarespace’s management presentation materials and noted that preliminary feedback had been provided by the Special Committee members and the Special Committee’s advisors on such materials. A representative of Centerview also reported that Permira had executed an NDA and certain historical financial information had been shared with Permira. After Ms. O’Connor left the meeting, representatives of Centerview provided an update regarding Centerview’s outreach process and the status of discussions with each potential bidder. The Special Committee members discussed the upcoming management presentations with potential bidders, which were in the process of being scheduled, and Mr. Casalena’s role in the management presentations. The Special Committee members, representatives of Centerview and representatives of RLF discussed Mr. Casalena’s position that he maintain a significant equity stake in Squarespace as well as significant governance rights and control over the day-to-day management of Squarespace following any transaction and when such terms should be discussed with potential bidders. After discussion, the Special Committee determined that it would be appropriate for Mr. Casalena to discuss these topics at a high level with bidders in his capacity as the largest stockholder of Squarespace with an intention to participate in any potential transaction as a significant rollover stockholder, but that specific post-closing governance, control and economic terms should not be discussed with potential bidders during the management presentation meetings.

The Special Committee’s second meeting on April 5, 2024, was attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor and representatives of Skadden, JPM, RLF and Centerview. Mr. Casalena and Mr. Gooden reviewed the management presentation materials and Squarespace’s long-range plan and projections for 2024 through 2027 with the Special Committee members. The Special Committee members provided feedback to Mr. Casalena and Mr. Gooden on the presentation materials and financial projections and asked the management team to address the feedback provided on the presentation materials and financial projections in advance of management presentations with potential bidders.

On April 8, 2024, a representative from Permira called Mr. Casalena to request an in-person dinner meeting if authorized by the Special Committee. Mr. Casalena indicated that he would discuss Permira’s request with the Special Committee.

On April 9, 2024, each of Party A, Party B, Party E and Party G executed an NDA. Each of these NDAs contained customary terms, including a standstill, but did not prevent the counterparty from bringing non-public proposals to Squarespace in a manner that did not require public disclosure. All interested parties that signed an NDA received access to the same information regarding Squarespace via a secure, third-party data room. Information provided was comprehensive on the business, including a detailed management presentation, financial projections and revenue drivers, and operational metrics.

On April 9, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview. A representative of Centerview reviewed an updated draft of the management presentation materials and noted that the long-range plan incorporated the feedback provided to Squarespace management by the Special Committee and Centerview during the Special Committee’s previous meeting. The Special Committee members discussed and asked questions about the long-range plan. After further discussion and due consideration, the Special Committee members approved the management presentation materials, including the long-range plan and financial projections for 2024 through 2027 included therein, and authorized them to be shared with potential bidders who had signed an NDA. The Special Committee members and the Special Committee’s advisors discussed the management presentation meeting that would be held with Permira later that day and Permira’s request for a dinner meeting with Mr. Casalena. The Special Committee members determined to support Mr. Casalena attending the dinner meeting with Permira as long as it was also attended by a Centerview representative, but agreed that additional non-diligence related meetings should not occur until a bid at a price that the Special Committee was interested in considering had been submitted. The Special Committee members and their advisors discussed next steps in the process during which it was noted that General Atlantic had requested to review the management presentation materials with Squarespace’s management. The Special Committee determined that it would be willing to permit such discussions, subject to General Atlantic signing an NDA. The materials that were presented by representatives of Centerview at this meeting are filed as Exhibit 16(c)(iv) to the Schedule 13e-3 of which this proxy statement forms a part.

Later on April 9, 2024, a management presentation attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor, Ashley Dahl (Senior Director, FP&A), representatives of JPM and representatives of Centerview was held with representatives of Permira. Following the management presentation with Permira, JPM and Centerview maintained an open line of communication with Permira and discussed potential sources of financing for the proposed transaction, including whether any stockholders of Squarespace, including General Atlantic or Accel, would be open to potentially participating as an equity source of financing to Permira in the proposed transaction and the potential quantum of rollover or reinvestment from each such stockholder. At the same time, Centerview regularly communicated with Mr. Fleisher and RLF about its communications with Permira.

On April 10, 2024, a management presentation attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor, Ms. Dahl, representatives of JPM and representatives of Centerview was held with representatives of Party B.

Also on April 10, 2024, Mr. Erlong had a breakfast meeting with Mr. Levy to discuss whether General Atlantic had any preliminary interest in potentially rolling a portion of their equity over in a potential transaction. Mr. Levy discussed the meeting with Mr. Fleisher and Mr. Fleisher asked Mr. Levy to continue to keep him informed of communications that he made or received from Permira and to direct material communications from Permira to the Special Committee and its advisors.

On April 11, 2024, a management presentation attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor, Ms. Dahl, representatives of JPM and representatives of Centerview was held with representatives of Party F.

On April 12, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview and (for a portion of the meeting) Ms. O’Connor. At the meeting, Ms. O’Connor reported on the status of management presentations with potential bidders and the diligence materials that had been made available to potential bidders. Representatives of Centerview provided an update on its outreach process to potential bidders. During the update, representatives of Centerview reported that Party D and Party E had withdrawn from the process and that Party C had not been responsive to requests from Centerview to confirm their interest in considering a potential transaction. Representatives of Centerview reported that management presentations had been held with Permira, Party B and Party F (each with Centerview present), and that meetings with Party A and Party G were scheduled for the following week. Representatives of Centerview provided an update to the Special Committee regarding the management presentation meeting held with Permira and on recent discussions with Permira. The Special Committee members discussed with representatives of RLF and representatives of Centerview timing considerations for engaging in further discussions with Permira and the other potential bidders. After such discussion, the Special Committee determined to set an initial bid deadline of April 26, 2024, and directed Centerview to inform potential bidders of the initial bid deadline. The Special Committee determined that it would be advisable to provide potential bidders with more detailed information regarding Mr. Casalena’s preferred post-closing governance terms so that they could be factored into initial bids. The Special Committee directed its advisors to ask Mr. Casalena to work with his counsel to prepare a list of his desired post-closing governance rights that could be provided to potential bidders in advance of the initial bid deadline.

Later that day, Mr. Casalena met with representatives of Wilson Sonsini Goodrich & Rosati, counsel to Mr. Casalena (“WSGR”), to discuss certain rights to include in the requested post-closing governance and rollover terms to share with the Special Committee. Thereafter, WSGR representatives provided a summary of Mr. Casalena’s preferred rollover and post-closing governance terms to the Special Committee, including that (i) he preferred to rollover at least two-thirds of his current holdings, (ii) that the rollover would result in him holding securities having economic terms consistent with any financial sponsor, (iii) that his post-transaction governance rights in the surviving entity would be consistent with (A) his existing governance rights, subject to ongoing achievement of to-be-agreed performance metrics, and (B) any protective provisions provided to any stockholder of the surviving entity other than Mr. Casalena, and (iv) that post-transaction he would serve as chief executive officer of the surviving entity with appropriate compensation.

On April 15, 2024, a management presentation attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor, Ms. Dahl, representatives of JPM and representatives of Centerview was held with representatives of Party G.

Also on April 15, 2024, General Atlantic executed an NDA. The General Atlantic NDA contained customary terms, but did not include standstill provisions.

Also on April 15, 2024, Mr. Casalena had dinner with representatives of Permira, with a representative of Centerview attending, as previously authorized by the Special Committee. During this meeting, the attendees discussed Squarespace’s business model and trajectory, but did not discuss specific terms regarding a potential transaction between Permira and Squarespace.

On April 16, 2024, a management presentation attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor, Ms. Dahl, representatives of JPM and representatives of Centerview was held with representatives of Party A.

Also on April 16, 2024, Mr. Casalena and Mr. Fleisher spoke briefly regarding the governance issues. Later that day, representatives of RLF and Centerview met with representatives of WSGR regarding Mr. Casalena’s proposed governance terms. Thereafter, Mr. Fleisher authorized Centerview to share the governance terms, in the form previously reviewed by the Special Committee, with potential bidders.

On April 17, 2024, the summary of Mr. Casalena’s proposed governance terms was made available to potential bidders via Squarespace’s virtual data room.

Also on April 17, 2024, Mr. Erlong had a brief telephone call with a representative of General Atlantic, during which they discussed the potential amount of a rollover/re-investment by General Atlantic. No agreement regarding participation in a transaction by General Atlantic was reached.

On April 18, 2024, a management presentation attended by Mr. Casalena, Mr. Gooden, Ms. O’Connor, Ms. Dahl, representatives of JPM and representatives of Centerview was held with representatives of General Atlantic.

On April 19, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview and (for a portion of the meeting) Ms. O’Connor. At the meeting, Ms. O’Connor reported that all scheduled management presentations with potential bidders had been completed. After Ms. O’Connor left the meeting, a representative of Centerview reported that, as directed by the Special Committee, Squarespace’s management team had provided Centerview with financial projections that now extended to 2028 and 2029 (but that remained unchanged in years 2024 through 2027 that had previously been approved by the Special Committee and made available to potential bidders) in order for Centerview to complete its own valuation analysis. Representatives of Centerview then reviewed such additional projections with the Special Committee members and the Special Committee authorized Centerview to use the projections in performing its valuation work. Representatives of Centerview provided an update on the status of discussions with potential bidders. Representatives of Centerview reported that Party C, Party D and Party E had withdrawn from the process and that initial bid process letters had been sent to Permira, Party A, Party B, Party F and Party G. Representatives of Centerview noted that Permira had asked to have further discussions with General Atlantic and an initial discussion with Accel to determine whether either party had any interest in potentially participating as a source of equity financing for the proposed transaction. After discussion, the Special Committee authorized Permira to have such discussions with General Atlantic and Accel, but stated that specific discussions between the parties regarding Mr. Casalena’s proposed post-closing governance and rollover matters should be deferred until later in the process. Mr. Fleisher noted that following the dinner meeting held between Mr. Casalena and Permira earlier that week, he had discussed with Mr. Casalena that neither he nor Squarespace’s management should hold additional meetings with Permira other than scheduled diligence meetings unless authorized by the Special Committee. A representative of RLF reported that RLF would work with Skadden to prepare a draft of a merger agreement that could be shared with bidders after initial bids were submitted. The materials that were presented by representatives of Centerview at this meeting are filed as Exhibit 16(c)(v) to the Schedule 13e-3 of which this proxy statement forms a part.

During the course of the next week, Skadden and RLF worked together to prepare the initial draft of the merger agreement that could be shared with any bidder who submitted a bid by the April 26 initial bid deadline.

On April 22, 2024, Mr. Casalena and other members of Squarespace’s management team met with representatives of Permira to discuss diligence matters related to Squarespace. No terms relating to the proposed transaction were discussed during these meetings.

On April 23, 2024, Mr. Casalena met with representatives of Permira to discuss diligence matters related to Squarespace. No terms relating to the proposed transaction were discussed during these meetings.

Also on April 23, 2024, members of Squarespace management met with representatives of General Atlantic to discuss diligence matters related to Squarespace.

On April 25, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview. At the meeting, a representative of Centerview provided an update on the remaining potential bidders. During the update, it was noted that General Atlantic had held discussions with Permira about participating as an equity source of financing to Permira in the proposed transaction, as authorized by the Special Committee, and that Permira was continuing to seek a similar discussion with Accel. Representatives of Centerview reviewed Centerview’s preliminary valuation analysis as well as certain other financial information, including Squarespace’s historical stock price, financial performance as compared to selected competitors and analyst price targets, with the Special Committee. The Special Committee members, representatives of Centerview and representatives of RLF discussed Centerview’s valuation analysis. The Special Committee then discussed the upcoming bid deadline and determined to meet on April 27, 2024, to review and evaluate any bids. The materials that were presented by representatives of Centerview at this meeting are filed as Exhibit 16(c)(vi) to the Schedule 13e-3 of which this proxy statement forms a part.

On April 26, 2024, Permira submitted a non-binding indication of interest to acquire Squarespace for $42.50 per share, which was a 20% premium to Squarespace’s closing share price as of April 25, 2024, a 27% premium to Squarespace’s 90-day volume weighted average price, a 57% premium to Squarespace’s two-year volume weighted average price and a 12% premium to Squarespace’s 52-week high share price (the “April 26 Proposal”). The April 26 Proposal contemplated a rollover / co-investment from Mr. Casalena of at least 75% of his existing equity stake in Squarespace as well as a reinvestment by other existing stockholders of Squarespace in the amount of $500 million to $1 billion. Consistent with its initial statement to Squarespace and given that the April 26 Proposal included rollover terms, Permira’s April 26 Proposal was expressly conditioned on approval of the Special Committee and a majority of the Unaffiliated Company Stockholders. The April 26 Proposal also contained proposed governance terms addressing the issues raised by Mr. Casalena, a letter from a prospective financing source, a list of outstanding diligence requests and an illustrative transaction timeline contemplating a targeted signing date during the week of May 13, 2024. Permira’s response regarding the governance matters proposed, among other things, that (i) Mr. Casalena would rollover at least 75% of his stake in Squarespace, (ii) Mr. Casalena would hold securities with economic terms consistent with any sponsor, (iii) subject to achievement of certain performance metrics, which Squarespace had not consistently met on a historical basis but which were reasonable based on Squarespace’s financial projections, Mr. Casalena would have full control over budget, personnel and day-to-day operations and would be entitled to retain the role of chief executive officer, (iv) Mr. Casalena would have certain protective provisions in the post-closing entity, including limited time-restrained veto rights in certain circumstances over an IPO or sale and the right to appoint two board members, and (v) Mr. Casalena would serve as the chief executive officer of Squarespace with appropriate compensation. Squarespace’s Class A Common Stock closed trading on April 26, 2024 at $35.53 per share.

None of Party A, Party B, Party C, Party D, Party E, Party F or Party G submitted a bid by the April 26 bid deadline and thereafter none of them participated further in the Special Committee’s strategic review process.

On April 27, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview. The Special Committee members and the Special Committee’s advisors reviewed and discussed the key terms of the April 26 Proposal submitted by Permira. Mr. Fleisher reported that he spoke with Mr. Casalena regarding the April 26 Proposal and Mr. Casalena explained that he was willing to consider rolling the portion of his equity contemplated in the April 26 Proposal but that he did not think $42.50 per share was a sufficiently attractive price to vote in favor of the transaction in his stockholder capacity. The Special Committee and representatives of Centerview and RLF discussed the possibility of soliciting interest from any other potential bidders in light of the fact that only Permira had submitted a bid. During this discussion, the Special Committee discussed various factors, including, the time delay associated with soliciting new potential bidders, the potential for information leaks, the risk of Permira losing interest in a potential transaction and the likelihood that any other party would be willing to submit a bid. Following this discussion, the Special Committee determined that it was in the best interests of the Unaffiliated Company Stockholders to focus on pushing for a further price increase from Permira rather than soliciting interest from other parties. As a result of this determination, the Special Committee directed Centerview to inform Permira that the Special Committee was interested in continuing discussions with Permira, but that Permira would need to increase its offer price of $42.50 per share in order for Permira to move forward in the process. A representative of RLF then discussed with the Special Committee members the possibility of granting Permira a Section 203 waiver to permit Permira to engage in more extensive discussions with Mr. Casalena, General Atlantic and Accel regarding potential equity participation in the potential transaction if Permira increased its offer price and related considerations. The RLF representatives also provided an overview of the key terms of the auction draft of the merger agreement, noting, among other things, that it contained a go-shop and that the merger was conditioned on approval by a majority of the Unaffiliated Company Stockholders and a separate class vote of the Class A and Class B stockholders, each voting as a separate class. The materials that were presented by representatives of Centerview at this meeting are filed as Exhibit 16(c)(vii) to the Schedule 13e-3 of which this proxy statement forms a part.

On April 29, 2024, Permira submitted a revised proposal to acquire Squarespace for an increased price of $43.25 per share, with the other non-price terms remaining identical to the April 26 Proposal, which was a 22% premium to Squarespace’s closing share price as of April 26, 2024, a 29% premium to Squarespace’s 90-day volume weighted average closing price, a 61% premium to Squarespace’s two-year volume weighted average closing price and a 14% premium to Squarespace’s 52-week high share price (the “April 29 Proposal”). The April 29 Proposal indicated that it was subject to Squarespace agreeing to an exclusivity period with Permira through May 15, 2024 to complete due diligence and finalize the documentation for the proposed transaction. The April 29 Proposal did not modify any terms contained in the April 26 Proposal relating to the governance requests from Mr. Casalena. Squarespace’s Class A Common Stock closed trading on April 29, 2024 at $35.56 per share.

During the course of that same day, the Special Committee members discussed the April 29 Proposal and agreed that it was sufficient for Permira to continue in the process. Accordingly, the Special Committee members instructed the Special Committee’s advisors to coordinate with Squarespace and its advisors to provide Permira with access to the additional diligence materials requested and with an initial draft of the Merger Agreement.

On April 30, 2024, an initial draft of the Merger Agreement was provided to Permira and Latham & Watkins LLP, Permira’s legal counsel (“Latham & Watkins”).

Also on April 30, 2024, a representative of Accel contacted Mr. Casalena and Mr. Gooden to request access to Squarespace’s virtual data room in connection with its evaluation of whether to potentially provide a portion of the equity financing contemplated in the April 26 Offer as coming from existing Squarespace stockholders. The Special Committee determined to permit Accel to access such diligence materials subject to Accel signing an NDA.

On April 30, 2024 and May 1, 2024, Mr. Casalena and other members of the Squarespace management team met with representatives of Permira. During these meetings, the parties discussed diligence matters concerning Squarespace and related matters, and did not discuss governance terms.

On May 1, 2024, Accel executed an NDA, following which certain of its representatives were provided with access to the virtual data room. Similar to the General Atlantic NDA, the Accel NDA contained customary terms, but did not include standstill provisions.

Also on May 1, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview. During the meeting, the Special Committee members and the Special Committee’s advisors discussed the April 29 Proposal. Representatives of Centerview then advised the Special Committee members on timing considerations with regard to the proposed timeline included in the April 29 Proposal and Permira’s request for exclusivity. The Special Committee members and their advisors discussed negotiation strategies for increasing Permira’s offered price. The Special Committee decided to reject Permira’s request for exclusivity and directed Centerview to give Permira a deadline of May 9, 2024 to submit a better proposal after conducting additional due diligence. The Special Committee also authorized RLF to work with Skadden to negotiate the terms of the Merger Agreement and related transaction documents with Latham & Watkins. The Special Committee also unanimously approved resolutions granting a waiver under Section 203 of the DGCL pursuant to which Mr. Casalena, General Atlantic and Accel (and their respective affiliates) were permitted to enter into more detailed discussions with each other and Permira in connection with the potential transaction, but the Special Committee retained final authority over whether or not to approve any final transaction or transaction documents that were negotiated (the “Section 203 Waiver”).

On May 2, 2024, the Squarespace Board held a regularly scheduled meeting, also attended by members of management during which management provided the Board with an update on Squarespace’s financial performance.

During this meeting, Mr. Fleisher provided the Squarespace Board with a general update regarding the Special Committee’s process and that the April 26 Proposal and the April 29 Proposal had been received, but did not discuss the Special Committee’s views on the terms or price proposed by Permira in the April 26 Proposal or the April 29 Proposal.

Also on May 2, 2024, Mr. Casalena and other members of Squarespace’s management team met with representatives of Permira to discuss diligence matters related to Squarespace. From May 2, 2024 through May 8, 2024, Squarespace management held a series of due diligence meetings regarding Squarespace’s business with Permira representatives and advisors.

Also on May 2, 2024, representatives of Latham & Watkins, RLF and Skadden met to discuss the initial draft of the Merger Agreement.

From May 2, 2024 through May 12, 2024, Mr. Erlong and a representative of General Atlantic had a series of brief telephone calls to discuss the potential transaction, the quantum of General Atlantic’s rollover and/or reinvestment and status of General Atlantic’s diligence. No terms of a governance proposal were discussed during these meetings.

Also on May 2, 2024, Mr. Erlong and Andrew Young, a partner of Permira, had a brief telephone call with a representative of Accel, which was followed by a meeting between Mr. Young and a representative of Accel on May 10, 2024 and a telephone call between Mr. Patel and a representative of Accel on May 11, 2024. The purpose of each of the telephone calls and the meeting with Accel was for Permira to better acquaint itself with Accel so that Permira could determine whether it would be comfortable having Accel participate in the proposed transaction as a potential source of equity financing. No terms of a governance proposal were discussed during these meetings.

From May 4, 2024 through the execution of the Merger Agreement, representatives of WSGR and Latham & Watkins held periodic discussions regarding the post-closing governance terms.

On May 5, 2024, Latham & Watkins provided their comments to the initial draft of the Merger Agreement. Latham & Watkins deleted the go-shop provision in its entirety and restricted the no-shop provision. In addition, Latham & Watkins deleted the two-tiered fee concept differentiating a termination during the go-shop period and no-shop period, and proposed a single company termination fee of 4% of Squarespace’s equity value as implied by Permira’s per share offer price. Latham & Watkins also lowered the reverse termination fee to 5%, which was decreased from the 7% proposed. Latham & Watkins generally made buyer-friendly revisions to the representations and warranties, interim operating covenants, and material adverse effect definition. Latham & Watkins generally accepted the antitrust covenant in the auction draft of the Merger Agreement (including the “hell or high water” standard of efforts to obtain antitrust clearance, with respect to controlled Affiliates of Parent), and agreed to make payments in respect of Squarespace’s vested RSUs, PSUs and in-the-money Squarespace Options, although any such Equity Awards, if unvested, would convert into cash awards to be paid as and when the applicable vesting conditions are satisfied.

Also on May 5, 2024, Mr. Casalena and Mr. Erlong met to discuss equity participation in the potential transaction and the post-closing governance arrangements. On May 6, 2024, Mr. Casalena and Mr. Erlong had a follow-up meeting to discuss the same topics. On the same day, Mr. Casalena had separate calls with a representative of each of Accel and General Atlantic to discuss their potential rollover and/or reinvestment commitments in connection with a potential transaction.

On May 6, 2024, the Special Committee acted by unanimous written consent to adopt resolutions expanding the previously granted Section 203 Waiver to permit Permira, Mr. Casalena, Accel and General Atlantic to engage in discussions regarding the potential transaction with Permira’s potential and existing limited partners or co-investors and potential financing sources.

On May 7, 2024, Skadden and RLF provided their comments to Latham & Watkins, in response to their draft of the Merger Agreement. Skadden and RLF reinserted the go-shop provision and revised the no-shop language to be more favorable to Squarespace. Skadden and RLF in addition reinserted the two-tiered company termination fee concept and proposed 3% for the company termination fee during the no-shop period and 1.5% for the go-shop termination fee. Skadden and RLF proposed a reverse termination fee of 6.5%. Skadden also reversed certain of Latham & Watkins’ edits to the representations and warranties, interim operating covenants and material adverse effect definition and made limited revisions to the antitrust covenant and provisions relating to payments in respect of equity awards.

Also on May 7, 2024, representatives of Permira and Accel (with a representative of Centerview present) met by videoconference to discuss the potential transaction.

On May 8, 2024, a management presentation attended by members of Squarespace management and representatives of JPM and Centerview was held with representatives of Accel. Also on that day, a representative of Accel met briefly with Mr. Casalena, with a representative of Centerview present, to discuss the proposed transaction.

Also on May 8, 2024, the Special Committee held a meeting, attended by representatives of RLF and Centerview. At the meeting, it was noted that Permira was expected to make its final bid on May 9, 2024. RLF representatives provided an update on the negotiations with Latham & Watkins regarding the Merger Agreement. Representatives of RLF and Centerview provided further updates on the negotiation process with Permira, including advising the Special Committee that Mr. Casalena, General Atlantic and Accel had met with Permira to discuss their possible equity participation in the potential transaction and certain post-closing governance matters. The Special Committee discussed timing and negotiation considerations related to the potential transaction.

On May 9, 2024, Permira submitted a revised proposal to acquire Squarespace for $44.00 per share, which Permira indicated was its best and final proposal and which was a 20% premium to Squarespace’s closing share price as of May 9, 2024, a 29% premium to Squarespace’s 90-day volume weighted average closing price, a 62% premium to Squarespace’s two year volume weighted average price and a 15% premium to Squarespace’s 52-week high share price (the “Final Proposal”). The Final Proposal contemplated a rollover by Mr. Casalena of 75% of his existing equity stake in Squarespace as well as a rollover/reinvestment by General Atlantic and Accel in the amount of $700 million in the aggregate. Along with the Final Proposal, Permira submitted its markup of the Merger Agreement, revised post-closing governance terms and markups of the disclosure letters to the Merger Agreement, form of equity commitment letter, Fee Funding Agreement, form of support agreement, Debt Commitment Letter and customarily redacted fee letters to the Debt Commitment Letter. The terms of the draft Merger Agreement submitted by Permira in connection with the Final Proposal conditioned the merger on approval by the Special Committee and a majority of the Unaffiliated Company Stockholders. The revised post-closing governance terms (i) provided that Mr. Casalena would rollover at least 75% of his stake in Squarespace, (ii) provided that Mr. Casalena would hold securities with economic terms consistent with any sponsor, (iii) provided that, subject to achievement of certain company performance metrics, which Squarespace had not consistently met on a historical basis but which were reasonable based on Squarespace’s financial projections, Mr. Casalena would have full control over budget, personnel and day-to-day operations (subject to limitations on acquisitions above certain thresholds, setting certain executive compensation, employee equity compensation and borrowing other than draws from the company’s revolver facility below a threshold) and would be entitled to retain the role of chief executive officer, (iv) Permira will have customary veto rights, (v) outlined certain protective provisions that Mr. Casalena would have in the post-closing entity, including limited time-restrained veto rights in certain circumstances over an IPO or sale, (vi) contained customary minority protective for General Atlantic and Accel, (vii) provided that Mr. Casalena would have the right to appoint two of eight board members with each of General Atlantic and Accel being entitled to appoint one board member and Permira having the right to appoint four board members, and (viii) contemplated that Mr. Casalena’s compensation would be appropriate, as determined by the post-closing board. Squarespace’s Class A Common Stock closed trading on May 9, 2024 at $36.82 per share.

Also on May 9, 2024, Mr. Casalena had several calls with representatives of Permira regarding the details of the post-closing governance matters contained in the Final Proposal and had an informal meeting with Ms. Everson (with a representative of Centerview attending) to discuss potential future collaboration if a transaction were to proceed.